ADP Consideration

According to figures by payroll processor ADP, employment grew again in the month of January, to the tune of 192,000. The headline figure was slightly above estimates of a 175,000 monthly addition by market analysts. Report details show major and optimistic gains as small and medium size businesses continued to hire in the first month of the year. Small businesses added 115,000 jobs to the economy while medium sized firms took on 79,000. Larger firms, by comparison, actually cut jobs – releasing 2,000 positions.

Once again the services sector bolstered a majority of the gains, with additions to construction and production crews supporting a positive tidbit on the month. Unfortunately, manufacturing continued to shed positions – losing 3,000 jobs.

All in all, a good report, the ADP survey lends to speculation that jobless claims should be lower than the anticipated 362,000, and also allude to a better than expected non-farm payrolls figure. Currently, estimates for the BLS report are for a 161,000 print.

Seasonal Calculation

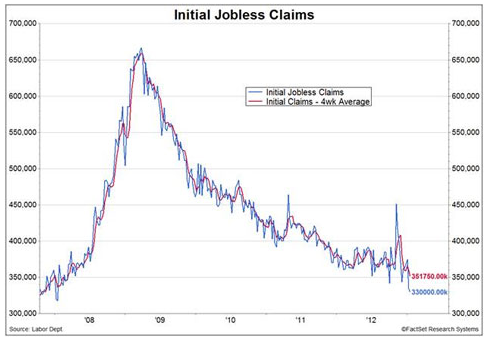

An additional consideration, heading into the jobless claims release, is the fact that many economists remain fixated on the report’s calculation as last week’s jobless claims fell to a five year low – a weekly 330,000. The steep decline in jobless claims, which fell from an earlier 371,000 two weeks prior, seems likely attributed to calculations that simply don’t take into account the holiday season and cyclical fluctuations.

As a result, a rise in the amount of claims may not spark any type of meaningful bearish sentiment surrounding the US economy.

What to Expect

At or Below 362,000. A bullish scenario, a below 362,000 figure would spark notions of stability in the US labor market, which in turn would spur consumer spending down the road – or higher US growth. This essentially would negate any notion of a calculative difference in the report and remain US Dollar bullish.

Above 362,000. Although alternatively bearish, an above 362,000 print may not be so bad. For the most part, the figure would be a normalization of the jobless claims figure – only confirming that last week’s release would have been an unadjusted slip up. Nonetheless, any bearish notions shouldn’t kick in until well above 380,000 – against an adjusted average of 370,000 for weekly claims.

Source: US Labor Department, FactSet

Source: US Labor Department, FactSet

注释: 本网页上的所有信息随时可能更改. 使用本网站的浏览者必须接受我们的用户协议. 请仔细阅读我们的保密协议和合法声明. 撰稿者在Forex21.cn发表的观点仅是他本人观点, 并不代表Forex21.cn或他组织的观点. 风险披露声明: 外汇保证金交易隐含巨大风险, 它不适合所有投资者. 过高的杠杆作用可以使您获利, 当然也可能会使您蒙受亏损. 在决定进行外汇保证金交易之前, 您应该谨慎考虑您的投资目的, 经验等级和冒险欲望. 在外汇保证金交易中, 亏损的风险可能超過您最初的保证金资金, 因此, 如果您不能负担资金的损失, 最好不要投资外汇. 您应该明白与外汇交易相关联的所有风险, 如果您有任何外汇保证金交易方面的问题, 您应该咨询与自己无利益关系的金融顾问.

Recommended Content

Editors’ Picks

AUD/USD dips below 0.6600 following RBA’s decision

The Australian Dollar registered losses of around 0.42% against the US Dollar on Tuesday, following the RBA's monetary policy decision to keep rates unchanged. However, it was perceived as a dovish decision. As Wednesday's Asian session began, the AUD/USD trades near 0.6591.

EUR/USD lacks momentum, churns near 1.0750

EUR/USD cycled familiar levels again on Tuesday, testing the waters near 1.0750 as broader markets look for signals to push in either direction. Risk appetite was crimped on Tuesday after Fedspeak from key US Federal Reserve officials threw caution on hopes for approaching rate cuts from the Fed.

Gold wanes as US Dollar soars, unfazed by lower US yields

Gold price slipped during the North American session, dropping around 0.4% amid a strong US Dollar and falling US Treasury bond yields. A scarce economic docket in the United States would keep investors focused on Federal Reserve officials during the week after last Friday’s US employment report.

Solana FireDancer validator launches documentation website, SOL price holds 23% weekly gains

Solana network has been sensational since the fourth quarter (Q4) of 2023, making headlines with a series of successful meme coin launches that outperformed their peers.

Living vicariously through rate cut expectations

U.S. stock indexes made gains on Tuesday as concerns about an overheating U.S. economy ease, particularly with incoming economic reports showing data surprises at their most negative levels since February of last year.