AUD/USD Outlook: 0.6500 holds the key for bulls ahead of Australian CPI on Wednesday

- AUD/USD draws support from hopes for more stimulus from China and modest USD weakness.

- The Fed’s projected three rate cuts in 2024 keep the US bond yields and the USD depressed.

- Traders seem reluctant to place aggressive directional bets ahead of the US PCE data on Friday.

The AUD/USD pair attracts some buyers for the second successive day on Tuesday and looks to build on the overnight rebound from the vicinity of the 0.6500 psychological mark. The worsening sentiment over a Chinese economic recovery has been fuelling hopes for more stimulus from the People's Bank of China (PBoC) and lending some support to the Australian Dollar (AUD). In fact, a Bloomberg survey of economists finds the consensus expectation is for two more cuts in the Reserve Requirement Ratio (RRR) in 2024, totalling 50 basis points. This, along with bets that the Reserve Bank of Australia (RBA) will not cut rates until the second half of the year, overshadows a fall in Australia's Westpac Consumer Sentiment Index to 84.4 in March from 86.0 in the previous month. Apart from this, a modest US Dollar (USD) Weakness turns out to be another factor acting as a tailwind for the currency pair.

The USD Index (DXY), which tracks the Greenback against a basket of currencies, extends the previous day's retracement slide from over a three-week top in the wake of mixed signals over the Federal Reserve's (Fed) rate-cut path. The US central bank said last week that it remains on track to cut interest rates by 75 bps this year. This keeps the US Treasury bond yields depressed and weighs on the buck. That said, several Fed officials expressed concern about sticky inflation and stronger-than-expected US macro data, which might limit the USD losses and cap any meaningful appreciating move for the AUD/USD pair. Atlanta Fed President Raphael Bostic anticipates just one rate cut this year as the US economy and inflation are expected to slow gradually. Moreover, Chicago Fed President Austan Goolsbee noted that the central bank needs to see progress in inflation and strike a balance with its dual mandate.

Adding to this, Fed Governor Lisa Cook said that inflation has fallen considerably, though the path of disinflation, as expected, has been bumpy and uneven, while the labor market has remained strong. Cook added that prematurely easing policy might allow above-target inflation to become entrenched and eventually require a tighter monetary stance. This, in turn, should hold back the USD bulls from placing aggressive bets ahead of the release of the US Personal Consumption and Expenditure (PCE) Price Index, or the Fed's preferred inflation gauge on Friday. In the meantime, traders on Tuesday will take cues from the US macro data – Durable Goods Orders, the Conference Board's Consumer Confidence Index and the Richmond Manufacturing Index – ahead of Australian CPI on Wednesday. The mixed fundamental backdrop, meanwhile, warrants caution before positioning for any further upside for the AUD/USD pair.

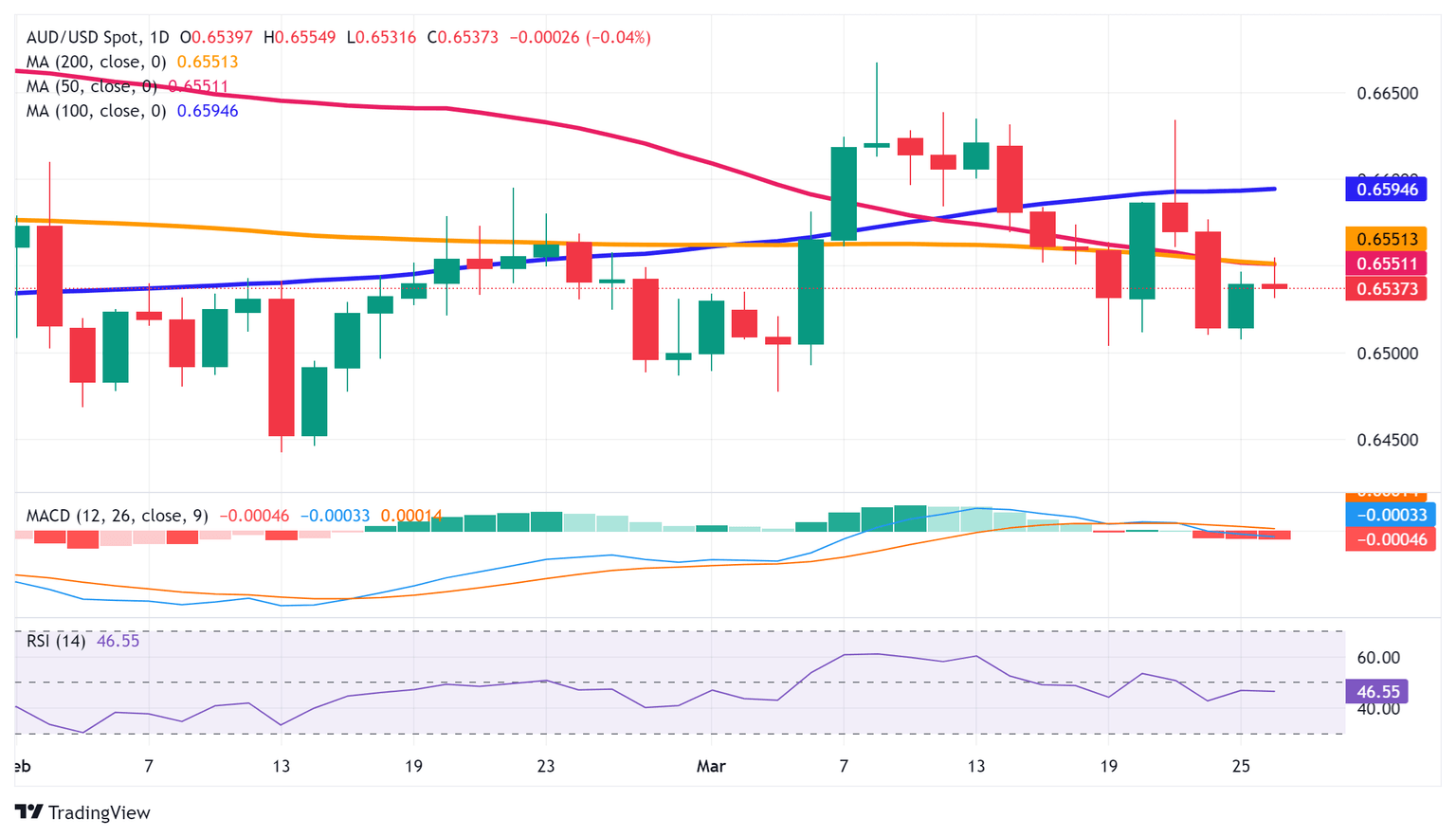

Technical Outlook

From a technical perspective, the recent repeated bounces from the 0.6500 psychological mark warrant some caution for bearish traders. That said, the lack of any meaningful buying warrants some caution before confirming that the AUD/USD pair has formed a near-term bottom. Moreover, oscillators on the daily chart have just started gaining negative traction and support prospects for an eventual breakdown through the said handle. The subsequent downfall has the potential to drag spot prices to the next relevant support near the 0.6445-0.6440 region, or the YTD low touched in February. Some follow-through selling should pave the way for the resumption of a nearly three-month-old downtrend.

On the flip side, momentum beyond the 0.6555-0.6560 region is likely to confront stiff resistance and meet with a fresh supply near the 0.6600 round-figure mark. This should cap the AUD/USD pair near last week's swing high, around the 0.6635 region, which if cleared decisively might shift the bias in favour of bullish traders. Spot prices might then aim to challenge the monthly swing high, around the 0.6665-0.6670 region before climbing to the 0.6700 round figure en route to the 0.6730 supply zone.

Premium

You have reached your limit of 3 free articles for this month.

Start your subscription and get access to all our original articles.

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.