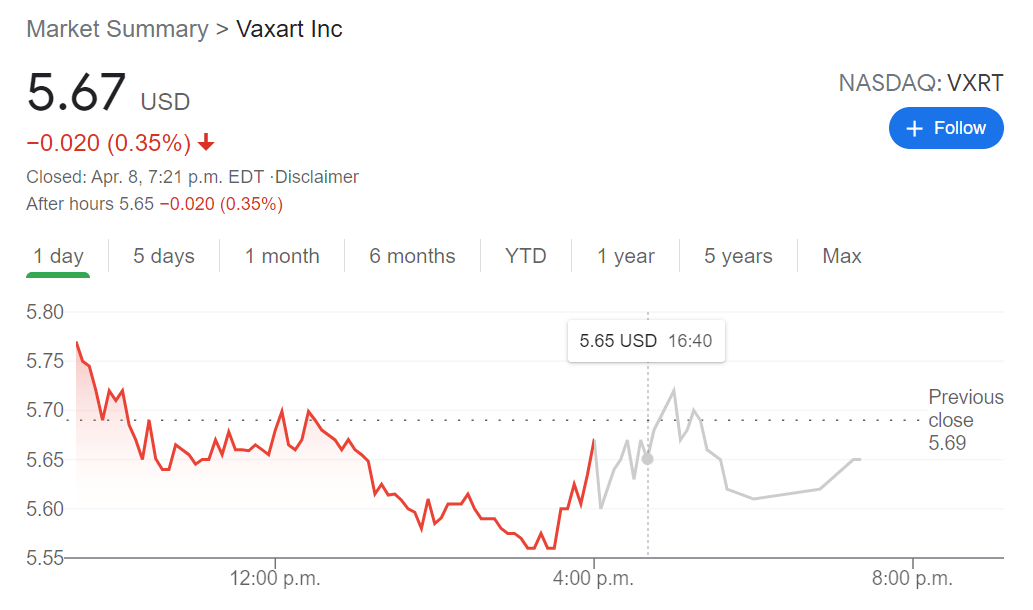

- NASDAQ:VXRT fell by 0.35% on Thursday as the stock lagged the NASDAQ index which gained 1.03%.

- Vaxart is banking on a demand for its COVID-19 tablet treatment.

- Vaxart teams up with a pharmaceutical giant to prepare for a flu vaccine in a post-COVID world.

Update April 28: Vaxart Inc (NASDAQ: VXRT) broke its two-month-long consolidative mode to the upside, rocketing nearly 37% to hit two-month highs of $9.48 on Tuesday. In post-market trading. The shares of the South San Francisco-based biotechnology company added another 3.50%, as the stock settled at $8.62. Vaxart posted its highest one-day gain since early February. The price of VXRT skyrocketed after the company announced an upcoming webinar scheduled for May 03, where it expects to release new Phase 1 data supporting the efficacy of its COVID-19 vaccine VXA-CoV2-1. The stocks were on a downtrend after the resignation of two prominent board members in late January.

Update April 12: Vaxart Inc( NASDAQ: VXRT) has extended its decline, closing Friday's session with a fall of 2.47% to close at $5.53. The South San Francisco-based biotechnology company remains one of the laggards in the race to vaccinate the world against COVID-19 and it seems that come investors are losing patience. Nevertheless, bargain-seekers seize on the company's headways into flu immunizations.

NASDAQ:VXRT has been one of the forgotten micro-cap biotech plays as Operation Warp Speed fades into the background. Following the releases of injectable vaccines from Pfizer (NYSE:PFE), Moderna (NASDAQ:MRNA), and AstraZeneca (NASDAQ:AZN), the COVID-19 vaccine discussion has lost its momentum. On Thursday, Vaxart traded relatively flat but still lagged the NASDAQ which once again surged by 1.03% on the strength of a rebound from big tech. Vaxart lost 0.35% during the trading session, and closed the day at $5.67. Vaxart has had a difficult time gaining traction with investors, and is trading well below both its 50-day and 200-day moving averages, signalling its downward trend thus far in 2021.

Stay up to speed with hot stocks' news!

Months ago, Vaxart surged on the news of its tablet-form COVID-19 vaccine candidate, named VXA-CoV2-1. This was during a time where logistics for transporting and storing Pfizer’s vaccine was making headlines, so many investors believed Vaxart’s tablet would be an easy solution. Well, here we are, and Pfizer’s vaccine remains in global circulation, while Vaxart received Phase 1 clinical trial data that its efficacy lagged that of Pfizer. Still, if further clinical trials return more positive news, then we could see Vaxart returning to its higher price levels.

VXRT Stock price news

Vaxart is also bringing its tablet form of vaccine to a new partnership with pharmaceutical giant Johnson & Johnson (NYSE:JNJ), to provide a new influenza vaccine moving forward. Although the flu has inexplicably disappeared for the most part during the COVID-19 pandemic, biopharma firms are already preparing for a world after COVID-19 is under control, which may mean a return of the seasonal flu virus.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended content

Editors’ Picks

EUR/USD clings to gains above 1.0750 after US data

EUR/USD manages to hold in positive territory above 1.0750 despite retreating from the fresh multi-week high it set above 1.0800 earlier in the day. The US Dollar struggles to find demand following the weaker-than-expected NFP data.

GBP/USD declines below 1.2550 following NFP-inspired upsurge

GBP/USD struggles to preserve its bullish momentum and trades below 1.2550 in the American session. Earlier in the day, the disappointing April jobs report from the US triggered a USD selloff and allowed the pair to reach multi-week highs above 1.2600.

Gold struggles to hold above $2,300 despite falling US yields

Gold stays on the back foot below $2,300 in the American session on Friday. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.6% after weak US data but the improving risk mood doesn't allow XAU/USD to gain traction.

Bitcoin Weekly Forecast: Should you buy BTC here? Premium

Bitcoin (BTC) price shows signs of a potential reversal but lacks confirmation, which has divided the investor community into two – those who are buying the dips and those who are expecting a further correction.

Week ahead – BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.