USD/CHF Price Forecast: Extends losing streak for sixth trading day

- USD/CHF slides further to near 0.7990 as the Swiss Franc outperforms its peers.

- The SNB is unlikely to push interest rates into negative territory.

- The US Dollar Index gains ground after hitting a weekly low near 99.30 on Tuesday.

The USD/CHF pair extends its losing streak for the sixth trading day on Wednesday. The Swiss Franc pair trades 0.15% lower to near 0.7990 during the European trading session. The pair faces selling pressure as the Swiss Franc (CHF) outperforms its peers, driven by hopes that the Swiss National Bank (SNB) will not push interest rates into a negative territory.

It is unlikely that the SNB will pivot to negative interest rates as inflationary pressures are expected to accelerate in the coming quarters. “Inflation should rise slightly in the next quarters, and interest rates are expected to remain on hold for a long time,” SNB Chairman Martin Schlegel said earlier this month.

Going forward, investors will focus on the Swiss Producer and Import Prices data for October, which will be released on Thursday.

Meanwhile, the US Dollar Index (DXY) stabilizes against its other peers during Wednesday’s European trading hours after posting a fresh weekly low around 99.30 on Tuesday. The USD Index fell the previous day after the release of the ADP Employment Change four-week average data, which showed that employers laid off 11.25K workers each week through late October.

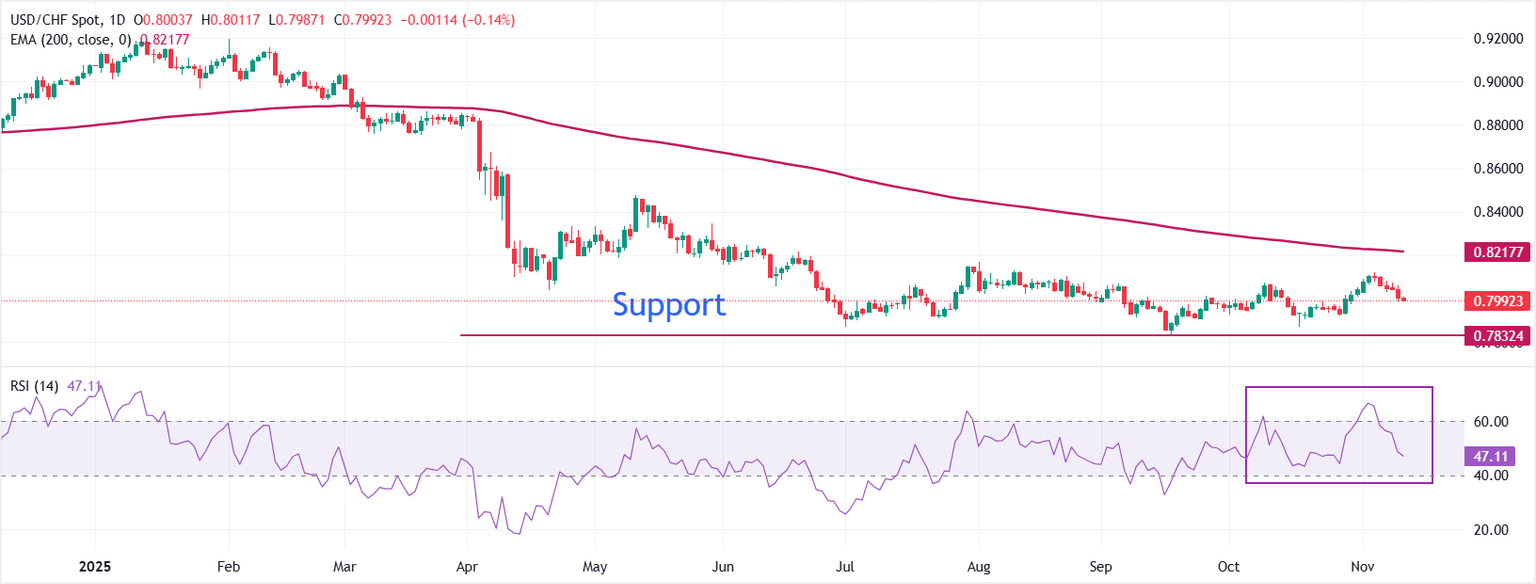

USD/CHF stays below the 200-day Exponential Moving Average (EMA), which trades around 0.8217, suggesting that the overall trend is bearish.

The 14-day Relative Strength Index (RSI) slides inside the 40.00-60.00 range, demonstrating an ongoing correction.

Going forward, the pair could slide towards 0.7800 and the late July 2011 low of 0.7580, if it breaks below the September 17 low of 0.7829.

On the flip side, a recovery move by the pair above the August 1 high of 0.8170 will open the room for more upside towards the June 19 high of 0.8215, followed by the June 6 high of 0.8248.

USD/CHF daily chart

SNB FAQs

The Swiss National Bank (SNB) is the country’s central bank. As an independent central bank, its mandate is to ensure price stability in the medium and long term. To ensure price stability, the SNB aims to maintain appropriate monetary conditions, which are determined by the interest rate level and exchange rates. For the SNB, price stability means a rise in the Swiss Consumer Price Index (CPI) of less than 2% per year.

The Swiss National Bank (SNB) Governing Board decides the appropriate level of its policy rate according to its price stability objective. When inflation is above target or forecasted to be above target in the foreseeable future, the bank will attempt to tame excessive price growth by raising its policy rate. Higher interest rates are generally positive for the Swiss Franc (CHF) as they lead to higher yields, making the country a more attractive place for investors. On the contrary, lower interest rates tend to weaken CHF.

Yes. The Swiss National Bank (SNB) has regularly intervened in the foreign exchange market in order to avoid the Swiss Franc (CHF) appreciating too much against other currencies. A strong CHF hurts the competitiveness of the country’s powerful export sector. Between 2011 and 2015, the SNB implemented a peg to the Euro to limit the CHF advance against it. The bank intervenes in the market using its hefty foreign exchange reserves, usually by buying foreign currencies such as the US Dollar or the Euro. During episodes of high inflation, particularly due to energy, the SNB refrains from intervening markets as a strong CHF makes energy imports cheaper, cushioning the price shock for Swiss households and businesses.

The SNB meets once a quarter – in March, June, September and December – to conduct its monetary policy assessment. Each of these assessments results in a monetary policy decision and the publication of a medium-term inflation forecast.

Author

Sagar Dua

FXStreet

Sagar Dua is associated with the financial markets from his college days. Along with pursuing post-graduation in Commerce in 2014, he started his markets training with chart analysis.