WTI crude subdued below $53.00 as market await key Powell and Biden speeches

- WTI crude oil currently trades marginally in the red during what has thus far been choppy directionless trade.

- Markets await speeches from Fed Chair Powell and US President-elect Biden for further impetus.

WTI crude oil currently trades flat during what has thus far been choppy directionless trade. Front-month WTI futures currently trade just beneath the $53.00 level. Prices have swung between pre-US session lows of just above $52.20 and recent highs just above $53.00. Focus is very much on demand-side fundamentals, with Fed Chair Jerome Powell speaking at 17:30GMT (any dovishness could help crude oil) and then US President-elect Joe Biden expected to unveil his plans for the next round of US fiscal stimulus (CNN sources suggested his plan could be worth $2T) at around 00:15GMT. Meanwhile, any news regarding Covid-19 lockdown and vaccines, as well as Middle Eastern geopolitics (tensions between Iran and the US) are worth keeping on the radar.

Supply-side fundamentals

Supply-side fundamental news has been light in recent days. Markets have now had time to fully digest the implications of last week’s OPEC+ meeting, the most consequential outcome of which was the Saudi Arabian’s unilateral decision to voluntarily cut output by 1M barrels per day in February and March to avoid an oversupplied market. The consensus is, of course, that this is a bullish development and will contribute to crude oil markets moving into undersupplied territory later in the year, which is expected to provide continual support for prices.

Otherwise, there is now much to update on aside from perhaps developments in the Middle East, where tensions between Iran and the US (in particular, the outgoing Trump administration) remain high. Fear of Iranian backed military attacks against US interests on at the one-year anniversary of the US’ killing of Iranian General Solemeini last in early January 2020 did not materialise into anything, likely in large part due to the US beefing up its military presence in the region in recent weeks. In terms of the latest, Iran has reportedly sent drones to its allies in Yemen.

Demand-side fundamentals

For the most part, WTI continues to shrug off negative news regarding the near-term demand for fuel as global lockdowns get increasingly strict. In terms of the latest on that front, France just introduced a new nationwide lockdown to start from 18:00GMT, German Chancellor Merkel reportedly wants to toughen the German lockdown and over 22M people are currently under strict lockdown conditions in China’s Hebei province, which surrounds Beijing. The country posted the largest number of new Covid-19 infections in over five months on Wednesday.

Vaccine optimism (i.e. expectations for a swift, vaccine fuelled global economic reopening later in the year) continues to take the edge off of any concerns over near-term demand and the latest news on this front continues to be good; mass vaccination programmes continue to make strong headway in the major developed market without serious issue and Johnson & Johnson provided a promising update in which the one-shot only vaccine was reported to be safe and generate an immune response in early trials. The company thinks its vaccine will have 80-85% efficacy.

Elsewhere, OPEC released its monthly oil market report; the cartel did not change their demand growth forecast for 2021, forecasting that global demand would rise by about 5.6M barrel per day on a YoY basis. The paper, which was the second of the three major monthly oil market reports to be released so far this January, was thus a little more bullish than the US Energy Information Administration’s (EIA) Short-Term Energy Outlook, which downgraded its forecast for world oil demand growth by 220K barrels per day.

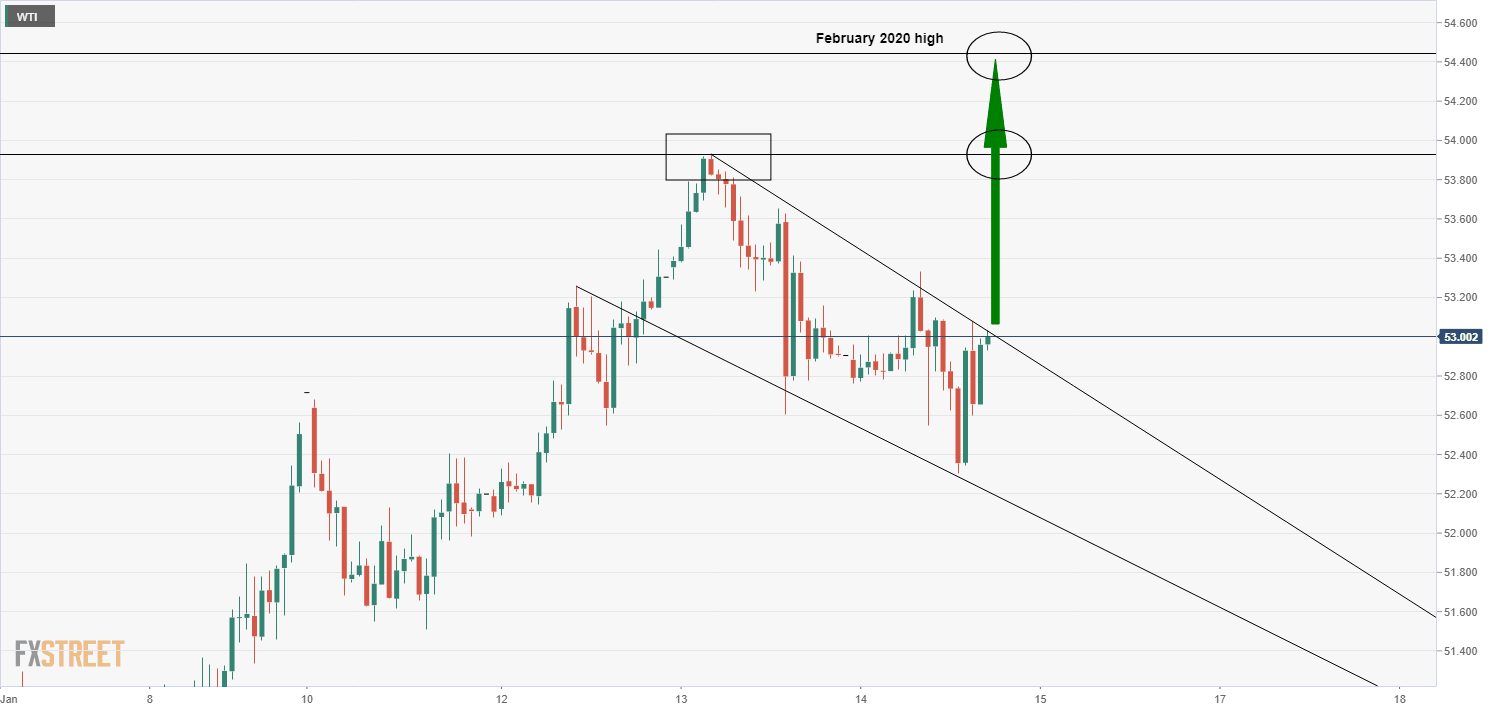

WTI forming bullish flag

WTI appears to be forming a bullish flag. An upside break would open the door to a test of recent highs close to $54.00 and then onto the February 2020 high at $54.45. With most analysts/market commentators very much bullish on crude oil markets right now, an upside break seems more likely than not.

WTI hourly chart

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset