- Macron said that he doesn’t think that Trump will change its mind on the Iranian deal.

- Trump is believed to not renew the Iranian deal on May 12 and oil market are not pricing that in according to analysts.

Crude oil West Texas Intermediate benchmark is trading at around 68.19 up 0.19% on Thursday as the market is undecided on the Iranian deal outcome.

The Iranian deal, which forces Iran to limit its nuclear program in exchange for the suspension of economic sanctions might be at risk on May 12 as Trump repeatedly said he is not willing to renew it. Trump wants to create a harsher version of the deal going against France, Germany and UK’s approval.

French President Macron went to Washington this week to discuss the issue with Trump, but the US President still appears decided to pull out of the deal. "My view, I don't know what your President will decide, is that he will get rid of this deal on his own, for domestic reasons," said Macron.

On the other hand, Iran said it will not accept a different version of the current deal and if any changes are made to it Iran threatens to resume its nuclear activity.

Oil markets are strongly underestimating what would be the impact of the US not renewing the Iranian deal on May 12, according to Ehsan Khoman, head of research at MUFG. The Iranian oil disruption can lead to a supply squeeze of about 350,000 barrels a day and the market might not have priced that in. If anything unexpected happens with the Iranian deal the analyst sees WTI crude oil above $75 a barrel.

"High geopolitical tensions between the U.S. and Iran certainly don't bode well for oil markets. Our base-case scenario is that Donald Trump will not sign the nuclear waiver agreement on May 12. He has been articulating that in tweeting policy and through other statements." according to Ehsan Khoman.

Meanwhile, on Thursday, two major oil companies reported their earnings for the first quarter of 2018 which showed a strong increase stemming from higher oil and gas prices. Shell reported a 42% increase in profits at $5.322 billion while, French oil major, Total, also reported above-consensus first-quarter earnings with net adjusted profit of $2.9 billion versus $2.77 billion expected by analysts.

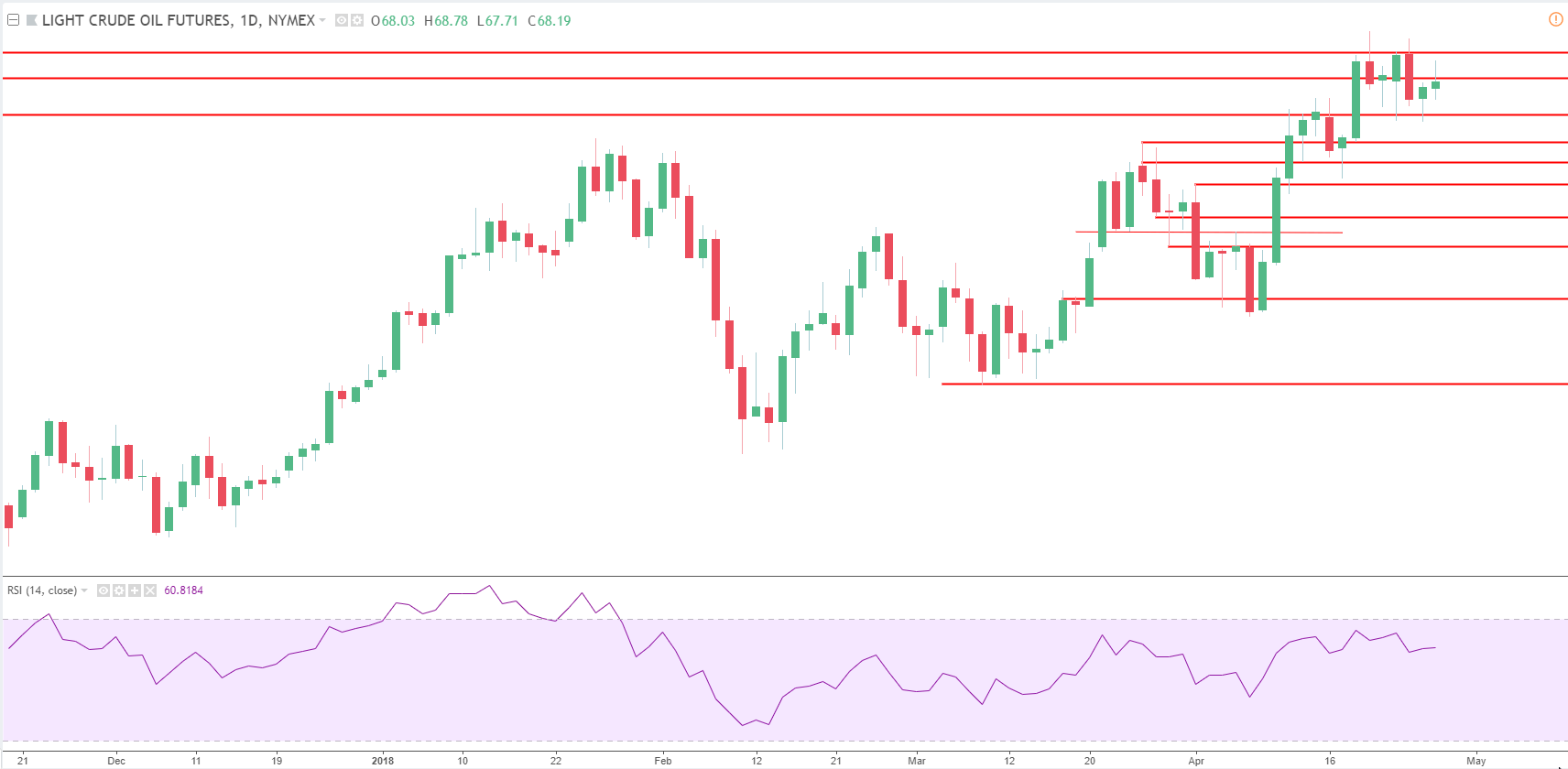

Crude oil WTI daily chart

The trend is bullish. Supports are seen at 67.30 demand level and 66.55 swing high while resistances are seen at 68.30 pivot level and the 69 figure.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

AUD/USD extends its upside above 0.6600, eyes on RBA rate decision

The AUD/USD pair extends its upside around 0.6610 during the Asian session on Monday. The downbeat US employment data for April has exerted some selling pressure on the US Dollar across the board. Investors will closely monitor the Reserve Bank of Australia interest rate decision on Tuesday.

EUR/USD: Optimism prevailed, hurting US Dollar demand

The EUR/USD pair advanced for a third consecutive week, accumulating a measly 160 pips in that period. The pair trades around 1.0760 ahead of the close after tumultuous headlines failed to trigger a clear directional path.

Gold bears take action on mixed signals from US economy

Gold price fell more than 2% for the second consecutive week, erased a small portion of its losses but finally came under renewed bearish pressure. The near-term technical outlook points to a loss of bullish momentum as the market focus shifts to Fedspeak.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.