USD Index holds on above 105.00 ahead of NFP

- The index appears mildly offered above the 105.00 mark.

- US yields accelerate the decline ahead of the key Payrolls.

- The US jobs report will take centre stage later in the NA session.

The greenback, when measured by the USD Index (DXY), navigates within a narrow range and slightly on the defensive above the 105.00 yardstick following the opening bell in the old continent on Friday.

USD Index focuses on key US data

The index gives away further ground and adds to the pessimism seen so far in the second half of the week on the back of a tepid improvement in the risk complex ahead of the release of the US jobs report.

Indeed, the upside momentum in the dollar appears somewhat mitigated following fresh YTD peaks near 106.00 the figure recorded in the wake of Chair Powell’s first testimony before the Congress.

The corrective decline in US yields across the curve also accompanies the dollar’s decline amidst divided consensus among investors regarding the upcoming interest rate hike by the Fed.

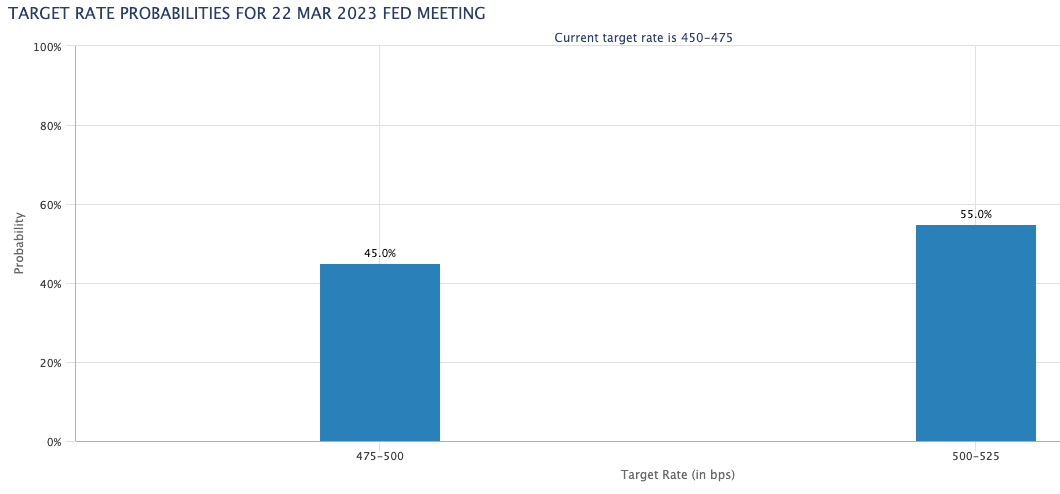

On this, CME Group’s FedWatch Tool now sees the probability of a 50 bps rate raise at 55%, from just below 80% a day ago.

In the US docket, the February’s Non-farm Payrolls will be in the limelight later in the session, with consensus expecting the US economy to have created 205K jobs during last month and the Unemployment Rate to have held steady at 3.4%.

What to look for around USD

The index remains cautious and hovers around the key 105.00 neighbourhood at the end of the week ahead of release of the US jobs report for the month of February.

The dollar, in the meantime, appears well supported by (dwindling?) expectations of a 50 bps rate raise at the Fed’s gathering later in the month. This view has been propped up by hawkish message from Fed speakers from many weeks now and lately by Chief Powell at both his testimonies earlier in the week.

In addition, the still elevated inflation as well as the solid labour market and the resilient economy in general also seem to underpin the tighter-for-longer stance from the Federal Reserve.

Key events in the US this week: Nonfarm Payrolls, Unemployment Rate, Monthly Budget Statement (Friday).

Eminent issues on the back boiler: Rising conviction of a soft landing of the US economy. Persistent narrative for a Fed’s tighter-for-longer stance. Terminal rates near 5.5%? Fed’s pivot. Geopolitical effervescence vs. Russia and China. US-China trade conflict.

USD Index relevant levels

Now, the index is retreating 0.04% at 105.23 and the breakdown of 104.09 (weekly low March 1) would open the door to 103.53 (55-day SMA) and finally 102.58 (weekly low February 14). On the other hand, the next up-barrier aligns at 105.88 (2023 high March 8) seconded by 106.62 (200-day SMA) and then 107.19 (weekly high November 30 2022).

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.