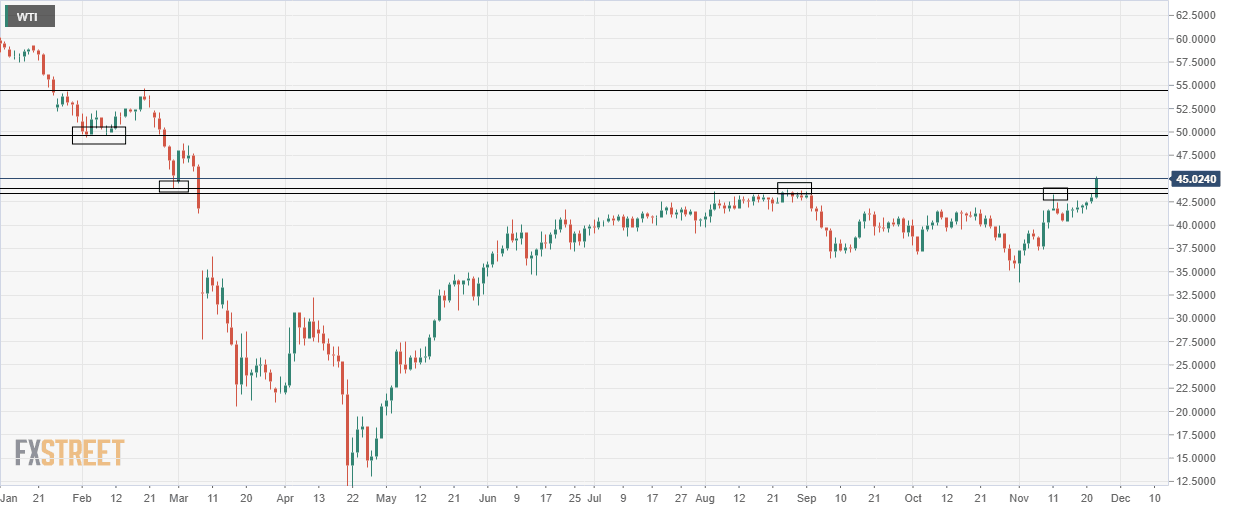

WTI extends gains to $45.00 mark, highest levels since 6 March

- WTI surged nearly $2 to reach $45 for the first time since early March on Tuesday.

- A confluence of risk on factors, including decreased US political uncertainty and vaccine, strong data and OPEC+ optimism are all helping.

WTI trades with gains of nearly $2 or 4.5% on Tuesday, taking the American benchmark for sweet light crude oil to briefly above the $45.00 mark, its highest levels since 6 March, prior to when Saudi Arabia initiated the price war that eventually resulted in the collapse of the front-month WTI futures to record lows of lower than -$30 per barrel.

Confluence of positives lifts crude to eight-month highs

Crude oil prices surged on Tuesday, seemingly buoyed by a significant uptick in the market’s broader appetite for risk on a few bullish macro factors;

The Trump Administration allowed the General Services Administration to inform the incoming Biden Administration that the formal transition process can begin. Though Trump is yet to admit defeat and is still pursuing his countless lawsuits and claiming fraud, this seems to be the first step to him admitting defeat, which gives markets one thing less to worry about.

Moreover, stock and commodity alike all seem to also still be deriving support amid the afterglow of Monday’s positive vaccine update from AstraZeneca, as well as stronger than expected US data and the news that the US Treasury Department is set to be in “safe hands” with former Fed Chairman Janet Yellen in charge.

More specifically for the crude oil complex; the notion that despite recent positive news on the vaccine front, OPEC+ members have yet to demonstrate a lower appetite for production cuts is also supportive.

Indeed, the greatest threat to the crude oil markets much hoped for at least three-month output cut extension from the cartel is likely to be recent crude oil price upside itself; countries might want to capitalise on higher prices by upping output at an earlier date (though this is just speculation).

Meanwhile, although not garnering a significant amount of attention on Tuesday, news of further risk to Saudi supply has also likely helped buoy crude oil prices today; Yemen’s Houthi rebel group attacked a Saudi Aramco distribution station in the Saudi Arabian city of Jeddah and a fire reportedly broke out. However, Aramco's said its supply of fuel to customers was not affected.

WTI bulls to eye a retest of big support at 26 August high

WTI crude oil prices cleared the 26 August high at $43.78 earlier on during Tuesday’s European session, opening the door to a sustained move to the upside, given a lack of any significant areas of resistance ahead of $49.00.

However, some profit-taking in wake of Tuesday’s outsized gains is likely warranted and could push WTI back towards a retest of the 26 August high. Here bulls are likely to be eager to buy the dip, so it ought to provide formidable resistance, but if the level does go, the 11 November high at $43.00 will be in focus.

WTI daily chart

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset