USD/CHF Price Forecast: Strives for firm footing above 0.9000

- USD/CHF gives up intraday gains and falls back to near 0.9000 as the US Dollar struggles to hold recovery.

- Fed officials expect that the current monetary policy is in the right place.

- The SNB could opt for negative interest rates to avoid risks of inflation remaining persistently lower.

The USD/CHF pair surrenders its intraday gains and falls back to near the psychological level of 0.9000 in European trading hours on Tuesday. The Swiss Franc pair gives up gains as the US Dollar (USD) corrects from the intraday high but still holds some gains. The US Dollar Index (DXY), which gauges the Greenback’s value against six major currencies, struggles to hold above the key level of 107.00.

Earlier in the day, the USD Index rebounded on firm expectations that the Federal Reserve (Fed) will keep interest rates steady in the current range of 4.25%-4.50% for a longer period. On Monday, a string of Fed officials stated that there is no need for a monetary policy adjustment amid resilient United States (US) economic growth, still-elevated inflation, and a balanced labor market.

The upside in the US Dollar has been capped by faded fears of the immediate imposition of reciprocal tariffs by US President Donald Trump. Trump said on Thursday that he has asked his team to work on reciprocity, while market participants anticipated that the President could unveil a detailed reciprocal tariff plan immediately.

Meanwhile, the Swiss Franc (CHF) is expected to remain on the backfoot as soft Consumer Price Index (CPI) data for January has boosted expectations that the Swiss National Bank (SNB) could push interest rates into the negative territory. Year-on-year Swiss CPI decelerated to 0.4%, as expected, from 0.6% in December, undershooting SNB’s target of 0%-2%.

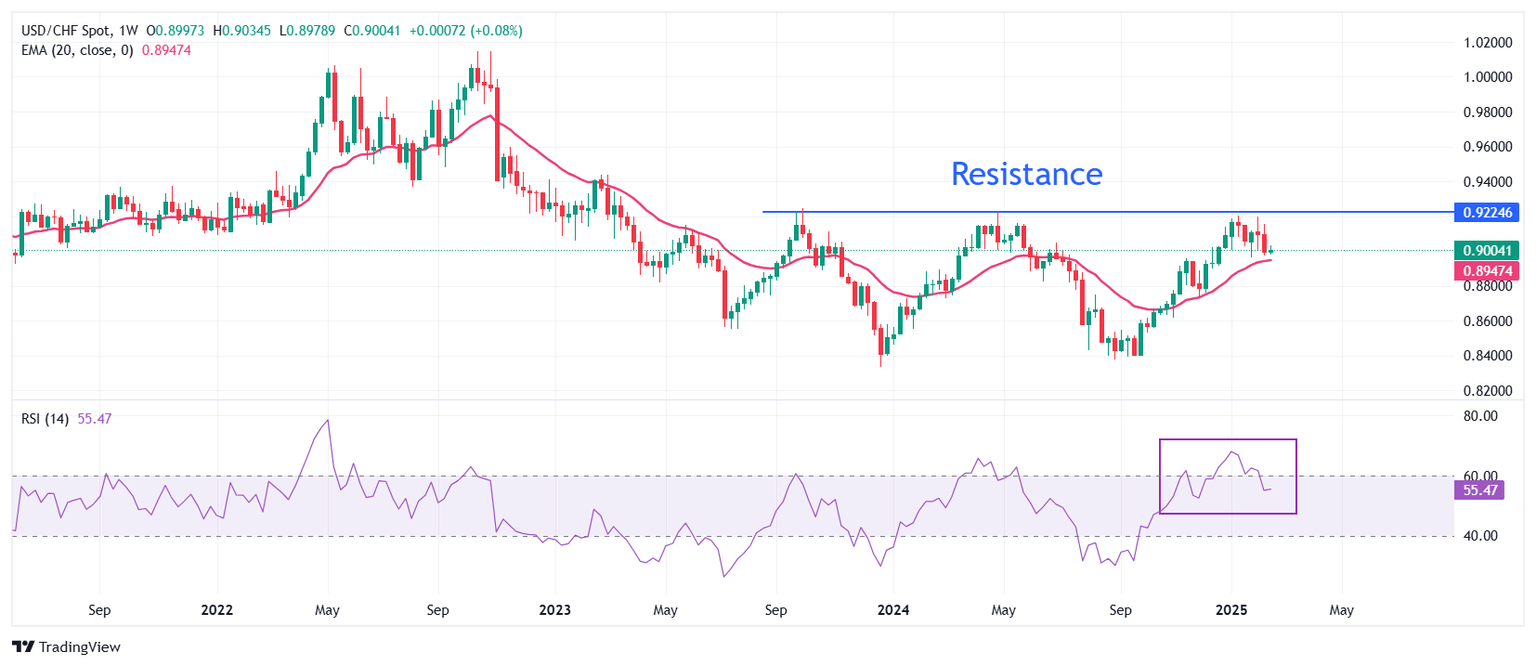

USD/CHF struggles to revisit its 15-month high, of around 0.9200. However, the outlook for the Swiss Franc pair remains firm, as the 20-week Exponential Moving Average (EMA) near 0.8947 is sloping higher.

The 14-week Relative Strength Index (RSI) falls into the 40.00-60.00 from the bullish range of 60.00-80.00, suggesting that the upside momentum has faded. However, the upside bias is intact.

For a fresh upside toward the round-level resistance of 0.9300 and the 16 March 2023 high of 0.9342, the asset needs to break decisively above the October 2023 high of 0.9244.

On the flip side, a downside move below the psychological support of 0.9000 would drag the asset towards the November 22 high of 0.8958, followed by the December 16 low of 0.8900.

USD/CHF weekly chart

Economic Indicator

Consumer Price Index (YoY)

The Consumer Price Index (CPI), released by the Swiss Federal Statistical Office on a monthly basis, measures the change in prices of goods and services which are representative of the private households’ consumption in Switzerland. The CPI is the main indicator to measure inflation and changes in purchasing trends. The YoY reading compares prices in the reference month to the same month a year earlier. Generally, a high reading is seen as bullish for the Swiss Franc (CHF), while a low reading is seen as bearish.

Read more.Last release: Thu Feb 13, 2025 07:30

Frequency: Monthly

Actual: 0.4%

Consensus: 0.4%

Previous: 0.6%

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.