Big picture: What’s the reason for stock market uncertainty

There has been a steady rise in neutral sentiment towards the direction of stocks. So, it is important to understand why that is.

The reason for indecision

The Fed has recently communicated two things clearly. Firstly, that interest rates must rise to combat inflation. Secondly, the pace is likely to slow, but the terminal rate could be higher than previously expected. The Fed has also said that it will be data-dependent going forward, so that means a constant push and pull from stocks as incoming data suggests peak inflation and the next piece suggest stickier inflation.

The latest run of data

US Core PCE last week showed that inflation still remains fairly high. Core PCE y/y stayed at 5% and the prior reading of 5.1% was revised higher to 5.2%. Hardly peak inflation here.

US ISM data last week printed lower than expected with prices coming in lower than even the lowest projections at 43. So, slowing US growth should mean slower and lower Fed rates (bullish stocks and negative USD). However, then Friday’s jobs reports contradicted the drop in manufacturing prices for November.

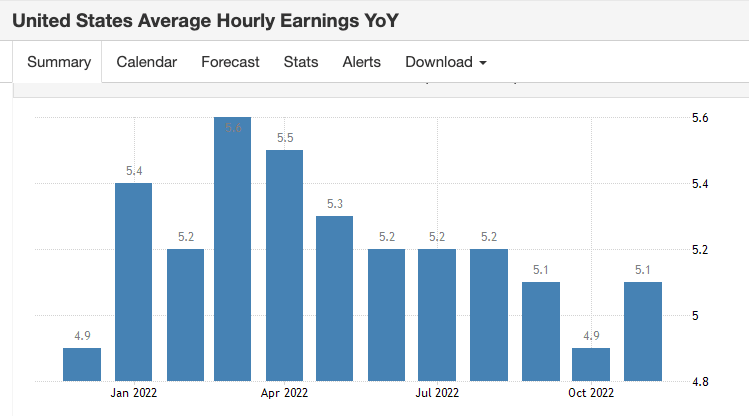

Last Friday’s NFP showed a higher than forecasted headline print of 263K and average hourly earnings were much higher at 5.1% vs 4.6% expected. The prior reading was slowly revised higher to 4.9%. This would potentially worry the Fed that there is a wage-price spiral underway.

Then yesterday the latest US Services PMI print came in strong and that affirms that the Fed could hike rates even higher if it needed to.

So, this means that the path for the pace and extent of Fed rates is uncertain in the current climate. But it means that medium-term/long-term traders may pay to be more patient. Short-term traders can continue to trade the different data points from the US as they indicate different narratives about the speed and extent of Fed hikes. Slower, and lower US rates should weaken the USD and support US stocks and gold. Faster, and higher US rates should strengthen the USD, but weaken stocks and gold.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.