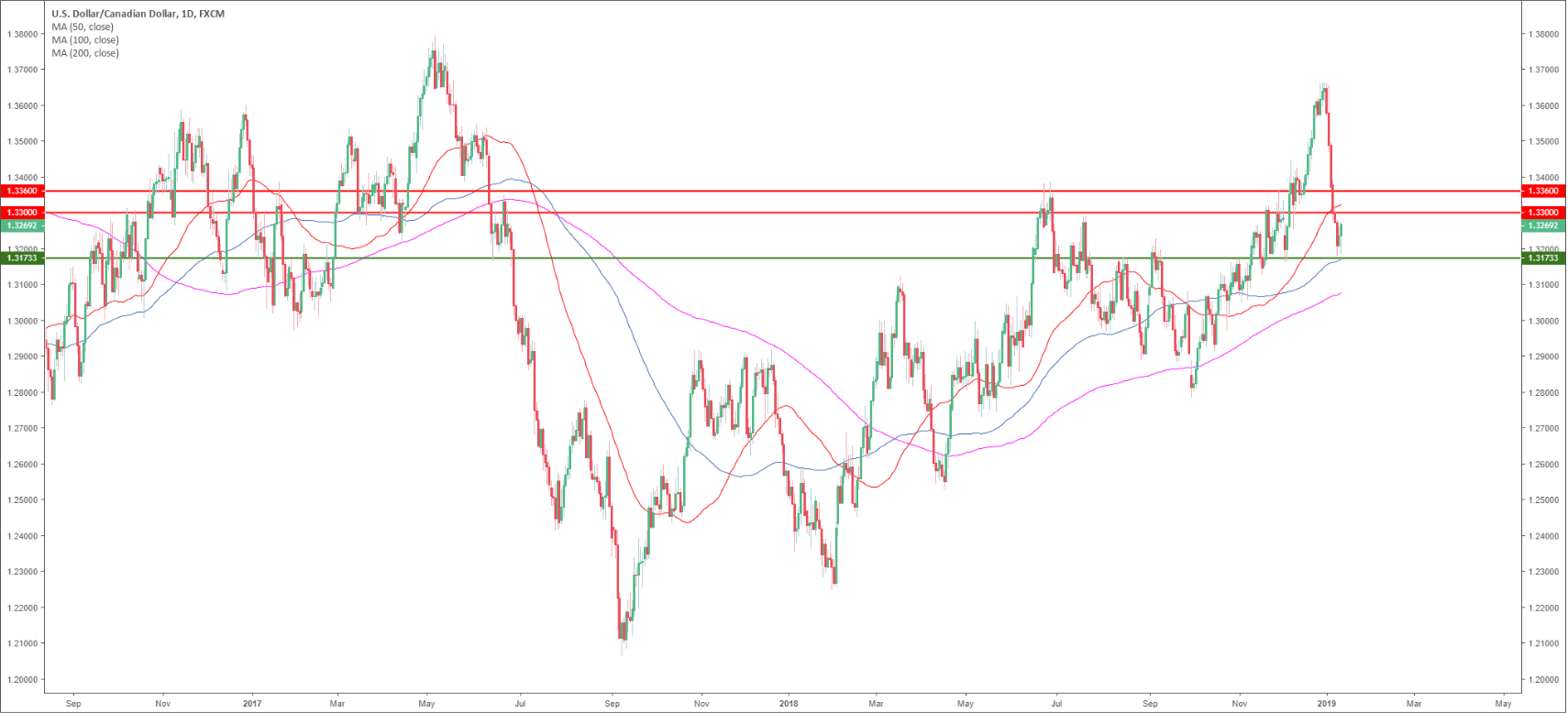

USD/CAD daily chart

- USD/CAD is trading in a bull trend above the 200 SMA.

- USD/CAD is consolidating the recent losses above 1.3200 and the 100 SMA.

- Earlier this Friday, the US CPI (Consumer Producer Index) matched analysts expectations at 2.2% for December y/y.

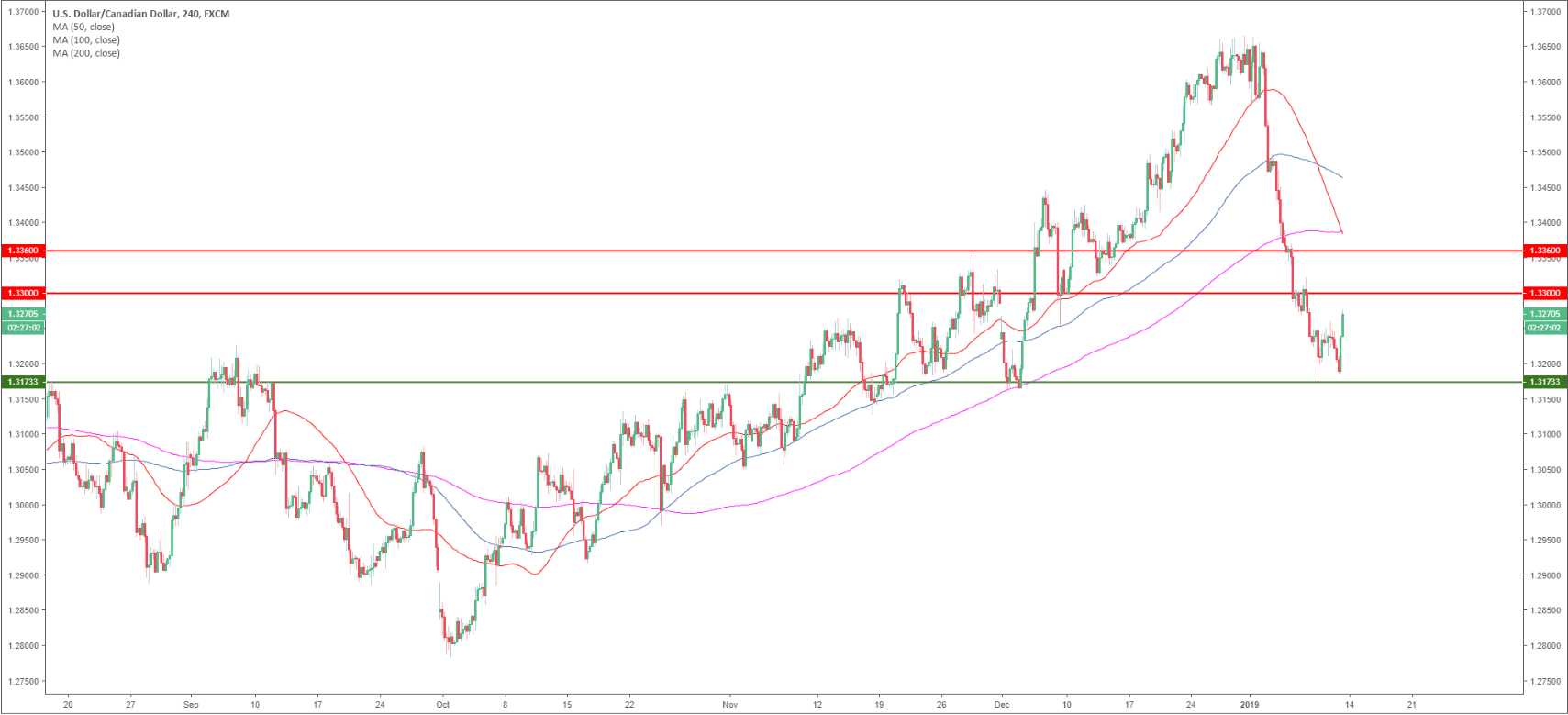

USD/CAD 4-hour chart

- USD/CAD is trading below its main SMAs.

USD/CAD 30-minute chart

- USD/CAD bulls are gaining ground as they reclaimed the main SMAs. They are now most likely en route to the 1.3300 figure and 1.3360 level if they gather enough steam.

Additional key levels

USD/CAD

Overview:

Today Last Price: 1.327

Today Daily change: 33 pips

Today Daily change %: 0.249%

Today Daily Open: 1.3237

Trends:

Previous Daily SMA20: 1.3509

Previous Daily SMA50: 1.3353

Previous Daily SMA100: 1.3185

Previous Daily SMA200: 1.3084

Levels:

Previous Daily High: 1.326

Previous Daily Low: 1.3202

Previous Weekly High: 1.3666

Previous Weekly Low: 1.338

Previous Monthly High: 1.4134

Previous Monthly Low: 1.316

Previous Daily Fibonacci 38.2%: 1.3238

Previous Daily Fibonacci 61.8%: 1.3224

Previous Daily Pivot Point S1: 1.3205

Previous Daily Pivot Point S2: 1.3174

Previous Daily Pivot Point S3: 1.3146

Previous Daily Pivot Point R1: 1.3264

Previous Daily Pivot Point R2: 1.3292

Previous Daily Pivot Point R3: 1.3323

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended content

Editors’ Picks

EUR/USD holds below 1.0750 ahead of key US data

EUR/USD trades in a tight range below 1.0750 in the European session on Friday. The US Dollar struggles to gather strength ahead of key PCE Price Index data, the Fed's preferred gauge of inflation, and helps the pair hold its ground.

USD/JPY stays firm above 156.00 after BoJ Governor Ueda's comments

USD/JPY stays firm above 156.00 after surging above this level on the Bank of Japan's decision to leave the policy settings unchanged. BoJ Governor said weak Yen was not impacting prices but added that they will watch FX developments closely.

Gold price oscillates in a range as the focus remains glued to the US PCE Price Index

Gold price struggles to attract any meaningful buyers amid the emergence of fresh USD buying. Bets that the Fed will keep rates higher for longer amid sticky inflation help revive the USD demand.

Bitcoin Weekly Forecast: BTC’s next breakout could propel it to $80,000 Premium

Bitcoin’s recent price consolidation could be nearing its end as technical indicators and on-chain metrics suggest a potential upward breakout. However, this move would not be straightforward and could punish impatient investors.

US core PCE inflation set to signal firm price pressures as markets delay Federal Reserve rate cut bets

The core PCE Price Index, which excludes volatile food and energy prices, is seen as the more influential measure of inflation in terms of Fed positioning. The index is forecast to rise 0.3% on a monthly basis in March, matching February’s increase.