On June 16, China's National Bureau of Statistics (NBS) has released partial economic data for May. As we are almost halfway through 2021, the data for the first five months can roughly reflect the basic situation of China's economy in the first half of the year, which can provide some reference for the judgment of the economic situation of the whole year.

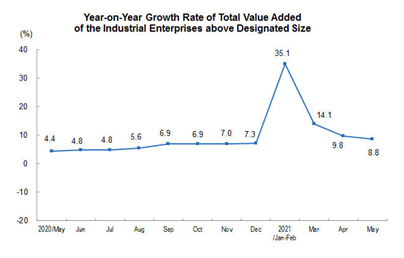

In terms of industrial growth, in May, the value-added of the industrial enterprises above the designated size grew by 8.8% year-on-year (real growth rate after deducting price factors), 13.6% higher than the same period in 2019, and the two-year average growth rate was 6.6%. On a month-on-month basis, in May, the value-added of the industrial enterprises above the designated size increased by 0.52% compared with the previous month. In the first five months of this year, the value-added of the industrial enterprises above the designated size increased by 17.8% year-on-year, representing a two-year average growth of 7.0%. In May, China's manufacturing PMI stood at 51.0, above the critical point for 15 consecutive months.

In the first four months of this year, the profits of industrial enterprises above the designated size reached RMB 2.5944 trillion, a year-on-year increase of 1.06 times and the two-year average growth rate was 22.3%. The operating profit margin of industrial enterprises above the designated size was 6.87%, 2.42 percentage points higher than that in the first four months of 2020.

One of the features of China's economic recovery since last year is the rapid recovery of industrial sector, which has become the fastest recovering sector of China's economy. This is related to the characteristics of China as the "world's factory". However, it is worth noting that since the second quarter of this year, China's industrial growth has started to slow down. Possible reasons are as follows: (1) Under the background of the gradual recovery of the world economy, industrial production in many countries is accelerating to recover after the pandemic has subsided, and the "dependence" on the Chinese industrial sector is decreasing. (2) China's industrial sector took the lead in recovering from last year's pandemic. So far, the potential for sustained growth has been fully unleashed and is close to the normal level.

In terms of investment, from January to May, China's fixed-asset investment (excluding rural households) was RMB 19.3917 trillion, up 15.4% year-on-year; it was 8.5% higher than that from January to May in 2019, with an average growth of 4.2% in two years. Among them, private investment in fixed assets was RMB 11.2472 trillion, up 18.1% year-on-year. On a month-on-month basis, investment in fixed assets (excluding rural households) increased by 0.17% in May. By industry, the investment in the primary industry was RMB 496.1 billion, up 28.7% year-on-year; the investment in the secondary industry was RMB 5.757 trillion, an increase of 18.1%; the investment in the tertiary industry was RMB 13.1386 trillion, an increase of 13.8%. In the secondary industry, industrial investment increased by 18.1% year on year. From January to May, the investment in real estate development nationwide reached RMB 5.4318 trillion, up 18.3% year-on-year; it was 17.9% higher than that from January to May in 2019, with an average growth of 8.6% in two years. Of this, investment in housing totaled RMB 4.075 trillion, up 20.7%.

It can be seen that under the low base effect, the fixed asset investment in the first five months of this year maintained a relatively rapid double-digit growth, but the growth rate of investment showed an obvious trend of gradual decline. As the economy gradually returns to normal after the pandemic, government-driven investment growth will gradually wane, while private investment will gradually increase. While overall investment growth slows, the consumption sector needs to play a more important role for a stable economic recovery.

In terms of consumption, the total retail sales of consumer goods in May reached RMB 3.5945 trillion, up 12.4% year-on-year; it was 9.3% higher than that in May 2019, with an average growth rate of 4.5% in two years. Among them, the retail sales of consumer goods other than automobiles reached RMB 3.2257 trillion, an increase of 13.2%. Excluding price factors, the total retail sales of consumer goods in May actually increased by 10.1%, with an average growth of 3.0% in two years. On a month-on-month basis, the total retail sales of social consumer goods increased by 0.81% in May. From January to May, the total retail sales of consumer goods reached RMB 17.4319 trillion, up 25.7% year-on-year, and the two-year average growth rate was 4.3%. Of this, the retail sales of consumer goods other than automobiles reached RMB 15.6304 trillion, up 24.4%. By consumption type, retail sales of goods in May grew 10.9% year-on-year, a two-year average growth of 4.9%; food and beverage revenue increased 26.6%, with a two-year average growth of 1.4%. From January to May, retail sales of goods grew 22.9% year-on-year, an average growth of 4.8% in two years; food and beverage revenue increased by 56.8%, with a two-year average decline of 0.3%. In the first five months of this year, China's online retail sales grew 24.7% year-on-year, a two-year average growth of 14.2%.

Even with the low base effect, the recovery in consumption still looks a bit sluggish, with the two-year average growth rate of retail sales of goods in May and January-May below 5%. As ANBOUND's researchers have pointed out before, consumption remains a shortcoming in China's economic recovery. There are many factors leading to poor consumption growth, but the most important factor should be related to income, i.e., consumers' expectations of future income growth, which constrains consumers' current consumption. The poor development situation of Chinese enterprises has also indirectly affected consumers' income growth expectations.

In terms of foreign trade, Mainland China's total merchandise imports and exports amounted to RMB 3.1361 trillion in May, up 26.9% year-on-year. Among them, exports grew 18.1% to RMB 1.7160 trillion, imports grew 39.5% to RMB 1.42 trillion, and the trade surplus reached RMB 296 billion. From January to May, China's merchandise imports and exports totaled RMB 14.7595 trillion, up 28.2% year on year. Among them, exports totaled RMB 8.0414 trillion, up 30.1% year-on-year; imports totaled RMB 6.7181 trillion, up 25.9% year-on-year. The performance of merchandise trade in the first five months is relatively good, which is related to the acceleration of global economic recovery. The recovery of the external economy has driven the growth of China's imports and exports.

In terms of price data, the consumer price index (CPI) rose 1.3% year-on-year in May, 0.4 percentage points higher than that in April. On a month-on-month basis, the CPI down 0.2% in May. By category, prices of food, tobacco, and alcohol rose by 0.8%, clothing by 0.4%, housing by 0.7%, household goods and services by 0.4%, transportation and communications by 5.5%, education, culture, and entertainment by 1.5%, medical and health care by 0.2%, and other goods and services by 0.9%. Among food, tobacco, and alcohol prices, the price of pork dropped by 23.8%. The core CPI, which excludes food and energy prices, rose 0.9%. From January to May, China's consumer prices rose 0.4% year on year.

The producer price index (PPI) rose 9.0% year-on-year in May, 2.2 percentage points higher than that in April. On a month-on-month basis, the PPI rose 1.6% in May. By industry, the PPI of oil and gas extraction industry, ferrous metal mining and processing industry, ferrous metal smelting and rolling industry, and non-ferrous metal smelting and rolling industry rose by 99.1%, 48.0%, 38.1%, and 30.4% respectively. The PPI for industrial products rose 12.5% year-on-year, 3.5 percentage points higher than April. In the first five months of this year, the ex-factory prices of industrial producers and purchasing prices of industrial producers rose by 4.4% and 5.9%, respectively. It is worth noting that there has been a sharp divergence between the CPI and PPI data in May. Due to the rising prices of commodities and raw materials, the PPI will increase, which will certainly put price pressure on downstream industries.

Final analysis conclusion

Overall, China's economic data still maintained a relatively moderate growth trend in May, which was driven by not only the domestic market demand but also the accelerated recovery of the world economy. However, it is important to note that a number of Chinese economic data growth rate have started to slow down, suggesting that the economy's momentum is still weak. Maintaining stable economic growth and economic resilience in the post-pandemic era should be the focus of China's economic policy in the next phase.

The information provided herein is derived from publicly available information that we believe to be reliable, but ANBOUND and its affiliates make no express or implied commitment or warranty as to the accuracy and completeness of the quoted information. The contents, views, analysis and conclusions of this article are for reference only and do not represent any inclination. ANBOUND and its affiliates do not accept any liability (whether direct, indirect or incidental) for any third party's acts or omissions in using this article and information. For specific suggestions or for more information on the content of this article, please contact the customer service staff of ANBOUND and its affiliated companies.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.