WTI Crude Oil accelerating declines towards $83, OPEC recommends maintaining prodution cuts

- WTI Crude Oil prices have extended recent declines.

- US crude prices are set to close in the red for four of the last five trading days.

- OPEC has reaffirmed lower production targets through 2024 to bolster crude costs.

West Texas Intermediary (WTI) dipped below $83.20 per barrel on Wednesday, pushed lower as markets eased off supply concerns and rising US Treasury yields put downside pressure on risk assets.

The Organization of the Petroleum Exporting Countries (OPEC) saw a meeting of its Joint Ministerial Monitoring Committee (JMMC), which reaffirmed OPEC's crude production cuts through the end of 2024 in order to support crude oil prices. The JMMC has no outright decision-making powers, but rather makes recommendations that are then reviewed at following OPEC ministerial meetings.

Saudi Arabia and Russia both reaffirmed their current output reductions, with Saudi Arabia keeping their reduced crude output and Russia holding their exportation cap through the end of the year. Both countries are set for a "review" of their respective output reduction caps next month.

Ongoing market concerns about a chronic undersupply of global crude oil demand are beginning to wane as crude oil reserves see relief on the horizon. US crude oil inventories continue to decline, but the pace of drawdown is slowing as gasoline reserves begin to surge as production facilities ramp up the conversion of crude oil into down-market products in order to take advantage of eye-watering barrel costs.

Crude reserve drawdown continues, but light at the end of the tunnel for US supplies

JP Morgan analyst Natasha Kaneva expects oil inventory drawdowns likely to pivot to slight rebuilds in the final months of the year.

The US' Energy Information Administration (EIA) showed crude oil inventories declined 2.2 million barrels last week, compared to 4.2 million barrels the week before, and a surprise 6 million-barrel jump in gasoline stockpiles.

WTI technical outlook

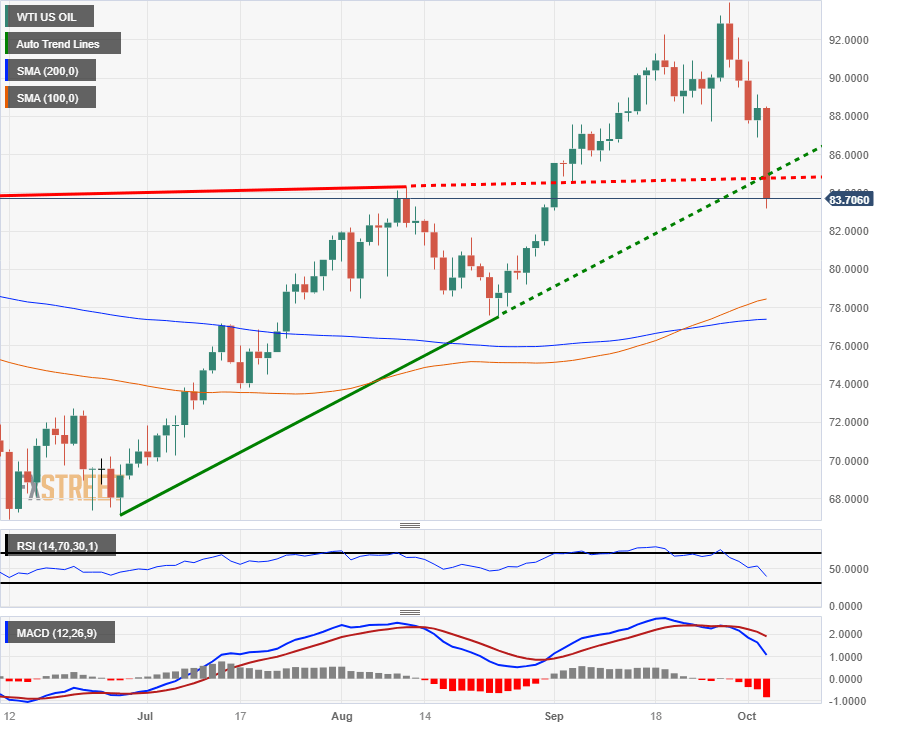

Wednesday's drop into 83.20 sees WTI crude oil prices making a bearish break of a bullish trendline from June's bottoms near $67.15, and sellers will be looking to make an extended run into the 200-day Simple Moving Average (SMA) near $77.40.

Technical indicators are cycling into the low end, and the Relative Strength Index (RSI) is set to ping oversold territory, currently declining to 38.93 with WTI down 11% from 13-month highs at $93.98 just five trading days ago.

WTI daily chart

WTI technical levels

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.