USD/CHF Price Analysis: Bulls take a breather, still above 21-HMA ahead of SNB

- USD/CHF bounced off key support on the hourly chart after the slump.

- Hourly RSI rebounds from the oversold region, points north.

- 21-HMA to challenge XAG/USD’s pullback from monthly lows.

USD/CHF is consolidating its four-day winning streak to two-month highs of 0.9245 amid the ongoing US dollar’s upbeat momentum, as the focus now shifts towards the Swiss National Bank’s (SNB) quarterly monetary policy assessment, due later on Thursday at 0730 GMT.

The SNB is expected to leave the benchmark sight deposit rate unchanged at -0.75% while maintaining the 3-Month Libor Target Range steady between -1.25% to -0.25%. The central bank is likely to reiterate that it will remain active in the fx markets, despite the recent weakness in the Swiss franc.

Short-term technical outlook

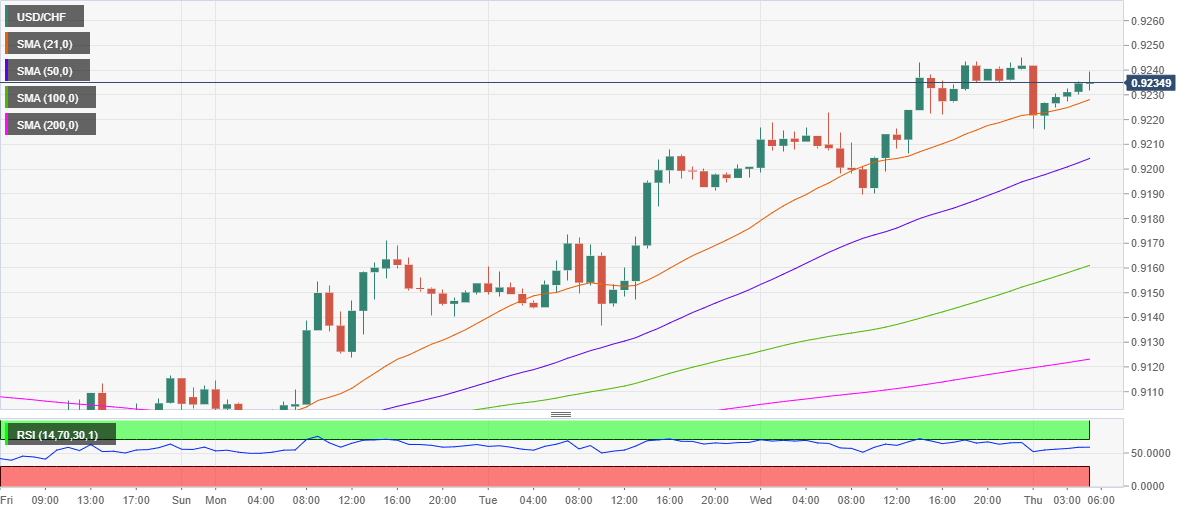

As observed on the hourly chart, the spot edges north, having managed to hold above the critical 21-daily Simple Moving Average (DMA), currently at 0.9228.

The price has formed a Doji candlestick, at the time of writing, suggesting that the buyers are turning cautious ahead of the SNB rate decision.

However, the path of least resistance remains to the upside, with the hourly Relative Strength Index (RSI) inching higher above the midline at 58.80. Also, backing the bullish case, the price trades above all major HMAs.

The major could test the July 24 high of 0.9260 should the bulls regain control. The next barrier is seen at 0.9300.

Alternatively, the 21-HMA support could limit the downside, below which the bears could challenge the intraday lows of 0.9215.

Further south, the upward-sloping 50-HMA at 0.9206 could be put to test should the selling pressure intensify.

USD/CHF: Hourly chart

USD/CHF: Additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.