USD/TRY consolidates the rally above 12.50, as bulls aim for 21-DMA

- USD/TRY keeps the green for the fourth consecutive session.

- Turkish government’s rescue plan fails to save the day for lira bulls.

- USD/TRY targets 21-DMA on the upside amid bullish daily RSI.

USD/TRY is trading better bid above 12.50, consolidating Wednesday’s massive surge to five-day highs of 12.69.

The lira bears refuse to give up, despite the Turkish government’s experimental plan to stabilize the currency. The government announced that it will promote the conversion of gold savings into liras.

“If the lira's depreciation versus gold exceeds bank interest rates, the central bank will make up for losses incurred by holders of lira deposits,” Hurriyat reports, citing quotes from the Turkish official gazette.

USD/TRY tumbled roughly 7% a day before, shrugging off the government’s efforts and the central bank’s comments. “The CBRT has no commitment to any exchange rate level and will not conduct FX buying or selling transactions to determine the level or direction of the exchange rates,” the bank said.

Wednesday’s rally reversed nearly 25% of the previous week’s losses in USD/TRY. The resurgent US dollar demand also helped the spot gain further ground.

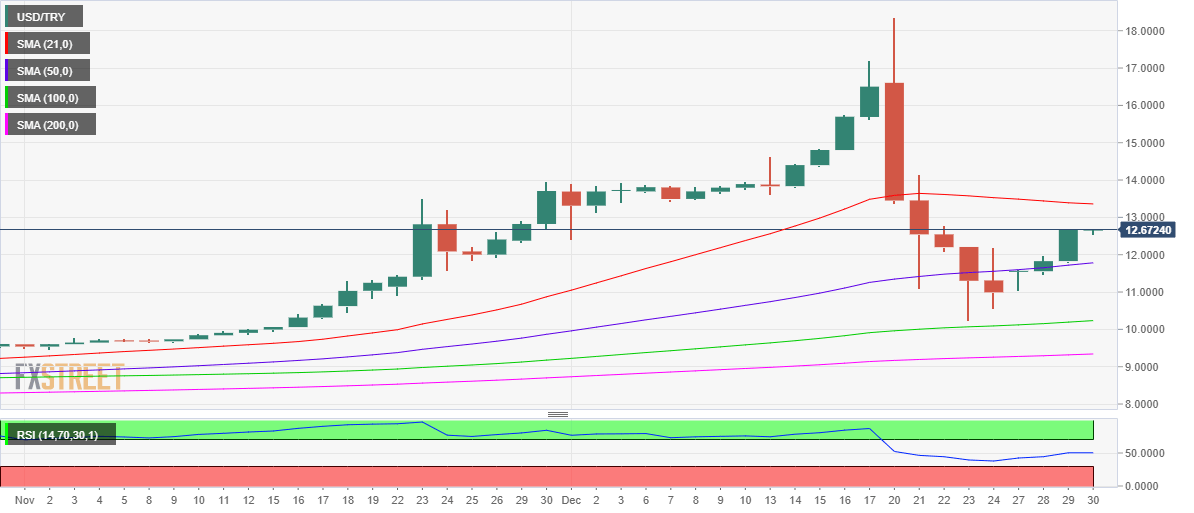

Looking at USD/TRY’s technical chart, the spot’s daily closing above the 50-Daily Moving Average (DMA) resistance, now at 11.78, on Tuesday, prompted a fresh upswing beyond 12.00. having bounced off the critical 100-DMA support in the previous week.

The 14-day Relative Strength Index (RSI) is trading just above the midline, having pierced the 50.00 level amid the renewed upside. The leading indicator points to more gains in the offing for the currency pair.

The next stop for bulls is seen at the mildly bullish 21-DMA at 13.38. A firm break above the latter will open doors for a test of the 15.00 level.

Alternatively, selling resurgence could put the 50-DMA resistance-turned-support at risk, below which Monday’s low of 11.07 will get tested.

The last line of defense for buyers is envisioned at 100-DMA at 10.23.

USD/TRY: Daily chart

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.