This article will explain why the CHF might be about to get interesting.

The Draghi press conference following the ECB rate decision will have caused more problems for the SNB than any other bank. With the ECB still considering QE, non-conventional and conventional measures to help the economy, the SNB will have wondered what more can they do to keep Switzerland and its economy on the right path.

The SNB, Central Bank of Switzerland, looks more beleaguered with each passing month. It is a small central bank with a large banking sector and an economy starring down the barrel of deflation at a time of Zero interest rates. The Swiss economy is a one trick pony, that trick is banking.

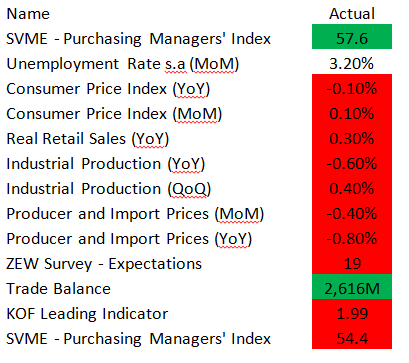

These are the data releases for March, It is hard to imagine a worse set of data. Just look at that price information, many other central Banks would have gone QE crazy. The SNB didn’t do anything.

Switzerland has pursued a long term strategy of developing a competitive advantage over Europe with lower borrowing rates and lower inflation. Without this advantage the famed Swiss banks would not exist, and consequently Switzerland might just be one more Eurozone periphery country. This competitive advantage is the foundation of the Swiss economy, it cannot be lost without huge pain and the SNB will defend it with its last Franc.

The SNB has defended, at great cost, an exchange rate against the Euro of 1.20 entering the market to manipulate the rate every time it is approached. This level is viewed as part of the competitive advantage but not the heart, a high CHF makes the services they provide look expensive however this is mitigated by the borrowing costs and inflation.

The one enduring bright light for the Swiss has been the Trade Balance, consistently higher than expected and at $2,616m very healthy for the size of the country. However I now doubt that light

A recent report by the Swiss Federal Customs Administration casts serious doubt on the validity of the GDP figures out of Switzerland and those out of the GB. Gold is counted as part of GDP, in my opinion it is money and not an export, and the UK exported 3.3Billion Euros of Gold to Switzerland in January (2014) alone. Switzerland then melted down the gold, re cast it in smaller bars and sold it to Asian countries at considerable profit.

UK GDP was reported at -3.5billion GBP which now looks like a huge overestimate of the actual figure. Perhaps the GB economy is a little slower than we thought.

London and the Bank of England is home to a large percentage of the world’s gold and movements of it does sometimes distort UK figures, however it is normally only temporary. Gold moves in and out of London on Balance sheets only, it is usually stored at the BoE. However this gold is gone to Asia for private investors and is unlikely to ever return.

Euro-Swiss inflation and the enduring competitive advantage

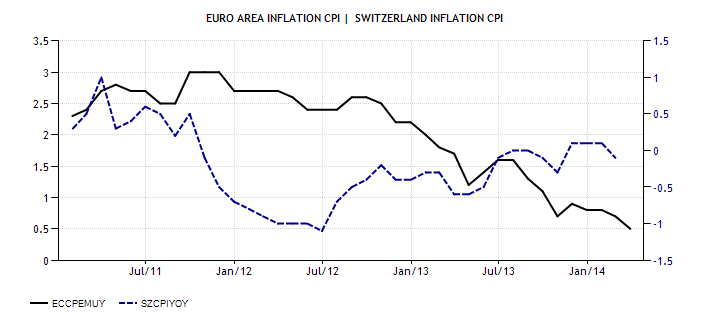

Pressure is building on the Exchange rate, it will soon approach SNB decision time. This graphic shows the two inflation rates over time.

As the inflation in Europe continues to fall, it is likely that it will become equal to, or less than, that in Switzerland. (The other possibility is that both move into ever worse deflation), effective interest rates are likely to be equal at around the same time. It is likely that Switzerland will remain a safe haven for risk off flows; geopolitical events may well increase those flows. China is a real possibility here. Flows into a country put upward pressure on the exchange rate.

The recent vote (last month) by the Swiss people to limit immigration will lead to wage pressure; it already has a very small unemployment rate. This will put inevitable pressure on inflation.Switzerland already has signs of a house price boom. More inflation pressureThis growing pressure on the Swiss Central Bank and the CHF is going to become unbearable going forward, inevitably the CHF is going to return to the 1.20 floor and the SNB will need to decide if they can defend that level.

They will find, as John Major did on black Wednesday, that the market will not accept a manipulated exchange rate value for long.

The SNB has only 2 choices:

- Allow a CHF appreciation and abandon the 1.20 floor

- Accept the loss of its competitive advantage over Europe in lower inflation and borrowing costs.

Conclusion

Without a substantial recovery in Europe, A tightening of the ECB’s policy the SNB will be forced to abandon the 1.20 floor.

Recommended Content

Editors’ Picks

EUR/USD clings to gains near 1.0750 ahead of US jobs report

EUR/USD clings to modest gains at around 1.0750 after closing the previous two days in positive territory. Investors eagerly await April jobs report from the US, which will include Nonfarm Payrolls and Unemployment Rate readings.

GBP/USD advances to 1.2550, all eyes on US NFP data

The GBP/USD pair trades on a stronger note around 1.2550 amid the softer US Dollar on Friday. Market participants refrain from taking large positions as focus shifts to April Nonfarm Payrolls and ISM Services PMI data from the US.

Gold remains stuck near $2,300 ahead of US NFP

Gold price struggles to gain any meaningful traction and trades in a tight channel near $2,300. The Fed’s less hawkish outlook drags the USD to a multi-week low and lends support to XAU/USD ahead of the key US NFP data.

XRP edges up after week-long decline as Ripple files letter in reply to SEC’s motion

Ripple filed a letter to the court to support its April 22 motion to strike new expert materials. The legal clash concerns whether SEC accountant Andrea Fox's testimony should be treated as a summary or expert witness.

US NFP Forecast: Nonfarm Payrolls gains expected to cool in April

The NFP report is expected to show that the US economy added 243,000 jobs last month, sharply lower than the 303,000 job creation seen in March. The Unemployment Rate is set to stay unchanged at 3.8% in the same period.