| 24 Hour: Neutral -Prefer to sell rallies? | Medium Term: Neutral – Possibly look to buy dips. |

Preferred Strategy: Neutral wait for the CPI – possibly sell rallies.

The Aud squeezed up to 0.7969 on Tuesday but the gains faded once the US$ regained its footing and the Aud has finished pretty much in the middle of the day’s range. We now await the CPI (exp 0.4% mm, 2.2% yy) and a speech from the RBA Governor Lowe, who may take another opportunity to talk the Aud lower.

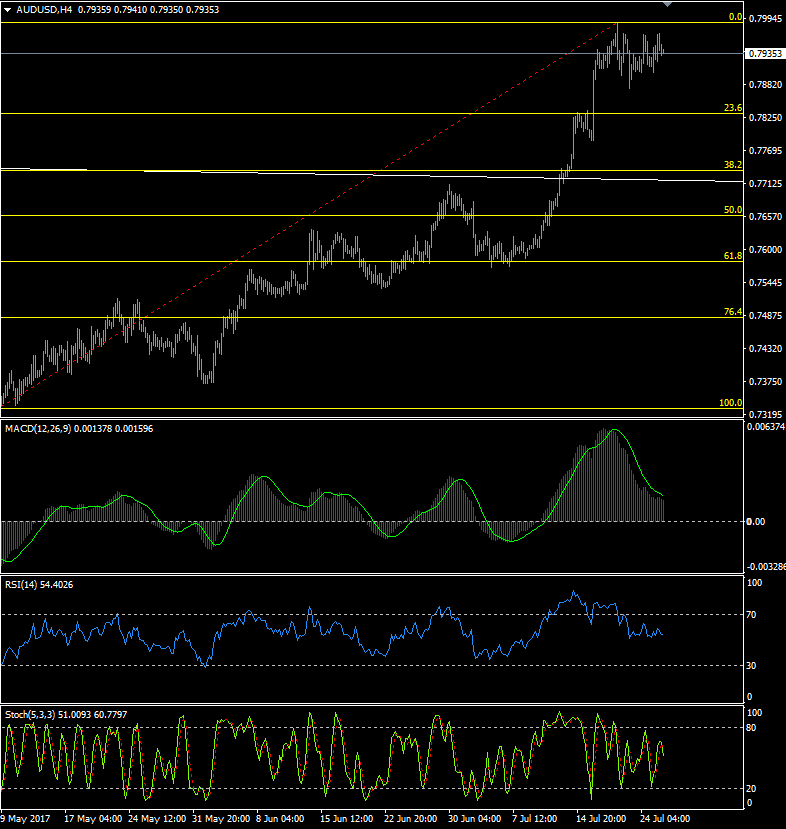

The momentum indicators look mixed again on Wednesday and a cautious stance is warranted although the longer term charts still hint that buying dips remains the medium term plan, with the weeklies particularly suggesting that at some stage we are in for a test of 0.8000+.

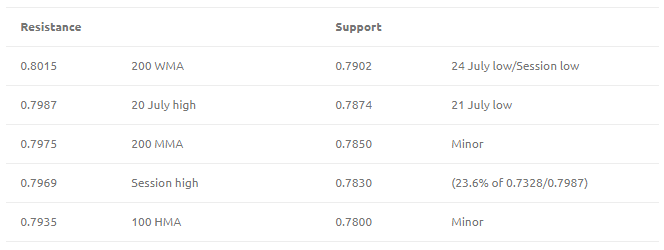

The short term momentum indicators look less positive and if we do head lower today, below 0.7900, the initial support will arrive at 21 July’s low of 0.7874, ahead of the chance of a drop to 0.7830 although this looks unlikely at this stage.

On the topside, the initial resistance will be seen at 0.7965/70, above which could see a move back to the 0.7988 trend high. Above here could then see a run towards 0.8000 and then to 0.8015 although I don’t think we are going there today unless the CPI easily beats expectations.

Economic data highlights will include:

W: CPI Q2

All content on this website, www.fxcharts.com.au (FX Charts PL) is a personal view only and offers absolutely no guarantee as to the correctness or otherwise of that opinion. The content here is of a “general nature” only and does not constitute personal or investment advice. The FX Charts website is not an inducement to trade Foreign Exchange (FX). No liability whatsoever is accepted for any loss or damage that may result, directly or indirectly, from any , comment, opinion, information or omission, whether negligent or otherwise, within the FX Charts Website. The information and any opinion or outlook expressed in this commentary may be based on assumptions or market conditions and may be liable change at any time, without notice.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.