USD/JPY Price Analysis: Refreshes weekly highs around 115.40 amid Ukraine/Russia war

- The USD/JPY is climbing in the week 0.38%, as demand for safe-haven currencies rises.

- USD/JPY plunged on Putin’s “special military operation” headline, but it is paring earlier losses.

- USD/JPY Technical Outlook: Upward biased in the daily and the 1-hour chart, but higher volatility levels, suggest following the markets in the short-term, caution is warranted.

USD/JPY rises sharply from daily lows around 114.40 to highs 115.30s amid the Russian invasion of Ukraine, which started on Thursday during the Asian Pacific session. That said, investors’ mood dampened as flows through safe-haven peers increased. At the time of writing, the USD/JPY is trading at 115.39.

During the Asian session, the UN hosted an emergency security council meeting. Around that time, Russian President Putin unveiled a speech announcing a “special military operation” in Ukraine, aiming to de-nazify and de-militarize the country.

How is Russian-Ukraine war impacting financial markets? Follow our live coverage updates!

Market’s reaction

The USD/JPY initial reaction to newswires was downwards, with the pair plummeting 70 pips and breaking the 50-day moving average (DMA) at 114.87 on its way down and reached a daily low at 114.40. Once European traders got to their offices, the pair recovered its losses and some more, trading near February 23 daily highs at 115.20.

USD/JPY Price Forecast: Technical outlook

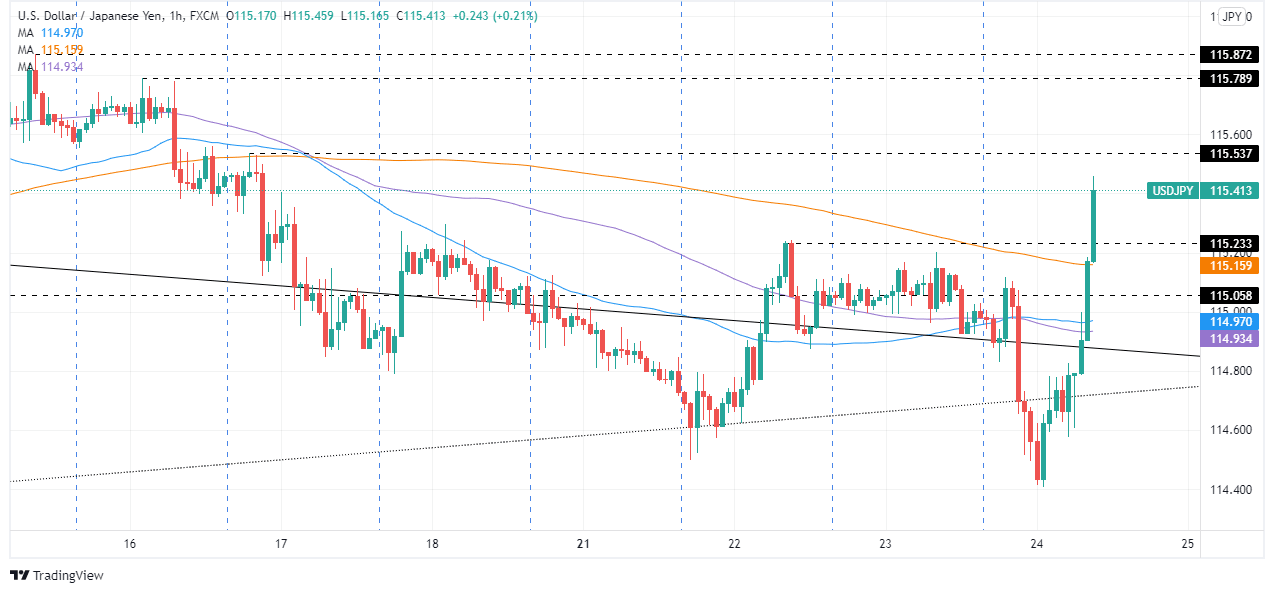

The USD/JPY Is upward biased, as shown by the daily chart from a technical perspective. The daily moving averages (DMAs) reside below the spot price, though it faces resistance around 115.52, November 24, 2021, daily high.

Due to geopolitical developments, it is suggested to take a short-term approach amid high volatility levels witnessed in the financial markets. That said, the USD/JPY 1-hour chart has a bullish bias, and USD/JPY would lean towards February 22 daily high at 115.24 as support. If the pair achieves to print a daily close above it, a move towards the 116.00 figure and YTD high at the 116.30 area is on the cards.

Upwards, the pair's first resistance would be February 17 daily high at 115.53, followed by February 16 cycle high at 115.79 and the February 15 115.82. On the flip side, the USD/JPY first support would be February 22 daily resistance turned support at 115.23. Breach of the latter would expose the 200-hour simple moving average (SMA) at 115.18, followed by the confluence of the 50-100 hour SMAs at 114.97 and 114.93, respectively.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.