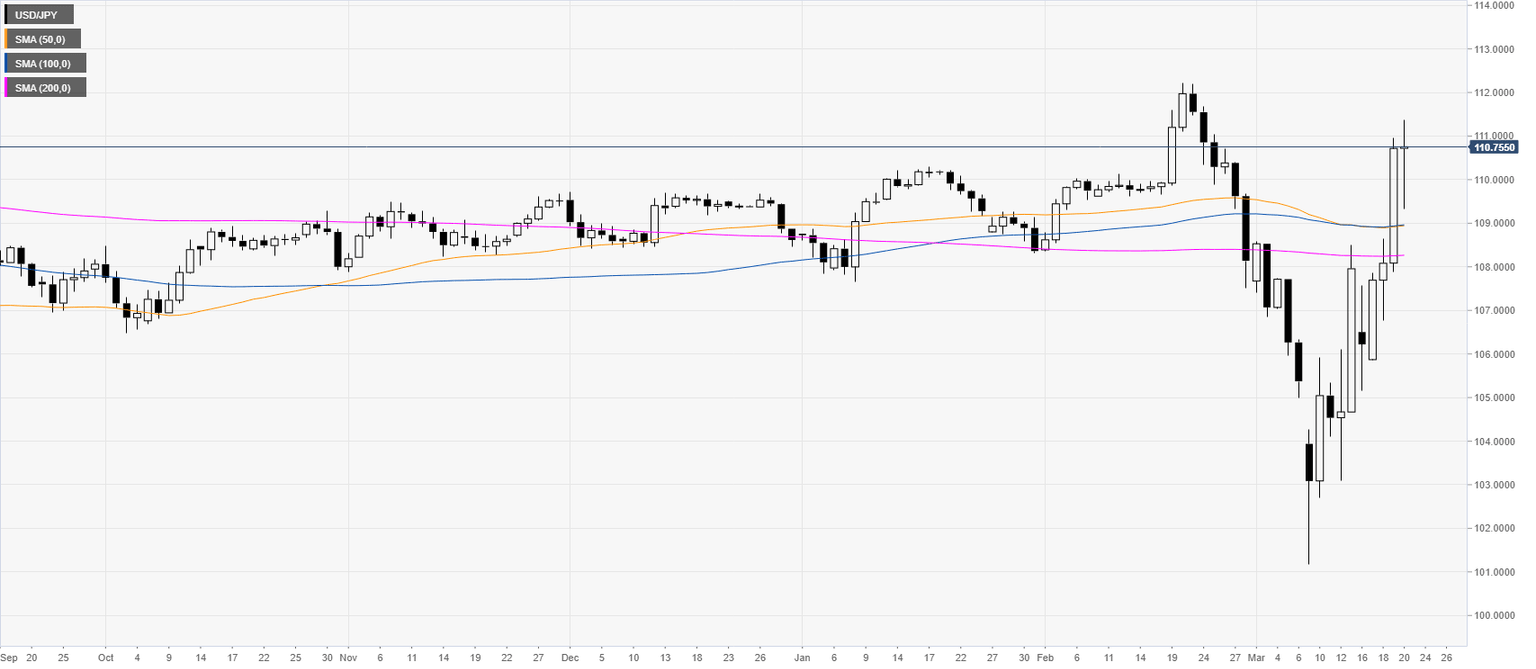

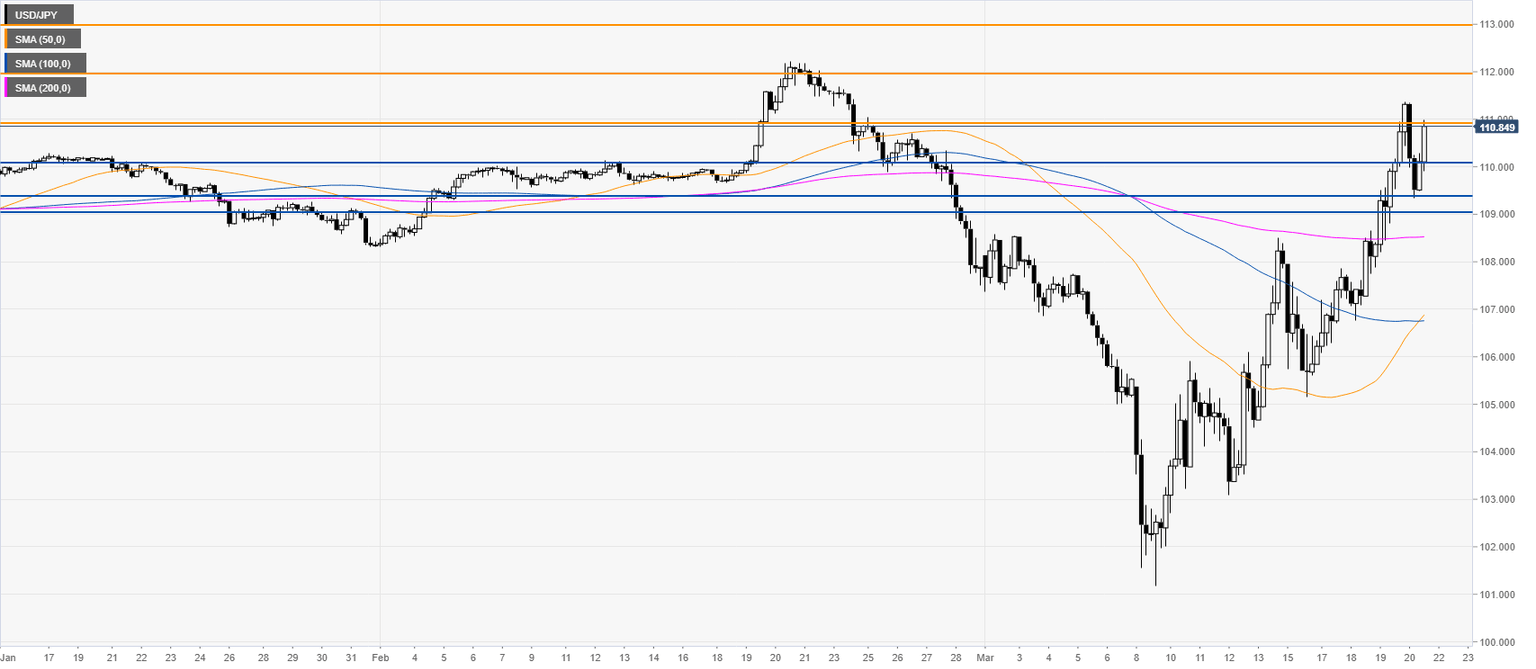

USD/JPY Price Analysis: Dollar clings to 3.5-week’s highs vs. yen, challenges 111.00 figure

- USD/JPY is challenging the 111.00 figure as DXY demand is relentless.

- The level to beat for buyers is the 111.00 figure.

USD/JPY daily chart

USD/JPY four-hour chart

Additional key levels

Author

Flavio Tosti

Independent Analyst