USD/JPY wraps up Monday on the downside, testing 146.50

- The USD/JPY inverts currency flows as the Yen rises and the greenback steps down.

- The BoJ could be on track to reverse negative rates, sending JPY back up the charts.

- USD traders will be looking towards US CPI figures on Wednesday.

The USD/JPY saw declines in one of the worst-closing trading days since July, finishing Monday near 146.50 after opening the new trading week on the high side near 147.85. The Japanese Yen (JPY) is seeing fresh bidding in the market on the back of bullish comments from the Bank of Japan (BoJ), and the Greenback (USD) is sliding across the board as profit-taking from the recent bull run saps momentum for the US Dollar.

Yen gaining ground on BoJ hints of future rate policy reversal

Weekend comments from the BoJ’s Governor Kazuo Ueda hinted that the Japanese central bank is inching closer to reversing its negative rate policy. In an interview with the Yomiuri Shimbun newspaper on the weekend, BoJ Governor Ueda expressed that the end of the year could see a shift in negative rates from the Japanese central bank, as long as data supports the view that the BoJ is on track to achieve their 2% annual inflation target.

Markets seized upon the statements, sending the Yen to fresh highs across the board in anticipation of the beginning of a long-awaited rate hike cycle from the BoJ. On the US Dollar side, Greenback traders are taking a step back ahead of key US inflation figures due in the midweek.

US Consumer Price Index (CPI) figures are due on Wednesday, with market forecasts calling for the headline CPI to print at 0.5% MoM, an uptick from the previous period’s 0.2%. Core CPI numbers are expected to hold steady at 0.2%, and deviations in inflation figures could see rapid changes in the market’s USD bias to close out the trading week.

USD/JPY technical outlook

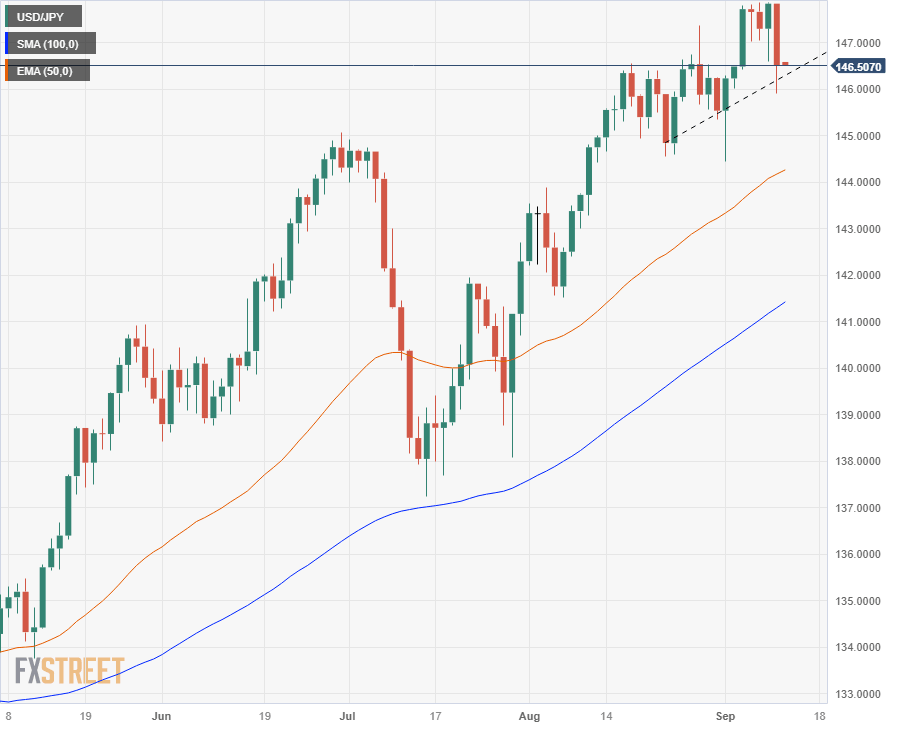

The Dollar-Yen pairing swooned below the 146.00 handle in early Monday trading, recovering to 147.00 before settling at the midpoint near 146.50. Last week saw the pair knocking on the ceiling just above 147.80, but fresh JPY bidding coupled with the USD step back has taken the pair off the highs, and a technical recovery will need to first gather steam from the resistance-turned-support barrier near 146.40.

A new rising trendline on daily candles will see dynamic support if current consolidation continues, and bulls will be looking for an upshot from US CPI data on Wednesday.

USD/JPY daily chart

Author

Joshua Gibson

FXStreet

Joshua joins the FXStreet team as an Economics and Finance double major from Vancouver Island University with twelve years' experience as an independent trader focusing on technical analysis.