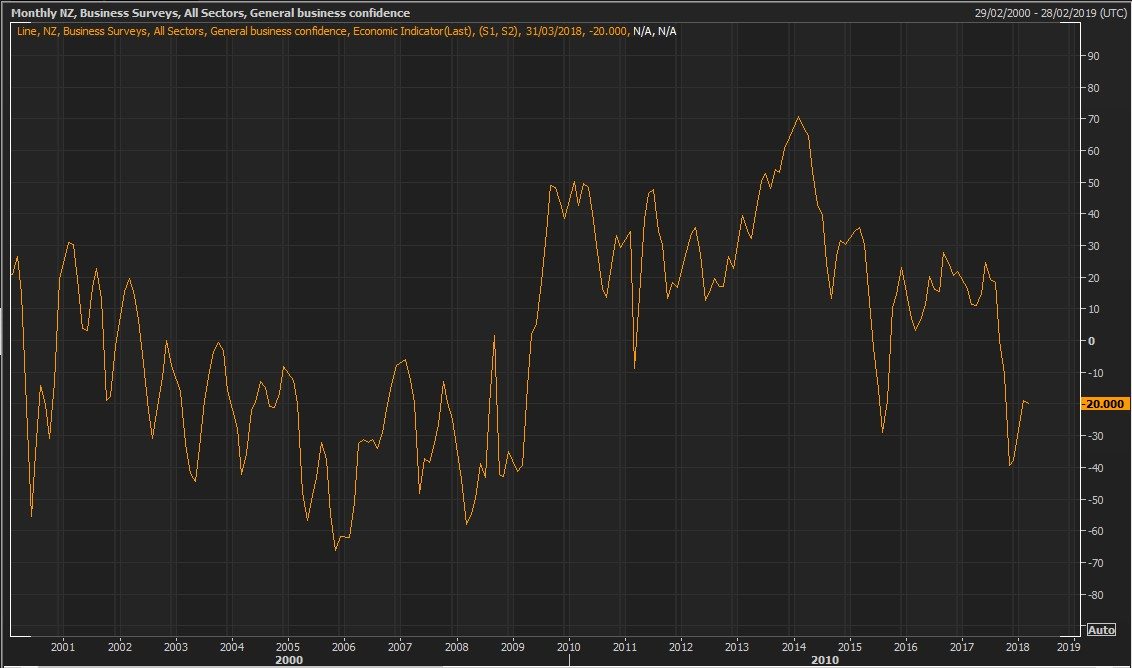

In the latest New Zealand Institute of Economic Research survey of 4300 businesses, it showed that uncertainty amongst businesses remain. Although the survey has bounced from the lows marked during last year’s election, the data still gives a not so optimistic outlook with a reading of -20. Furthermore, fewer businesses expect input prices to increase, with 33% believing prices will rise as opposed to 40% from the previous quarter.

Chart: Reuters Eikon

The report along with recent PMIs paint a picture of an economy in the process of muddling along, rather than one experience a growth acceleration with a higher rate of inflation on the horizon.

Another supporting factor is the latest REINZ House sales number which came in weaker overnight. The implementation of the Foreign real estate ban looks to be impacting the housing market. As a result, CPI data on Wednesday night may also disappoint.

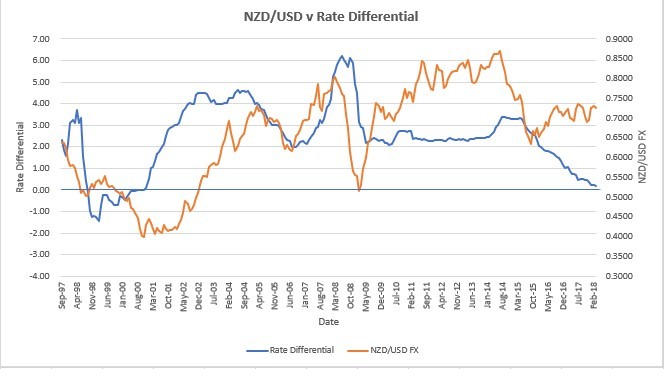

Despite the domestic story and global risk events including developments in Syria and the trade war narrative, the typically ‘risk on’ NZD has remained well bid throughout 2018. Even with a narrowing rate differential on the back of the Fed raising rates and RBNZ standing still, NZD/USD has continued to climb.

Check out how the rate differential and NZD/USD exchange rate has diverged…

Chart: Traders Corner

Interestingly, NZD positioning went from net short in mid-March, to pretty long as of last week’s positioning data. Considering the weakening fundamental outlook and aggressive market positioning, I feel a short NZD position (against the consensus) ahead of the CPI release may prove to be fruitful.

NZD Net Positioning

Chart: Traders Corner

I accept that short NZD/USD has been a tough trade this year as the weak USD theme has remained dominant, but there is an argument for a weaker NZD, and a disappointing CPI number could be the catalyst.

Trading foreign currencies is a challenging and potentially profitable opportunity for educated and experienced investors. However, before deciding to participate in the Forex market, you should carefully consider your investment objectives, level of experience and risk appetite. Most importantly, do not invest money you cannot afford to lose. There is considerable exposure to risk in any foreign exchange transaction.

Traders Corner, and any of its affiliates, will not be held responsible for any losses that the reader incurs as a result of utilizing the information contained within our articles. The content provided, is put forward in good faith and believed to be accurate; however, there are no explicit or implicit warranties of accuracy or timeliness made by Traders Corner or its affiliates.

Recommended Content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

GBP/USD consolidates above 1.2500, eyes on US PCE data

GBP/USD fluctuates at around 1.2500 in the European session on Friday following the three-day rebound. The PCE inflation data for March will be watched closely by market participants later in the day.

Gold clings to modest daily gains at around $2,350

Gold stays in positive territory at around $2,350 after closing in positive territory on Thursday. The benchmark 10-year US Treasury bond yield edges lower ahead of US PCE Price Index data, allowing XAU/USD to stretch higher.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

Week ahead – Hawkish risk as Fed and NFP on tap, Eurozone data eyed too

Fed meets on Wednesday as US inflation stays elevated. Will Friday’s jobs report bring relief or more angst for the markets? Eurozone flash GDP and CPI numbers in focus for the Euro.