USD/INR corrects sharply due to RBI's intervention, US CPI in focus

- The Indian Rupee bounces back from its record lows against the US Dollar, following the RBI’s intervention.

- FIIs have remained net sellers in seven months so far this year.

- The Fed is expected to hold interest rates steady in the January 2026 meeting.

The Indian Rupee (INR) gains sharply against the US Dollar (USD) in the opening session on Wednesday. The USD/INR pair plunges over 1% to near 90.00 from its all-time high of 91.56 due to the Reserve Bank of India’s (RBI) intervention in the spot and Non-deliverable Forward (NDF) markets.

State-run banks were spotted offering US dollars aggressively, most likely on behalf of the RBI, three traders told Reuters.

The RBI was expected to intervene to support the domestic currency, which has remained the worst-performing Asian currency against the US Dollar, and is down almost 6.45% so far this year.

The continuous outflow of foreign funds from the Indian stock market is due to the absence of a trade announcement between the United States (US) and India. The ongoing US-Indian trade stalemate has also increased demand for US Dollars by Indian importers, resulting in weakness in the Indian Rupee.

So far this year, Foreign Institutional Investors (FIIs) have remained net sellers in seven out of 11 months. In December, FIIs have offloaded stake in the Indian equity market worth Rs. 23,455.75 crore.

On the monetary policy front, RBI Governor Sanjay Malhotra has stated in an interview with Financial Times (FT) that interest rates will “remain low for a longer period”. Malhotra added that the recent headline Gross Domestic Product (GDP) figure "was surprising", which led the central bank to "improve its forecasting". He further added that the impact of the US-India trade deal could be as much as 0.5% on the overall GDP.

The table below shows the percentage change of Indian Rupee (INR) against listed major currencies today. Indian Rupee was the weakest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | INR | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | 0.32% | 0.36% | 0.37% | 0.18% | 0.28% | -0.66% | 0.29% | |

| EUR | -0.32% | 0.04% | 0.05% | -0.14% | -0.04% | -0.95% | -0.03% | |

| GBP | -0.36% | -0.04% | 0.02% | -0.18% | -0.08% | -1.01% | -0.07% | |

| JPY | -0.37% | -0.05% | -0.02% | -0.20% | -0.10% | -1.05% | -0.09% | |

| CAD | -0.18% | 0.14% | 0.18% | 0.20% | 0.10% | -0.82% | 0.11% | |

| AUD | -0.28% | 0.04% | 0.08% | 0.10% | -0.10% | -0.91% | 0.02% | |

| INR | 0.66% | 0.95% | 1.01% | 1.05% | 0.82% | 0.91% | 0.94% | |

| CHF | -0.29% | 0.03% | 0.07% | 0.09% | -0.11% | -0.02% | -0.94% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Indian Rupee from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent INR (base)/USD (quote).

Daily digest market movers: Investors await US CPI data for November

- The US Dollar extends its Tuesday’s recovery move during Wednesday’s Asian trading hours, even as weak US data has escalated concerns over the economic outlook. At the time of writing, the US Dollar Index (DXY), which tracks the Greenback’s value against six major currencies, trades 0.17% higher to near 98.40. The USD Index rebounded on Tuesday after posting a fresh eight-week low near 98.00.

- On Wednesday, the combined Nonfarm Payrolls (NFP) report for October and November showed that the Unemployment Rate rose to 4.6% lately, the highest figure seen since September 2021. The report also showed that the economy shed 105K jobs in October before creating 64K fresh in November.

- Apart from the labour market data, Retail Sales data for October and preliminary S&P Global Purchasing Managers’ Index (PMI) data for December remained weak. Month-on-month Retail Sales turned out flat, while they were expected to grow steadily by 0.1%. Meanwhile, flash private sector activity data grew at a moderate pace. The Composite PMI landed at 53.0, sharply lower than 54.2 in November.

- While the US data has prompted economic concerns, market experts believe that it is unlikely to impact the Federal Reserve’s (Fed) monetary policy expectations, as the data was distorted by the government shutdown.

- Currently, the CME FedWatch tool shows that the Fed is unlikely to cut interest rates in the January 2026 policy meeting.

- Going forward, investors will focus on the US Consumer Price Index (CPI) data for November, which will be released on Thursday.

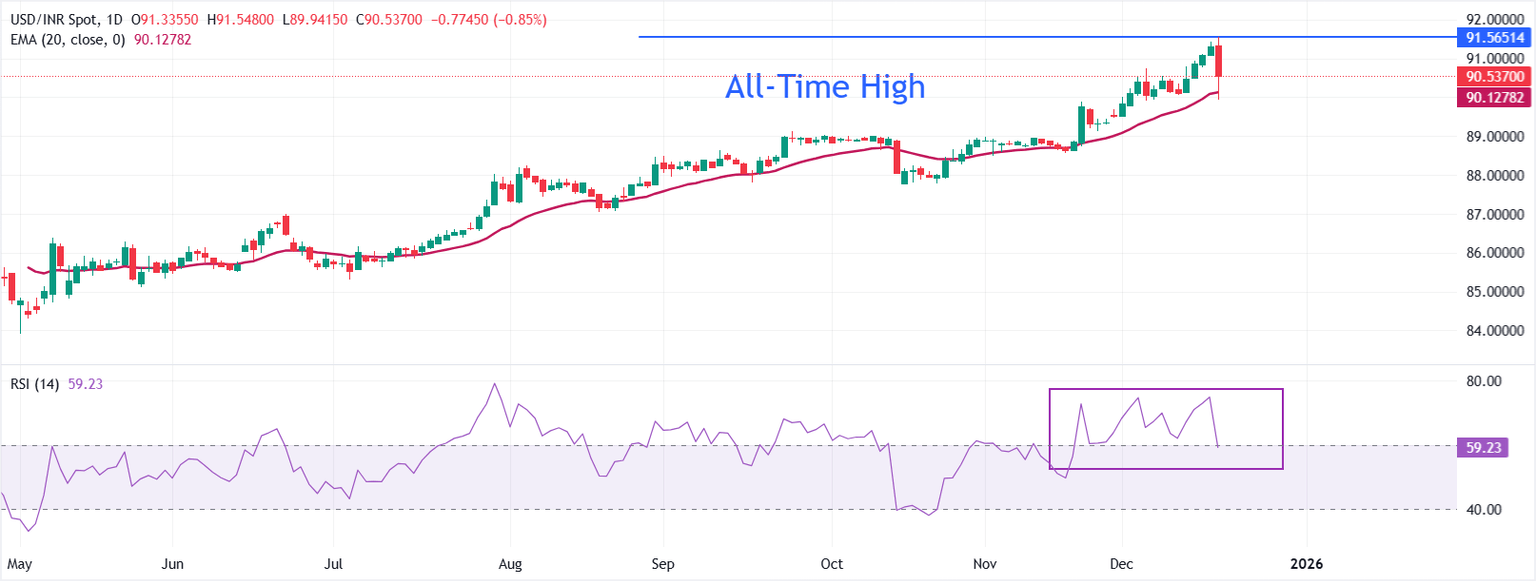

Technical Analysis: USD/INR holds key 20-day EMA

In the daily chart, USD/INR trades at 90.5370. Price holds above the rising 20-day Exponential Moving Average (EMA), preserving a bullish bias. The average continues to ascend and now stands at 90.1278.

The RSI at 59.23, above the 50 midline, confirms positive momentum after unwinding from recent overbought readings. Initial support is at the 20-EMA at 90.1278; sustained trade above this gauge keeps the topside favored.

Trend conditions remain firm, though momentum has moderated as the RSI pulled back from the 70s to 59.23. Pullbacks would remain in check while USD/INR defends the moving-average base, with a support zone across the 20-EMA cluster at 89.9556–89.8364. A daily close below that area would tilt the bias toward consolidation, whereas maintaining bids above it would leave scope for an extension higher.

(The technical analysis of this story was written with the help of an AI tool.)

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.