USD/JPY retraces from weekly highs, and slips below 136.00 on safe-haven flows

- Risk-off impulse dominates the last trading day of June, boosting safe-haven peers.

- The USD/JPY falls from 137.00 below the 136.00 mark, weighted by the drop in US Treasury yields.

- The US Federal Reserve’s favorite inflation gauge, the core PCE came lower than the previous reading, signaling the effects of higher rates begin to feel.

The USD/JPY slides on Thursday, following a lower-than-expected inflation report, which could deter the US Federal Reserve from tightening at a faster pace amidst odds increasing of recession, keeping investors uneasy. At 135.85, the USD/JPY retreats from daily highs shy of 137.00, back below the 136.00 mark.

Negative sentiment and falling yields, a headwind for the USD/JPY

Risk aversion dominates the markets, as half/quarter/month-end flows bolstered the greenback. US equities remain heavy; the greenback rises shown by the US Dollar Index up by 0.04%, at 105.135, while US Treasury yields drop, led by the 10-year T-note rate at 3.00%, diving nine bps.

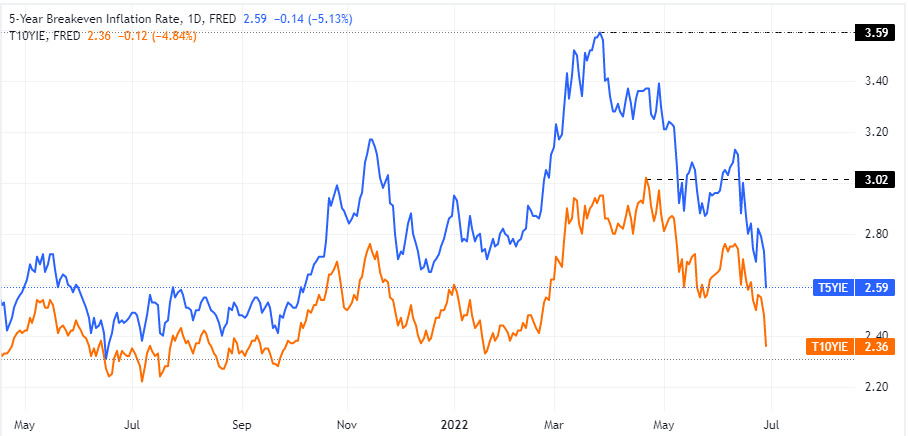

Besides that, fears of a recession as global growth stagnated, alongside high inflation, spurred a flight to safe-haven. Particularly in the USD/JPY, the yen remains bid, boosted by the fall in US Treasury yields, weighed by falling US inflation expectations, as illustrated by the five and 10-year break-even inflation rates, easing from YTD highs around 3.59% and 3.02% each, down to 2.59% and 2.36%, respectively.

In the meantime, US inflation, as measured by the Personal Consumption Expenditure (PCE), rose by 6.3% YoY, unchanged in May, the US Bureau of Economic Analysis reported. Meanwhile, the Fed’s favorite gauge of inflation, the core PCE, which excludes volatile items, grew 4.7%, YoY, lower than the 4.9% in April.

On the Japanese front, the docket revealed Industrial Production, which shrank faster than expected -1.3% MoM to -7.2%. Annually based, recovered some ground but stayed negatively at -2.8%, from a previous reading at -4.9%.

USD/JPY Key Technical Levels

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.