USD/INR Price News: Indian rupee bounces off three-week low, stays on the way to 75.65

- USD/INR seesaws around intraday low after refreshing multi-day top.

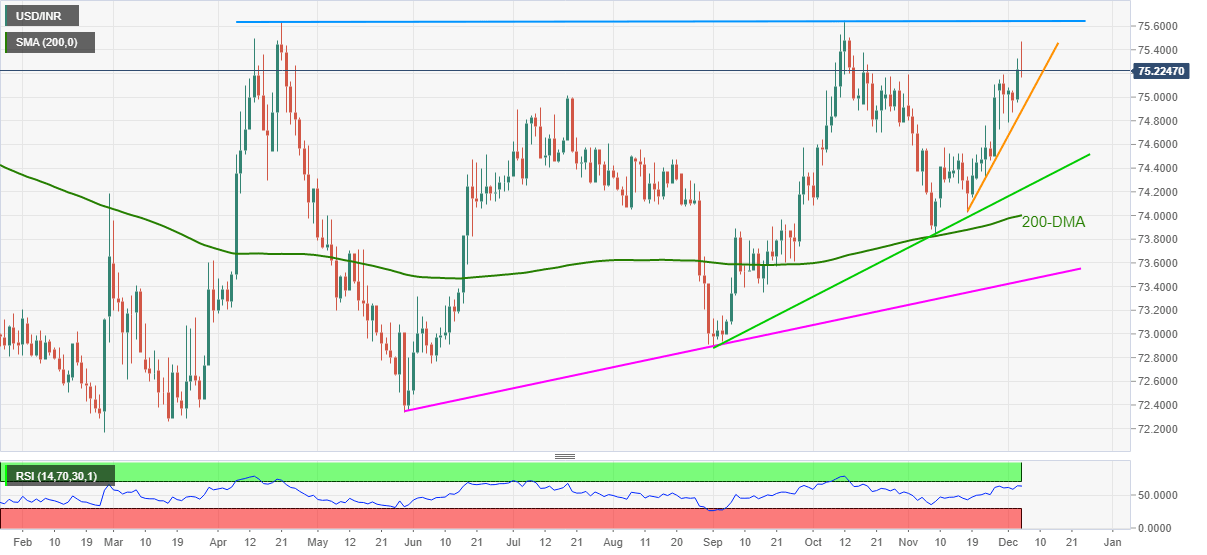

- 12-day-old ascending trend line, firmer RSI keeps buyers hopeful.

- Multiple hurdles on the south for the bears to tackle for entry, double-top around 75.65 in focus.

USD/INR retreats to 75.21, following an uptick to refresh the three-week high. In doing so, the Indian rupee (INR) pair buyers take a breather around multi-day top during the run-up to the key 75.65 hurdle.

Immediately favoring the odds of upside is an ascending support line from November 18, near 74.90, as well as a firmer RSI line, not overbought.

Even if the quote drops below 74.90, a three-month-long rising trend line and the 200-DMA, respectively around 74.22 and 74.00, will be crucial to watch as they hold the key to further weakness towards an upward sloping support line from May, near 73.45.

During the quote’s further advances, the latest swing high of 75.47 and the stated double-top near 75.65 will be important to watch.

Should USD/INR bulls keep reins past 75.65, April 2020 peak near 77.00 will gain the market’s attention ahead of the theoretical target surrounding 78.00.

To sum up, USD/INR is ready for further upside but 75.65 is the key to watch.

USD/INR: Daily chart

Trend: Further upside expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.