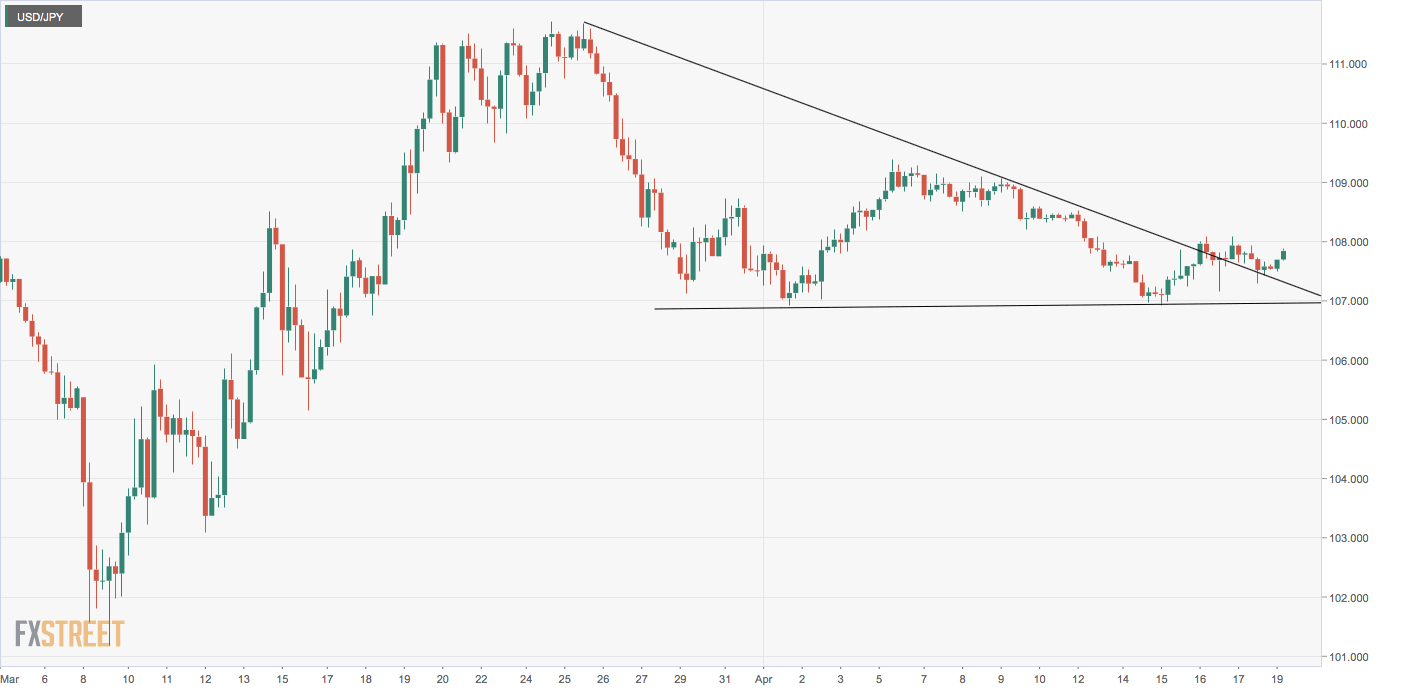

USD/JPY Price Analysis: Bid near 107.80 with descending triangle breakout on 4H

- USD/JPY's 4-hour chart is reporting a bullish continuation pattern.

- A break above 108.00 could be seen duing the day ahead.

USD/JPY is flashing green near 107.80 at press time with the American dollar drawing bids amid renewed risk-off tone in the equity markets.

The currency pair could rise further as the 4-hour chart is now reporting a descending triangle breakout, which comprises trendlines connecting lower highs and horizontal supports.

The pattern indicates a resumption of the rally from the March 9 low of 101.18 and suggests scope for a move above 108.00.

Alternatively, a move under 106.92 – the base of the triangle – would signal an extension of the pullback from the March 25 high of 111.68 and could yield a drop to 105.00.

The prospects of a downside break under 106.92 would improve if the pair drops under 107.30, validating Friday’s red candle.

4-hour chart

Trend: Bullish

Technical levels

Author

Omkar Godbole

FXStreet Contributor

Omkar Godbole, editor and analyst, joined FXStreet after four years as a research analyst at several Indian brokerage companies.