USD/CNH Price Analysis: Pair extends the gains, hovers below 7.3590 resistance confluence

- USD/CNH extends its gains due to the firmer US Dollar (USD) following the consistent stream of upbeat economic data.

- Momentum indicators indicate a favorable upward trend in the short-term trajectory.

- Chinese President Xi Jinping will not attend the G20 leaders' summit in New Delhi.

USD/CNH continues the winning streak for the fifth day during the Asian session on Friday, trading around 7.3530 aligned to the 7.3590 resistance confluence. Meanwhile, the onshore Yuan (CNY) has marked a 16-year high at 7.3462 vs. the US Dollar (USD). The pair is experiencing upward support due to the firmer Greenback following the consistent stream of upbeat economic data from the United States (US).

On Thursday, the United States (US) released data indicating that as of September 1, US Initial Jobless Claims stood at 216,000, which is a decrease from the previous figure of 229,000. Market expectations had anticipated an increase to 234,000. Additionally, US Unit Labor Costs for the second quarter (Q2) rose to 2.2%, up from the previous reading of 1.6%, contrary to the expectation that it would remain unchanged.

Moreover, the G20 leaders' summit is scheduled to kick off in New Delhi this coming Saturday. It is worth highlighting that US President Joe Biden will participate in the event, while Chinese President Xi Jinping will not be in attendance. This situation is likely to add to the existing strain on the already delicate and deteriorating relationship between the two superpowers.

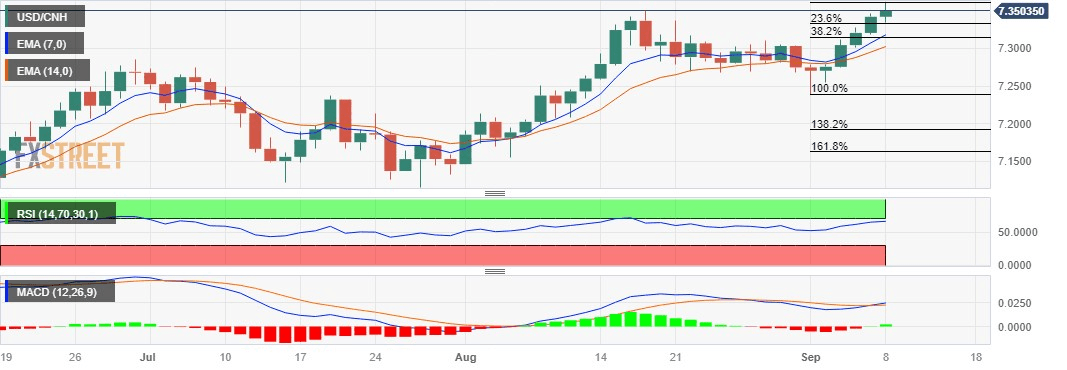

The Moving Average Convergence Divergence (MACD) line stays above the centerline and lies above the signal line. This configuration indicates that the recent momentum is relatively robust and in an upward direction.

On the downside, the pair could meet the support around 23.6% Fibonacci retracement at 7.3325 level. A firm break below the latter could push the USD/CNH pair to navigate the region around the seven-day Exponential Moving Average (EMA) at 7.3188 aligned to the 38.2% Fibonacci retracement at 7.3146, following the 14-day EMA at 7.3029.

In the near future, the USD/CNH pair is expected to maintain its bullish stance, contingent upon the 14-day Relative Strength Index (RSI) remaining above the 50 level.

USD/CNH: Daily Chart

Author

Akhtar Faruqui

FXStreet

Akhtar Faruqui is a Forex Analyst based in New Delhi, India. With a keen eye for market trends and a passion for dissecting complex financial dynamics, he is dedicated to delivering accurate and insightful Forex news and analysis.