USD/INR falls on RBI’s intervention, upside remains favored

- The Indian Rupee rises against the US Dollar at the open after the RBI’s intervention.

- The Indian equity market fell sharply on Sunday after the government announced the FY 2026-27 fiscal budget.

- Warsh’s selection as the Fed’s new Chairman has strengthened the US Dollar.

The Indian Rupee (INR) gains against the US Dollar (USD) in the opening session on Monday, following the fiscal budget Financial Year (FY) 2026-27 announcement by the Indian government on Sunday. The USD/INR pair declines to near 91.85 as the Reserve Bank of India (RBI) has intervened in the spot and Non-Deliverable Forward (NDF) markets to provide a cushion to the Indian Rupee near its lifetime lows against the US Dollar.

According to a report from Reuters, traders say that the Indian central bank likely intervened before the local spot market opened on Monday to help the currency stave off a fall to near record low levels.

Meanwhile, Indian stock markets trade slightly higher after a subdued opening on Monday, striving to regain ground after crashing the previous day. Indian bourses fell like a house of cards on Sunday after the annual budget announcement in which the government surprisingly raised Securities Transaction Tax (STT) on trading in the Futures and Options (F&O) segment in the derivative market to extend its grip on curbing speculative activities.

Other major highlights of the fiscal budget were 22% increase in the defence budget to modernize defence equipment, 9% rise in capital expenditure to ₹12.2 lakh crore, tax holidays for global companies to produce data centers in India till 2047, an increase in outlay of Rs. 40,000 Crore to boost the manufacturing of electronic components, and the launch of the Semiconductor Mission 2.0.

Going forward, the major trigger for the Indian Rupee will be the monetary policy announcement by the RBI on Friday. In the December policy meeting, the Indian central bank slashed the Repo Rate by 25 basis points (bps) to 5.25%, and announced a fresh liquidity infusion of ₹1.5 lakh crore to boost credit flow.

The table below shows the percentage change of Indian Rupee (INR) against listed major currencies today. Indian Rupee was the strongest against the Australian Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | INR | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.05% | 0.00% | -0.06% | 0.27% | 0.47% | -0.20% | -0.07% | |

| EUR | 0.05% | 0.06% | -0.02% | 0.33% | 0.52% | -0.12% | -0.02% | |

| GBP | -0.01% | -0.06% | -0.06% | 0.27% | 0.46% | -0.21% | -0.07% | |

| JPY | 0.06% | 0.02% | 0.06% | 0.34% | 0.53% | -0.10% | -0.01% | |

| CAD | -0.27% | -0.33% | -0.27% | -0.34% | 0.19% | -0.47% | -0.35% | |

| AUD | -0.47% | -0.52% | -0.46% | -0.53% | -0.19% | -0.66% | -0.54% | |

| INR | 0.20% | 0.12% | 0.21% | 0.10% | 0.47% | 0.66% | 0.10% | |

| CHF | 0.07% | 0.02% | 0.07% | 0.00% | 0.35% | 0.54% | -0.10% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Indian Rupee from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent INR (base)/USD (quote).

Daily Digest Market Movers: Investors await US NFP data for January

- RBI’s surprise intervention has supported the Indian Rupee to counter the firm US Dollar. As of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, holds onto Friday’s gains near 97.33.

- The US Dollar gained sharply on Friday after the White House nominated former Federal Reserve (Fed) Governor Kevin Warsh as the successor of current Chairman Jerome Powell. Investors took Warsh’s appointment as favorable for the US Dollar, given his historical preference for a strong US Dollar in his prior term at the Fed.

- While investors think Warsh will be inclined to cut rates as United States (US) President Donald Trump already said that the *new Chairman will support bigger cuts, they expect him to rein in the Fed’s balance sheet, which is typically supportive for the dollar as it reduces the money supply in the market, Reuters reported.

- A higher US Dollar has resulted in a sharp decline in the appeal of precious metals, which had rallied significantly in recent months on expectations that Trump’s new candidate will dampen the Fed’s autonomous character.

- For near-term cues on the Fed’s monetary policy outlook, investors await a slew of employment-related economic data, especially the Nonfarm Payrolls (NFP) report for January, which will be released on Friday.

- In Monday’s session, investors will focus on the ISM Manufacturing Purchasing Managers’ Index (PMI) data for January, which will be published at 15:00 GMT. Economists expect the manufacturing sector activity to have contracted again, but at a moderate pace. A figure below 50.0 is considered a contraction in the business activity. The ISM Manufacturing PMI is seen higher at 48.3 from 47.9 in December.

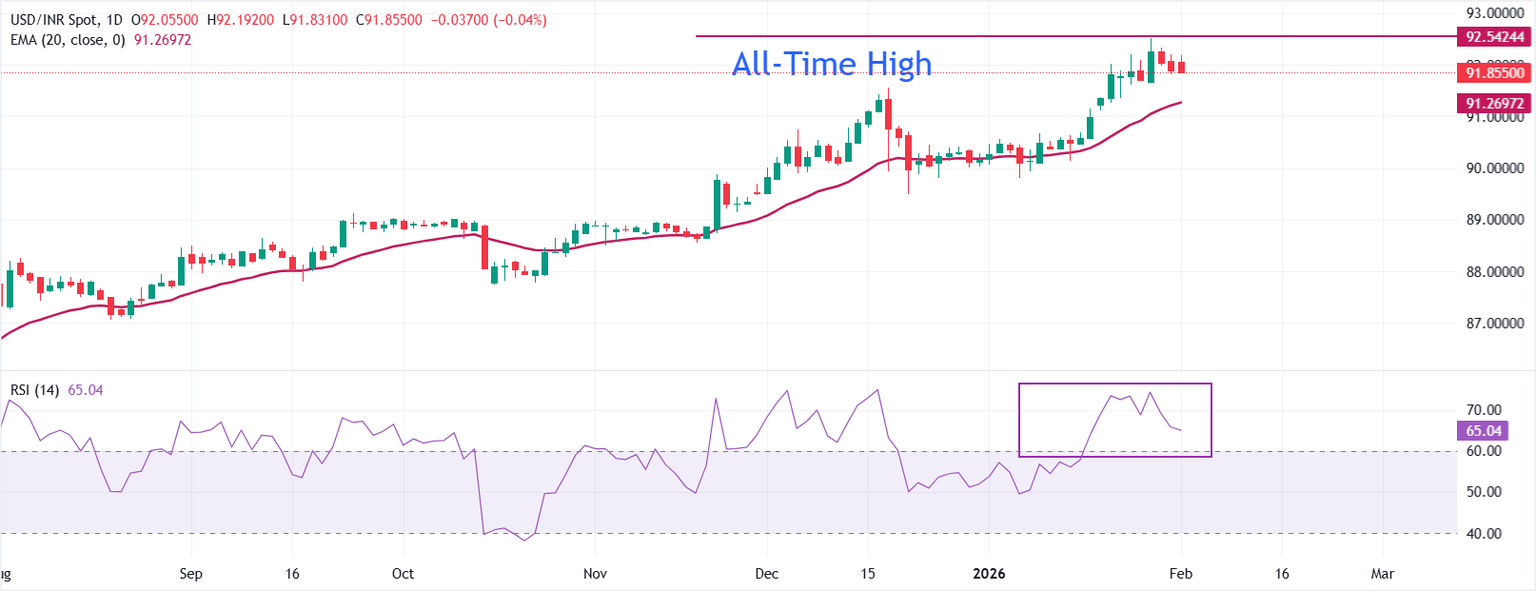

Technical Analysis: USD/INR sees immediate support near 91.50

USD/INR trades lower at around 91.8550 at the time of writing. The pair holds firm above the rising 20-day EMA at 91.2697, keeping the short-term uptrend intact. The average continues to ascend, pointing to sustained buying pressure and favoring dips to be bought.

RSI at 65 (positive) has cooled from recent overbought readings, yet remains above the midline to validate bullish momentum. Continuation could see the advance extend, while pullbacks would find initial support at the rising average. A daily close beneath it would open room for a deeper correction.

(The technical analysis of this story was written with the help of an AI tool.)

Economic Indicator

RBI Interest Rate Decision (Repo Rate)

The RBI Interest Rate Decision is announced by the Reserve Bank of India. If the bank is hawkish about the inflationary outlook of the economy and rises the interest rates, it is seen as positive, or bullish, for the INR, while a dovish outlook for the economy (or a rate cut) is seen as negative, or bearish, for the currency.

Read more.Next release: Fri Feb 06, 2026 04:30

Frequency: Irregular

Consensus: 5.25%

Previous: 5.25%

Source: Reserve Bank of India

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.