Takeaway

Capital outflows can push emerging market economies to breaking point, some degree of contagion is inevitable however history shows that these events affect some more than others and that they are triggered by actions at the FED and other Central Banks. Trading implications are clear, when risk aversion subsides the USD and the GBP will be strong, their economic strength is the reason for the emerging market crisis in the first place.The Report

Last week we had a substantial fall in the emerging market currencies and world capital markets, in recent times we have had a number of similar events. The two latest were in 2008 and the mid 1990's, these collapses don't happen at random they were caused by a particular set of circumstances and unfolded in a predictable manner, by analysing these past events we can gain clues as to what is likely to happen this time around and how we should position our trades.After the 1995 crisis the National Bureau of Economic Research published an excellent paper that looked at the data behind the collapse in various currencies, the contagion effect and provided a critique of the risk aversion arguments presented by most other economists. They took a real 'follow the money' forensic approach one Bagehot would have been proud of and one in-tune with Bagehotsway. The report found three key elements leading to currency devaluation much of this post is based on the data in that report.

What is capital outflow?

Markets are forward looking and investors try to avoid short term losses, they move their money away from countries where they expect to see a currency depreciation take place and into a country where they expect to see an appreciation take place, each investor assess the likelihood that an individual currency will devalue and then takes action accordingly. When money is cheap (low interest rates) people move it in search of higher yield, fast growing economies are a beneficiary. Monetary stimulus reduces risk providing further incentive to chase yield.The key element causing the changes in currency valuation is this flow of capital between the richer developed nations and the cash needy emerging markets nations. The money is in search of yield, if money moves into a country its currency goes up in value but the reverse is also true. The reverse can, to some extent, be absorbed by countries spending their national reserves if they are able or willing to do so. Once a currency begins to devalue it can trigger holders of liquid domestic liabilities (government debt and later local equities) to sell and move money abroad to safer environments (Japan, the US, Switzerland, the UK and the EU). The selling of government debt causes prices to drop and yields to rise increasing the local governments borrowing cost. This is a cycle that can lead to sovereign default and a currency collapse.

In 1995 the Tequila crisis (as it came to be known) began with the Mexican Peso. Prior to the collapse Mexico had built up substantial debts, it had low reserves and had seen substantial capital inflows in the previous years benefiting from a low interest rate policy in the US and a growing local economy offering high yields. In 1995 Mexico suffered huge capital outflows with money moving to the US$ and buying US debt. The trigger for the this flow was the Fed's decision (under Greenspan) to tighten monetary policy, leading to a doubling of interest rates in less than 12 months. That brought a lot of US$ home again seeking yield, high yields on an appreciating safe haven currency, in a country that can pay its debt, that would be good enough for me. (Dollars going back home sparked the problem everyone else selling and getting out of Dodge was the problem). Does this sound familiar? Fed tightening, US dollars going home?

The contagion spread but not all countries suffered the same way Chile, Colombia and Malaysia experienced relatively small transitory depreciation. While others suffered the same fate as Mexico (its currency went from 4 pesos to the dollar to 7.2) The 'lucky' countries had not increased debt in the preceding years and seemed able to repay their existing loans.

These are the three conditions highlighted in the NBER report,(1) several years of capital inflow under conditions of accommodative monetary policy, (2)substantial increase in government debt over this period and finally (3) low reserves leading to an inability to survive a period of reduced economic activity.

So we have a template: Capital outflows cause currency to fall in value, this happens to emerging markets when developed stable economies look like they are tightening their monetary policy after a period of very accommodative policy. The countries at greatest risk are those who have recently increased their debt, might have problems repaying it and have generally ridden the ride of easy money and moral hazard over the recent past.

The Current Situation: Which countries are at Risk?

According to the template of history countries with stable debt levels, good reserves and have not seen a boom economy in recent years will see a moderate devaluation in currency. Malaysia once again is a good example:- with a debt rating of A-(strong capacity to meet commitments) and a stable debt level, as seen below

During January the Malaysian Ringgit went from 3.30 to 3.35 per USD, bad but manageable.

Countries at risk

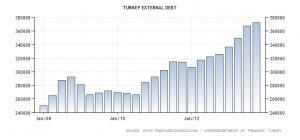

Which countries have increased debts recently? Argentina, Brazil, South Africa, Brazil and Russia. A graphic just to show the extent of the increase and for comparison with Malaysia, the graphs are roughly the same for all of these countries.

Last week the Argentine peso went from 6.40 to 7.80 per USD, that is beyond manageable.

What about their ability to repay their debt. I will use Standard and Poors ratings for this. The lowest rating is Argentina with CCC+ the highest is Turkey with BB+. S and P classify BB+ as 'highly speculative' and CCC+ as 'Currently vulnerable, dependent on favourable economic conditions to meet commitments'. Roughly translated these countries will have real trouble making payments, they can not afford their debt.

Official figures show that the cash outflow started 3 months ago corresponding almost exactly with the 100% belief that the FED would taper in September, according to published data it was $2.4 billion last week, Bank of America say it is not capitulation just yet that would need $20 billion!

Round Up

The markets are positioning for more taper, the resulting capital outflows are hurting emerging economies, some of them will need help to steady their currencies (in 1995 the US came to the aid of Mexico). The markets are showing this pain in a risk aversion move. History suggests that this risk aversion will not spread into all asset classes and will be confined to a few countries.

Recommended Content

Editors’ Picks

EUR/USD edges lower toward 1.0700 post-US PCE

EUR/USD stays under modest bearish pressure but manages to hold above 1.0700 in the American session on Friday. The US Dollar (USD) gathers strength against its rivals after the stronger-than-forecast PCE inflation data, not allowing the pair to gain traction.

GBP/USD retreats to 1.2500 on renewed USD strength

GBP/USD lost its traction and turned negative on the day near 1.2500. Following the stronger-than-expected PCE inflation readings from the US, the USD stays resilient and makes it difficult for the pair to gather recovery momentum.

Gold struggles to hold above $2,350 following US inflation

Gold turned south and declined toward $2,340, erasing a large portion of its daily gains, as the USD benefited from PCE inflation data. The benchmark 10-year US yield, however, stays in negative territory and helps XAU/USD limit its losses.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.