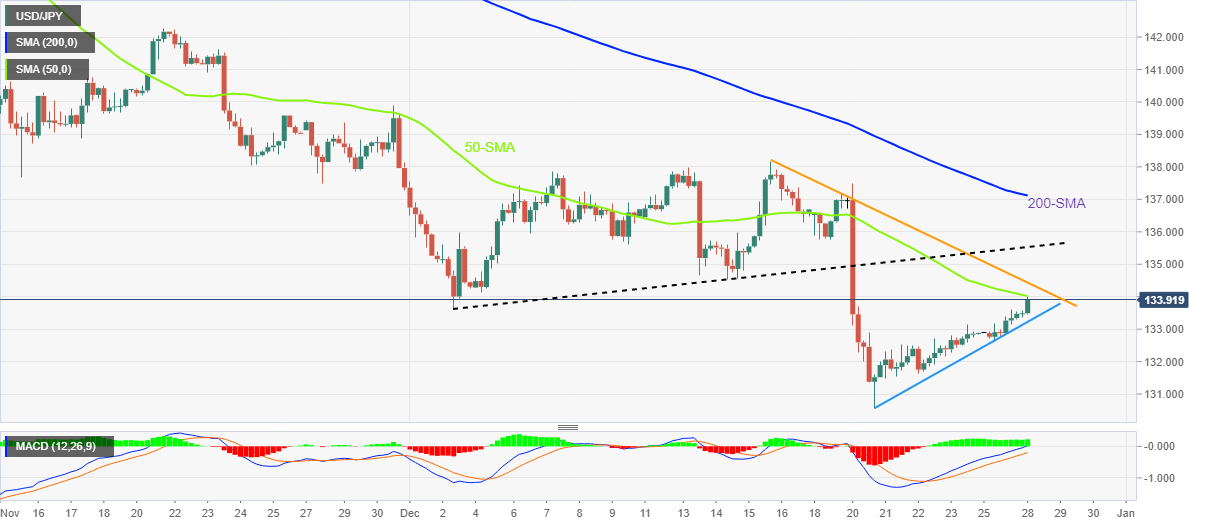

USD/JPY Price Analysis: 50-SMA probes bulls near 134.00

- USD/JPY grinds higher around weekly top during five-day winning streak.

- 50-SMA, fortnight-old descending trend line probe immediate upside.

- Bullish MACD signals, one-week-old ascending trend line keeps buyers hopeful.

USD/JPY seesaws around 134.00 as bulls keep the reins during a five-day uptrend near the weekly top. In doing so, the Yen pair pokes the 50-SMA level amid Wednesday’s sluggish trading.

Given the Yen pair’s steady recovery from the four-month low marked in the last week, portrayed by short-term support, as well as the bullish MACD signals, the USD/JPY could cross the immediate hurdle, namely the 50-SMA level of 134.00.

Even so, a downward-sloping resistance line from December 15, near 134.45 by the press time, will precede the previous support line from the month-start low, close to 135.50, to challenge the short-term USD/JPY upside.

It’s worth noting that the 200-SMA and the monthly peak, respectively near 137.15 and 138.20, could act as the last defense of the USD/JPY bears, a successful break of which will give control to the buyers.

Alternatively, a one-week-old ascending support line, around 133.20 by the press time, restricts nearby downside of the Yen pair.

Following that, the monthly low and the August 2022 bottom, near 130.55 and 130.40 in that order, could challenge the pair sellers before directing USD/JPY to the 130.00 psychological magnet.

USD/JPY: Four-hour chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.