As if Fed turned

S&P 500 and risk assets embraced the sharp jump in unemployment claims, and both 3m and 6m yields solidly declined. I don‘t think Powell would rock the boat next week, and we‘re most likely to get a no hike FOMC with plenty of existing tightening data impact caution with reassurances about this not being the terminal Fed funds rate, and that the progress chiefly on core inflation data warrants further tightening and balance sheet shrinking. Remember the most recent actions of Canada and Australia before celebrating ECB...

Forget about real economy (more so in goods than services) deterioration as indicated by international shipping rates, steel production or packaging industry more than anecdotal evidence of upcoming recession (beyond hard data such as LEIs or manufacturing).

Forget about Treasury replenishing TGA and its impact on commercial bank balance sheets at a time when both the government and private sector need rollover and fresh financing. In Sunday‘s extensive analysis I covered why the bearish impact wouldn‘t be nearly as negative as feared – and I‘ll take on more macroeconomics with technicals to ready you for Monday‘s trading again very soon.

Keep enjoying the lively Twitter feed via keeping my tab open at all times (notifications on aren't enough) – combine with Telegram that always delivers my extra intraday calls (head off to Twitter to talk to me there), but getting the key daily analytics right into your mailbox is the bedrock.

So, make sure you‘re signed up for the free newsletter and make use of both Twitter and Telegram - benefit and find out why I'm the most blocked market analyst and trader on Twitter.

Let‘s move right into the charts – today‘s full scale article contains 5 of them.

S&P 500 and Nasdaq outlook

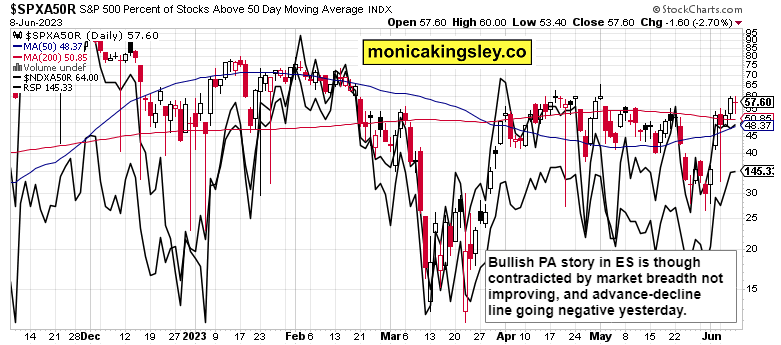

Time for tech with XLY and XLC came yesterday, and value didn‘t suffer all that much through the rotation – on the surface, must be said, because market breadth data don‘t paint a picture of strength. Nevermind, stocks are still in buy the dip environment, especially until 4,247 gets questioned – and that‘s not exactly on the table.

Therefore 4,283 serves as the nearest support if chop decides to strike, because there won‘t be any reversal today (still going up) – the megacaps won‘t turn south, and even if as weak as yesterday, the rotations would be enough to underpin stocks to take on 4,305 once again, probably with success.

Let‘s consider yesterday a consolidation in improving market breadth rather than claiming it would be hanging by the fingernails. No immediate danger to ES upswing here.

Credit markets

The called for improvement in bond prices came really fast yesterday, and is likely to sufficiently support stock market bulls also today. As said earlier, the theme is that bets on Jun pause are irresistible.

Author

Monica Kingsley

Monicakingsley

Monica Kingsley is a trader and financial analyst serving countless investors and traders since Feb 2020.