USD weakness to continue if Democrats take control of the Senate – TDS

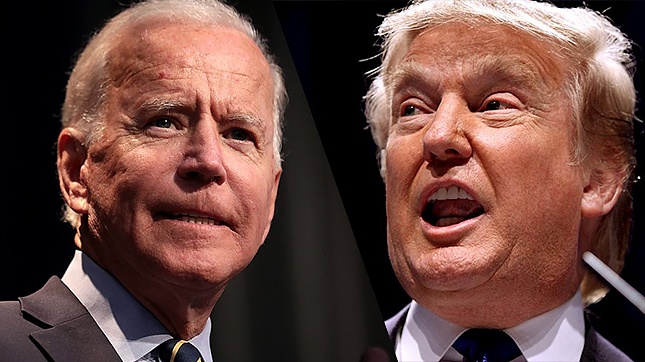

The Georgia Senate runoffs on January 5, 2021, will determine the balance of power in the Senate. The Senate is currently controlled by Republicans, who hold 50 seats to the Democrats' 48. If the Democrats are able to win both Georgia seats, the Senate would be tied at 50-50, with incoming Vice President Harris becoming the potential tie-breaker in favor of the Democrats.

According to economists at TD Securities, the USD could see further downside momentum should the Democrats flip both Georgia seats.

Key quotes

“Republicans need to win just one of the two GA contests on Tuesday to remain the majority party in the Senate, but polls have been moving in favor of the Democrats and betting odds have tightened. The Ossoff-Perdue race is expected to be the tighter of the two.”

“Vote counting is likely to proceed fairly quickly after polls close, but winners may still not be determined for several days if races are close. Final counts are likely to be more favorable for the Democrats than the initial results, similar to the pattern in November.”

“Should the Democrats succeed in flipping the Georgia Senate seats, we think the odds of another covid relief package will outweigh the downside associated with a potentially more ambitious Biden agenda. Taken in conjunction with the easing of notable tail risks (like Brexit), we think this would fuel the USD's downside momentum under the umbrella of reflation cemented by a higher inflation risk premium. We think this could further Asia FX outperformance versus the USD and corresponding equity markets.”

“Should the Senate remain in the hands of the GOP, we think the USD could find some limitation in terms of the weakness observed across the G10, particularly against EUR/USD where recent price action looks to have stalled around 1.23, at least tactically. That said, we do not think a GOP controlled Senate is enough to push investors off of the prevailing bias, which remains anchored towards USD bearishness – the degree of which might be shallower than a Senate seating 50 Democrats.”

Author

FXStreet Team

FXStreet