USD/JPY Price Analysis: edges high but remains short of 124.00 post-Fed minutes

- The USD/JPY remained positive in the week, up 1.11%, amidst a risk-off sentiment and underpinned by the US 10-year yield.

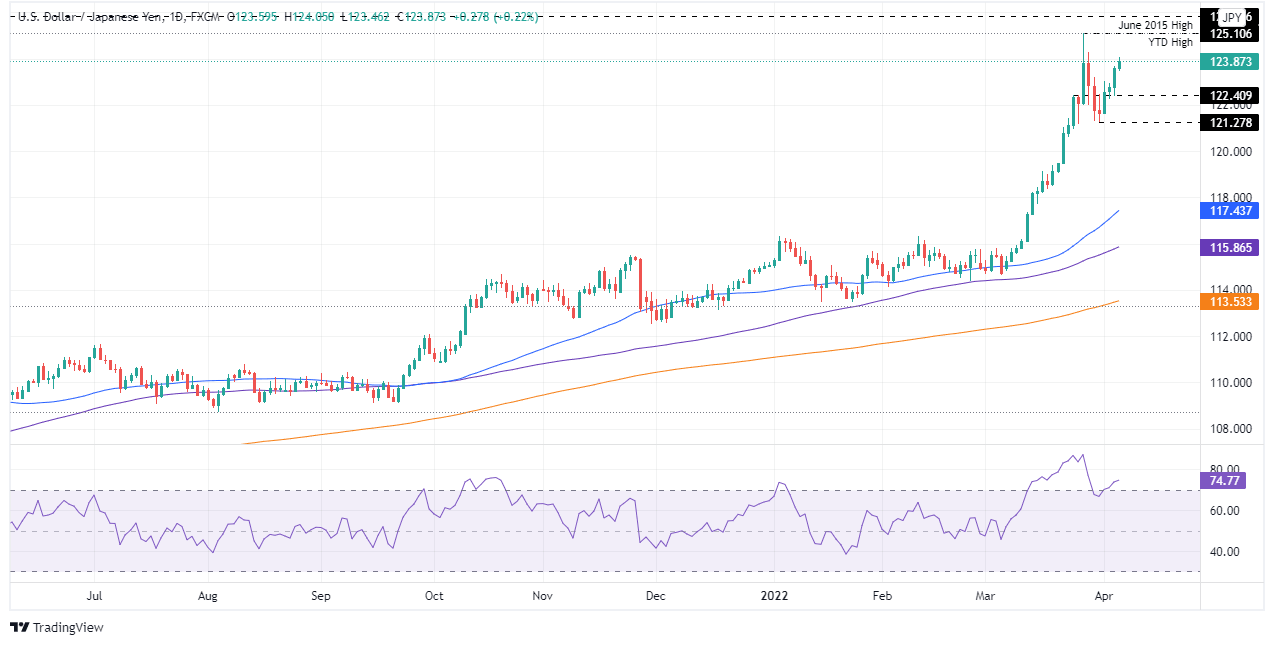

- USD/JPY Price Forecast: The bias is upwards, but the RSI within the overbought area might suggest caution is warranted.

The USD/JPY advances in the North American session amid a risk-off market mood, courtesy of Fed speaking, the continuation of the Russian-Ukraine war, and China’s economy about to slow, as reported by Manufacturing and Services PMIs, which fell below the expansion levels. At the time of writing, the USD/JPY is trading at 123.87.

US equities remain trading in the red, with losses between 0.89% and 2.66%. Meanwhile, the greenback remains buoyant, as shown by the US Dollar Index, a measure of the buck’s value vs. its peers, up 0.25%, sitting at 99.742, underpinned by the 10-year US Treasury yield up to six basis points, currently at 2.622%.

Overnight, the USD/JPY seesawed around the 123.50-124.00 range ahead of the release of the FOMC March meeting. Once unveiled, the USD/JPY dipped towards the daily lows at 123.46 but recovered some ground and is aiming towards the 124.00 mark.

USD/JPY Price Forecast: Technical outlook

The USD/JPY is upward biased. The daily moving averages (DMAs) reside well below the spot price and confirm the bias. However, the Relative Strength Index (RSI) at 74.65 is well within the overbought area, suggesting that caution is warranted.

That said, the USD/JPY first resistance level would be 124.00. A breach of the latter would expose the YTD high at 125.10, followed by June 2015 swing high at 125.85, followed by April 2001 daily high at 126.85, and then February 2002 pivot high at 135.02.

On the flip side, the USD/JPY first support would be 123.00. A decisive break would open the door towards 121.27, but it would find some hurdles on its way south. Once 123.00 gives way, the next support would be 122.41, followed by 122.00 and then March’s 31 daily low at 121.27.

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.