Australian Employment Preview: September job losses to flag RBA rate cut

- Australia’s unemployment rate seen higher at 7.1%.

- Coronavirus resurgence to affect the employment scenario.

- Dismal jobs data to call for Nov RBA rate cut, down the AUD.

With coronavirus spikes once again witnessed in Victoria and New South Wales (NSW), Australia’s two most populous states, on Wednesday, the country’s September employment data due on Thursday will all the more grab attention.

The Australian labor market report could pave the way for further interest rates cuts by the Reserve Bank of Australia (RBA), as the central bank’s focus remains on the jobs market and inflation.

Growing unemployment

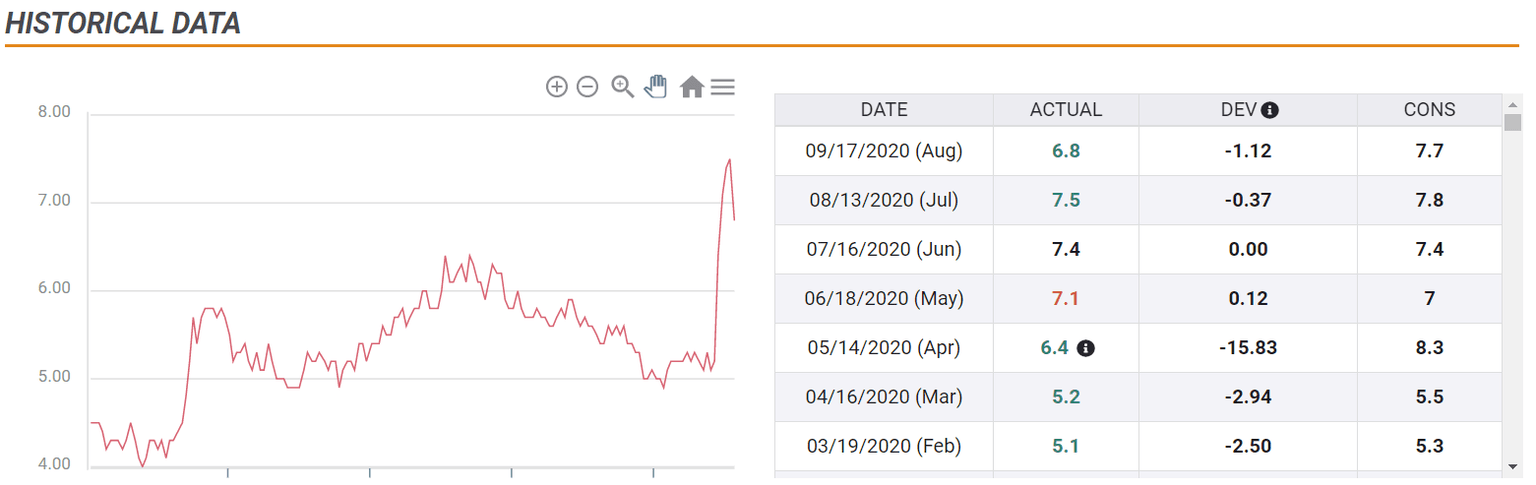

Despite a positive surprise delivered by the employment data in August, the market expects 35K job losses in September, pricing in the impact of Victoria’s Stage 4 restrictions to contain the virus spread. The Unemployment Rate is expected to tick higher to 7.1% from 6.8% in August, although is likely to remain below the levels seen in June and July. The Participation Rate is seen steady at 64.8% last month, not painting a favorable picture of the aussie jobs market.

Coronavirus, RBA and job losses

Until a week ago, the South Pacific nation reported zero COVID-19 deaths. However, it was about time that the virus concerns seep back, with new clusters found in NSW and Victoria, which are likely to cause a delay in easing restrictions. Although this may impact the next employment data publication, it may not go unnoticed by the RBA amid increased calls for a November interest rate cut.

The Australian central bank stood pat on its monetary policy last week but left doors open for additional easy to support the virus-hit economic recovery. Governor Phillip Lowe, however, ruled out the use of negative interest.

"The Board views addressing the high rate of unemployment as an important national priority … Board continues to consider how additional monetary easing could support jobs as the economy opens up further”.

A slowdown in the jobs market recovery would need the RBA to accelerate its efforts to achieve its employment objective, implying that a rate cut could be on the table next month.

On the AUD value, the RBA said that the currency’s appreciation is consistent with higher commodity prices, although they added: “ while members noted that the Australian dollar was broadly aligned with its fundamental determinants, a lower exchange rate would provide more assistance to the Australian economy in its recovery.”

AUD/USD technical outlook

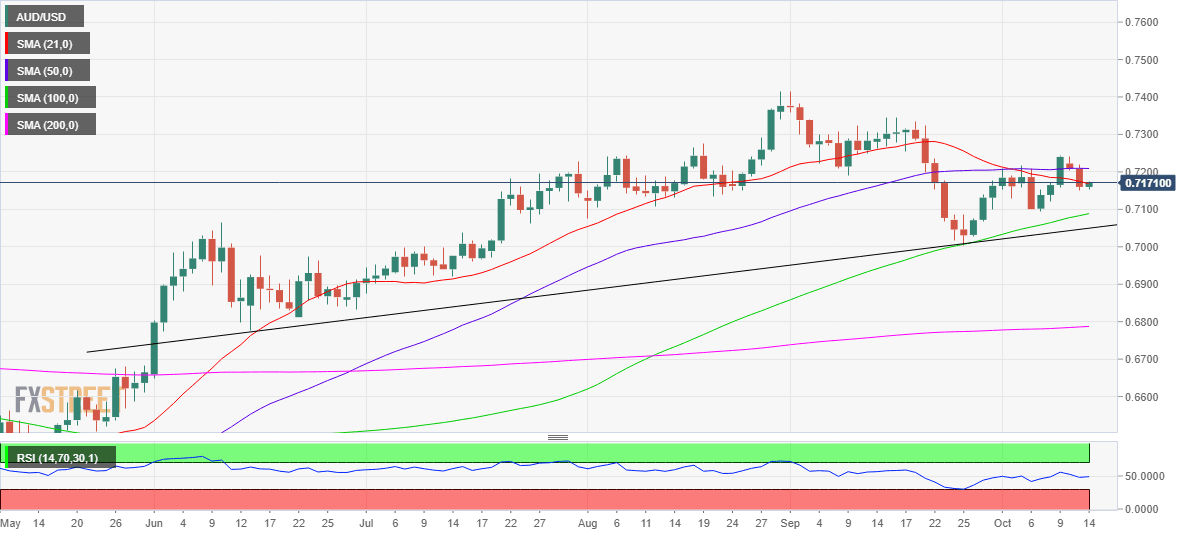

The Australian dollar has emerged as the best performing G10 currency and is up over 30% from the March low against the US dollar. However, the appreciation of the AUD is not much of a concern for the RBA, at the moment, as they said: “While members noted that the Australian dollar was broadly aligned with its fundamental determinants, a lower exchange rate would provide more assistance to the Australian economy in its recovery.”

Heading into the jobs report, AUD/USD remains pressured below 0.7200, mainly driven by the increased haven demand for the US dollar amid growing coronavirus risks and US fiscal stimulus deadlock.

Should the report positively surprise the markets, with a less-than-expected rise in the jobless and/ or smaller job losses, AUD/USD could rebound towards the critical level at 0.7244, two-week highs. On the downbeat numbers, the spot could accelerate its declines to challenge the 100-day moving average (DMA) at 0.7088.

Daily chart

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.