Australian economy vaccination recovery

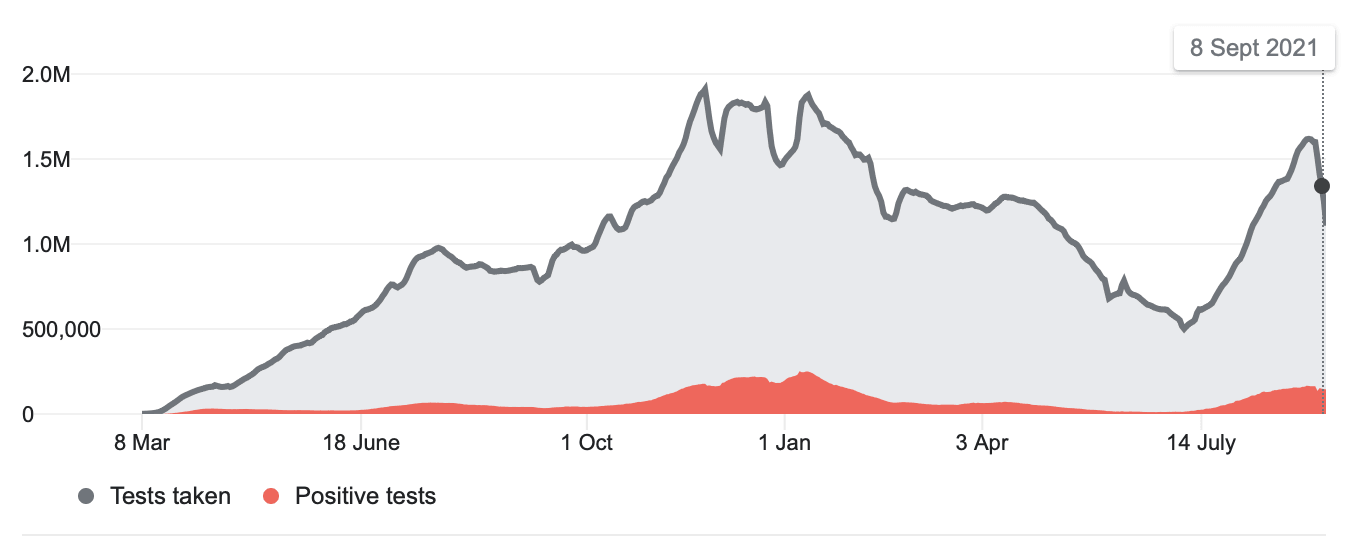

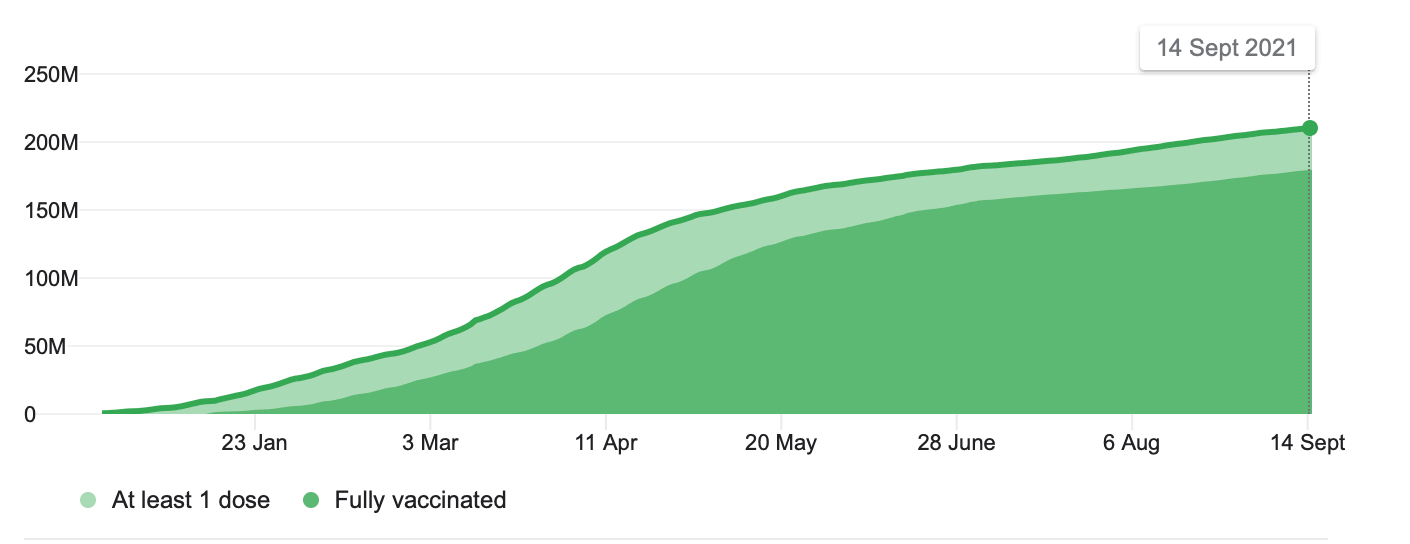

USA experience. It is better to know.

Unfortunately, cases, deaths and hospitalisations are all running toward the first wave levels. Hopefully, this second wave will be peaking here, but it is too early to be sure. The economic impact is real, though often localised due to the greater adversity to lockdowns. This is with high vaccination levels.

NSW

As vaccination rates have gone up, so too, have the number of vaccinated who are hospitalised. Currently around 20% in Sydney for those who have had vaccines. Though these are mostly single shot cases, which could again be due to the double shots having been acquired more recently.

It is impossible to make sound economic assessments and forecasts without considering the path of Delta.

The fact is, there will be significant impact among the vaccinated. While marginalising the un-vaccinated will create a permanent drag on the economy. There is no simple solution or fast bounce back scenario on the horizon.

Hence, equities run the risk of serious disappointment in this regard.

We must open up our economy, but we should not delude ourselves. What we want to believe, "the great vaccination solve all", is unlikely be our Australian reality.

As previously forecast, there is a very real risk of Australia experiencing rolling on-going disruptive influences. Even, when out of lockdown.

Of perhaps greater risk, is that NSW will move from lockdown to semi-permanent lockout by the rest of Australia.

Previous agreements will not matter. The Federal road map was taken as a guide and not binding by state leaders in any case. With most states enjoying exceptionally low case numbers and minimal impact to daily life, there is little to motivate them to import the NSW experience.

Should NSW persist with opening up international travel, the isolation of NSW from the rest of Australia will only intensify.

This is a quite high probability scenario, and represents a major threat to economic growth over the next 1-3 years.

Author

Clifford Bennett

Independent Analyst

With over 35 years of economic and market trading experience, Clifford Bennett (aka Big Call Bennett) is an internationally renowned predictor of the global financial markets, earning titles such as the “World’s most a