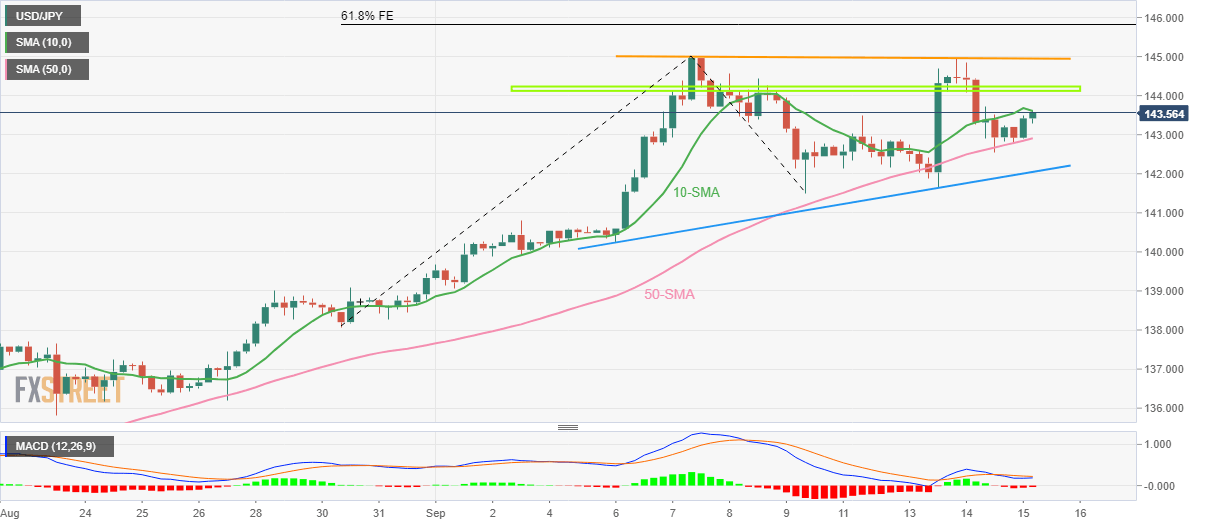

USD/JPY Price Analysis: Bulls proceed on the bumpy road to 145.00

- USD/JPY renews intraday high inside a weekly bullish triangle.

- 10-SMA, 144.10-20 restricts immediate upside ahead of double tops near 145.00.

- 50-SMA, weekly low act as additional downside filters.

USD/JPY takes the bids to refresh daily tops near 143.55 heading into Thursday’s European session. In doing so, the yen pair reverses the previous day’s pullback inside a one-week-old triangle formation.

Given the impending bull cross of the MACD and the quote’s sustained trading beyond the 50-SMA, the USD/JPY prices are likely to remain firmer.

However, the 10-SMA and a weekly horizontal resistance area, respectively near 143.60 and 144.10-20, could challenge the yen pair’s intraday upside.

Following that, the double tops around the 145.00 threshold will gain the market’s attention before the 61.8% Fibonacci Expansion (FE) of August 30 to September 09 moves, near 145.80.

In a case where the USD/JPY prices remain firmer past 145.80, the 146.00 round figure may test the bulls before directing them to the theoretical target of the double top breakout, close to 148.50.

Meanwhile, 50-SMA and the stated triangle’s support line, near 142.90 and 142.00 in that order, restrict the short-term downside of the pair.

Even if the USD/JPY prices decline below 142.00, the weekly low near 141.65 could act as the additional downside filter.

USD/JPY: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.