USD/CHF Price Forecast: Stuck near 0.8070 ahead of Fed minutes

- USD/CHF holds around 0.8073, trapped in a tight range with buyers and sellers lacking momentum ahead of Fed events.

- Technical outlook shows pair supported by 20/50-day SMAs, with 0.8100 resistance key for any upside continuation.

- Break below 0.8053 could spark further weakness, exposing July 22 low at 0.7918 as next downside target.

The USDCHF ended Monday’s session with minimal gains, yet it consolidated around the 0.8070 figure for the third straight day. At the time of writing, the pair trades at 0.8073, virtually unchanged.

The lack of economic data across both sides of the Atlantic keeps traders adrift to geopolitical developments. Also, the release of the minutes of the Federal Reserve’s last meeting and Fed Chair Jerome Powell's speech in Jackson Hole are eyed by traders.

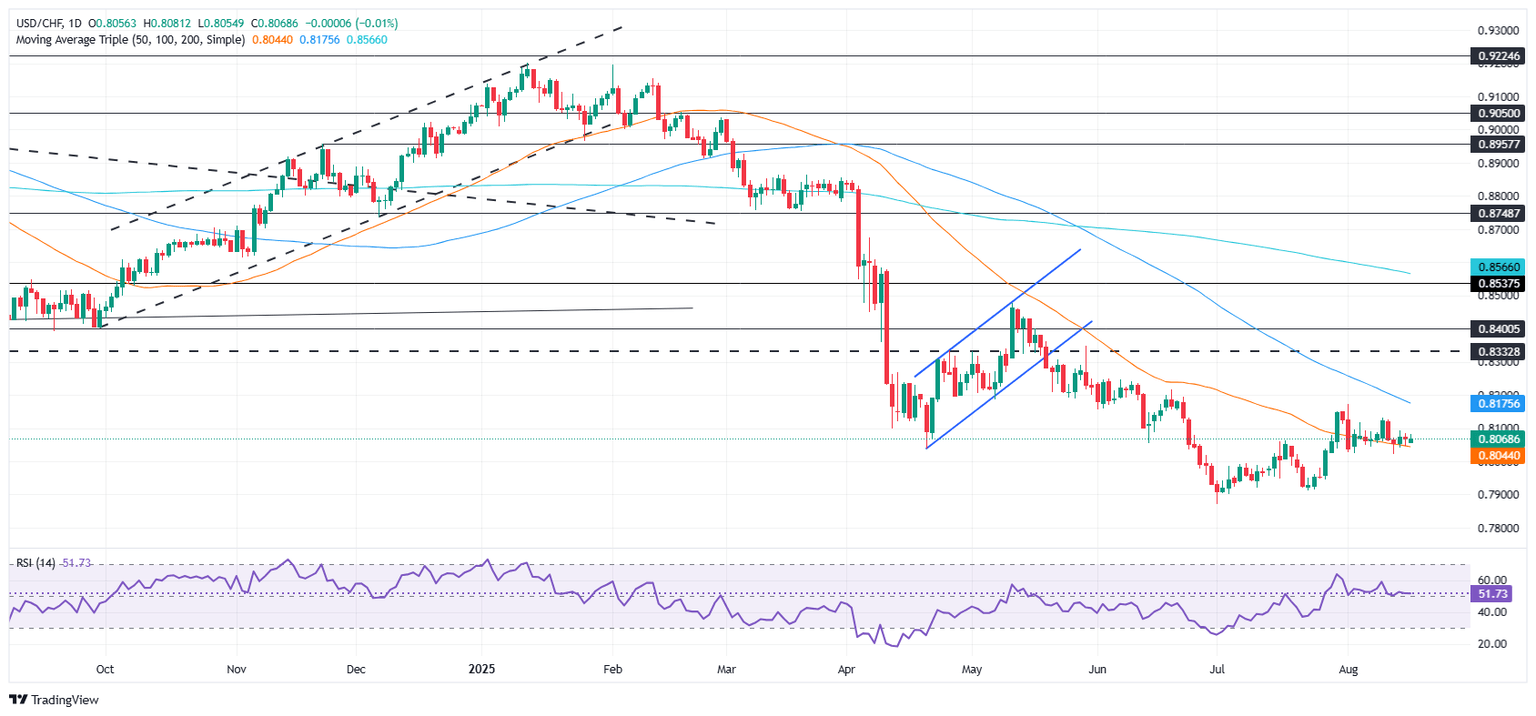

USD/CHF Price Forecast: Technical outlook

USD/CHF has bounced off the confluence of the 20 and 50-day SMAs of 0.8036/53, and climbed past the 0.8070 mark, with traders eyeing further upside but lacking the strength to regain 0.8100. From a momentum standpoint, neither buyers nor sellers are in charge, as depicted by the Relative Strength Index (RSI). The RSI is bullish but flatlined above its neutral line.

If USD/CHF rises above 0.8100, a move towards the 100-day SMA at 0.8163 is on the cards. Once surpassed, up next lies the 0.8200 figure. Conversely, if the pair tumbles below 0.8053/36, expect further downward pressure. The next support would be the July 22 low of 0.7918.

USD/CHF Price Chart – Daily

Swiss Franc PRICE Today

The table below shows the percentage change of Swiss Franc (CHF) against listed major currencies today. Swiss Franc was the strongest against the US Dollar.

| USD | EUR | GBP | JPY | CAD | AUD | NZD | CHF | |

|---|---|---|---|---|---|---|---|---|

| USD | -0.11% | -0.02% | 0.06% | -0.03% | -0.01% | -0.07% | -0.05% | |

| EUR | 0.11% | 0.09% | 0.07% | 0.09% | 0.01% | 0.05% | 0.07% | |

| GBP | 0.02% | -0.09% | -0.16% | -0.00% | -0.03% | -0.04% | -0.02% | |

| JPY | -0.06% | -0.07% | 0.16% | -0.02% | 0.00% | -0.10% | -0.04% | |

| CAD | 0.03% | -0.09% | 0.00% | 0.02% | 0.03% | -0.04% | -0.02% | |

| AUD | 0.00% | -0.01% | 0.03% | -0.00% | -0.03% | -0.00% | 0.02% | |

| NZD | 0.07% | -0.05% | 0.04% | 0.10% | 0.04% | 0.00% | 0.02% | |

| CHF | 0.05% | -0.07% | 0.02% | 0.04% | 0.02% | -0.02% | -0.02% |

The heat map shows percentage changes of major currencies against each other. The base currency is picked from the left column, while the quote currency is picked from the top row. For example, if you pick the Swiss Franc from the left column and move along the horizontal line to the US Dollar, the percentage change displayed in the box will represent CHF (base)/USD (quote).

Author

Christian Borjon Valencia

FXStreet

Markets analyst, news editor, and trading instructor with over 14 years of experience across FX, commodities, US equity indices, and global macro markets.