As Prime Minister Abe prepares to raise the consumption tax by 3% on April 1st, investors are wondering if USD/JPY and Nikkei will experience the same rally followed by weakness. Raising taxes is always a difficult choice for politicians but Japan is running out of options. With a rapidly aging population, they need to find ways to pay for the growing costs of social security and health care as the numbers of working-age Japanese fall fast. By raising taxes from 5% to 8% next week and then to 10% in October 2015, the goal is to reduce their budget deficit by 50% next year and bring it into surplus by 2020.

The increase has been years in the making and as such, Abe’s administration is confident that the times are different and households are better equipped to withstand the rise because of the reduction in income taxes over the past few years and the opportunity to adjust their spending plans accordingly. Abe also feels that consumers understand that these difficult decisions are being made to build a sound foundation for Japan’s future, which he hopes will boost confidence.

We believe these views are overly optimistic especially with wages growing slowly but the pain could be brief if the Bank of Japan sweeps in with another round of stimulus. Also the difference between now and then is that the Asian Financial Crisis hit shortly after the tax increase. However what is similar is that like now, the strength of the economy gave the Japanese government the confidence to raise taxes in 1997 – unfortunately that was not enough to prevent a recession.

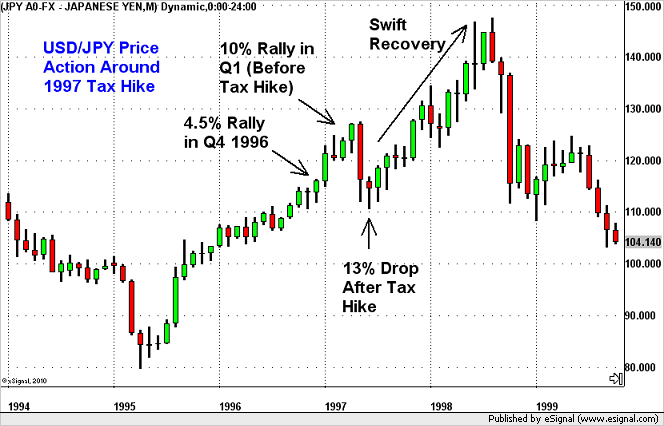

The sales-tax increase is the biggest risk for Japan’s economy this year. To understand how USD/JPY and the Nikkei could react to this year’s rise, we took a look at how Japanese assets performed in 1997. In the months leading up to the tax increase in 1997, the economy grew rapidly with Q4 GDP growth in 1996 hitting a high of 6.1%. Growth remained strong in the first quarter of Q1, with GDP rising 3%. In the quarter of the increase, the economy contracted by 3.8%. Leading up to the tax hike, the Nikkei fell but rallied strongly in the 3 months after taxes were raised. It was not until August of that year did stocks begin their long-term decline. The sell-off in USD/JPY on the other hand was sharp but short-lived. The currency pair plunged 13% between April and June but recovered strongly for the rest of the year. This same type of performance can be seen across the Yen crosses.

Will the Bank of Japan Ride in Like a White Knight with More Stimulus?

We believe that the main reason why the Bank of Japan has been reluctant to increase stimulus is because they are saving their ammunition for a time when the economy needs it most, which will be after taxes are increased. We firmly believe that the BoJ will respond to slower growth in the coming month by increasing the size of their Quantitative Easing program. Prime Minister Abe also has the option to reduce corporate taxes – in 2013 he only scrapped the surcharge for the 2011 earthquake reconstruction, leaving room for a further reduction in 2014 if the economy contracts sharply. So far, the Japanese government is playing it cool by saying they have accounted for slower growth and will not react to temporary factors. However if the BoJ increases asset purchases and the Japanese government announces a corporate tax reduction, any sell-off in USD/JPY on the back of weaker demand in April and May will be short-lived. If they stubbornly forgo another round of stimulus next year, USD/JPY could be subject to a nasty correction that could match the move in 1997 because many investors are positioned for more easing. Given how long Japan has waited for its current recovery, we can’t imagine a scenario where they do nothing and risk sending the economy back into stagnation.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.