Markets

Despite a pushback on rate cuts from one of the most influential Fed members, Christopher Waller, and what was supposed to be cautious trading sentiment ahead of critical US inflation data released later on Friday, the S&P 500 rose on Thursday, marking its best first-quarter performance in five years.

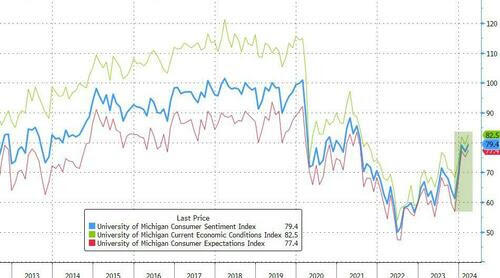

Markets were supported by a critical indicator of US consumer sentiment, which showed a notable and unexpected improvement in the final reading for March, released on Thursday.

The revised headline figure on the University of Michigan's index for this month was 79.4, up from 76.5 in the preliminary release. Consensus forecasts had anticipated no change from the original reading.

Indeed, as we approach the US election, predicting economic data has become increasingly challenging. The discrepancy between robust GDP growth, low unemployment rates, and subdued economic perceptions is a persistent concern for market participants and policymakers.

But notably, from a consumer inflation perspective, Thursday's release included downward revisions at both horizons. Year-ahead expectations were revised to 2.9% from the initial 3%, and five- to 10-year expectations were adjusted to 2.8% from 2.9%. In other words, consumers honestly think inflation has turned the corner.

And positively for stock market operators, the update on Michigan sentiment could be interpreted as fitting the Goldilocks narrative. Survey director Joanne Hsu highlighted that inflation uncertainty had diminished, stating, "Consumers are now broadly in agreement that inflation will continue to slow both over the short-term and the long-term."

In such an environment, stocks are expected to remain attractive to investors, with buying interest persisting even during temporary market declines or pullbacks. This sentiment suggests a preference for stability and moderate growth, which keeps the Fed on course and supports continued bullishness in equities as long as the overall economic balance remains favourable.

The asymmetry in the central bank's decision calculus, where the threshold for rate cuts is modest while the bar for rate hikes is high, is a crucial factor supporting risk assets. This dynamic suggests that the central bank is more inclined to provide monetary stimulus in response to economic challenges. At the same time, the sturdy US consumer allows the Fed to buy time for inflation to ease.

The bear case for equities almost feels like it is getting scripted for a cartoon, with vague uncertainties that are almost intangible.

For instance, during a recent web event, JPMorgan's Dubravko Lakos-Bujas told clients that the bearish turn in the market might come unexpectedly "one day out of the blue."

Of course, the biggest market upheavals are the ones we don’t see coming and are unprepared for, but left-field meltdown hypnosis like this, especially when Bloomberg dubbed it “ The Talk Of The Stock Market,” adds little to the narrative. Yeah, it was the talk of the market, but for comical relief.

Bears have been standing before a steamroller as the US stock market has kicked off 2024 with remarkable momentum. This surge is driven by a combination of factors, including renewed confidence in the economy, the prospect of interest rate cuts, and the allure of opportunities within the burgeoning field of artificial intelligence.

Forex markets

Will the Fed be late to the rate cut party?

Christopher Waller's moderately hawkish speech has bolstered the dollar over the past 48 hours, signaling to markets that the Federal Reserve may delay implementing rate cuts. This sentiment has contributed to the dollar's strength in currency markets.

Waller's recent remarks at the Economic Club of New York underscored the Federal Reserve's deliberate and cautious approach. Entitled "There’s Still No Rush," his speech echoed sentiments from a previous address in February titled "What’s The Rush?" In his latest commentary, Waller expressed disappointment with recent US CPI releases, emphasizing the need for sustained improvement in inflation data over the next few months before considering rate cuts.

While this cautious stance may be interpreted as somewhat hawkish, it's essential to note the timing: it's only March, with June still three months away. The phrase "at least a couple" suggests a timeline of two to three months, maintaining the possibility of rate cuts in June, consistent with market expectations. Moreover, this dovetails with expectations of rate cuts by the European Central Bank in June and potentially by the Bank of England in August.

But at face value, FX traders think the Fed will be late to the rate cut party.

Oil markets

In the last session of the first quarter, oil markets experienced a bullish trend driven by positive macroeconomic data, particularly after rebounding from support levels earlier in the week.

Despite the Federal Reserve's tightening monetary policy, the resilience of the US consumer has consistently defied market expectations. Despite initial concerns of a recession at the onset of the central bank's rate-hiking cycle, the US consumer has continued to demonstrate strength. Although US GDP growth moderated from a robust 4.9% in the third quarter of 2023, forecasts from the Federal Reserve Bank of Atlanta's GDPNow model anticipate a 2.1% expansion for the first quarter of the current year.

SPI Asset Management provides forex, commodities, and global indices analysis, in a timely and accurate fashion on major economic trends, technical analysis, and worldwide events that impact different asset classes and investors.

Our publications are for general information purposes only. It is not investment advice or a solicitation to buy or sell securities.

Opinions are the authors — not necessarily SPI Asset Management its officers or directors. Leveraged trading is high risk and not suitable for all. Losses can exceed investments.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.