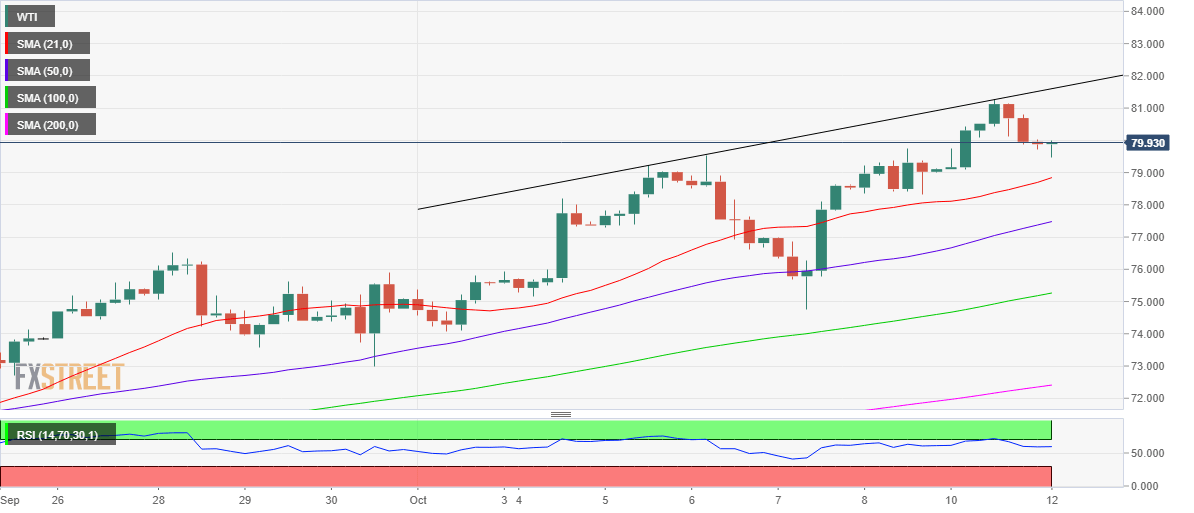

WTI Price Analysis: Drops back below $80 after facing rejection at key trendline hurdle

- WTI turns south after facing rejection above the $81 mark.

- Rising trendline hurdle at $81.28 on the 4H chart is a tough nut to crack for WTI bulls.

- RSI has eased from the overbought region but holds above 50.00, keeping bulls hopeful.

WTI (NYMEX futures) is consolidating near daily lows below the $80 mark so far this Tuesday, as the sellers take a breather after the run lower from seven-year highs in the overnight trades.

The retreat in oil prices comes on the heels of the reduced appetite for the riskier assets, as concerns over higher inflation amid surging energy prices weighed on the investors’ sentiment. The energy crunch threatens to negatively impact the post-pandemic global economic recovery.

From a short-term technical perspective, WTI turned south after facing rejection at rising trendline resistance at $81.28 on the four-hour chart.

With the latest leg down, WTI breached the $80 mark, remaining on track to test the upward-sloping 21-Simple Moving Average (SMA) at $78.84.

WTI: Four-hour chart

However, with the Relative Strength Index (RSI) easing from the overbought region, the bullish expectations have revived, as the leading indicator still holds well above the midline.

Therefore, bargain hunting could seep in at lower levels, taking WTI back above the $80 level, above which the aforesaid trendline hurdle could get retested.

Further up, buyers will continue to aim for the $82 round figure if the bullish momentum regains traction.

WTI: Additional levels to watch

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.