USD/CAD Price Analysis: Refreshes weekly low and rebounds, back above 1.2800 mark

- USD/CAD witnessed some intraday selling on Friday and dropped to a fresh weekly low.

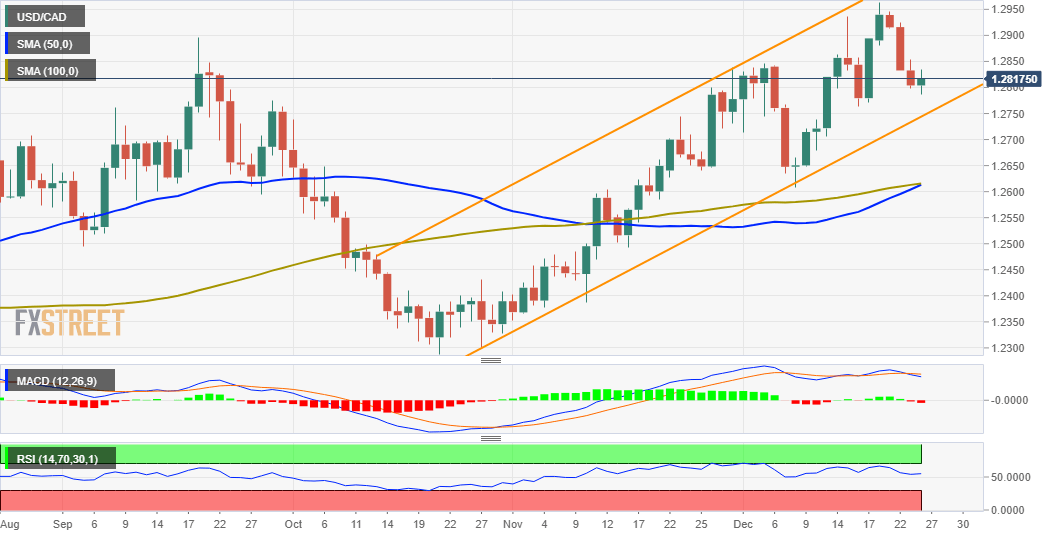

- The ascending channel formation supports prospects for the emergence of dip-buying.

- A convincing break below the 1.2740-35 area is needed to negate the positive outlook.

The USD/CAD pair struggled to capitalize on its modest intraday gains, instead met with a fresh supply near the 1.2835 region on Friday and refreshed weekly low during the mid-European session. The pair, however, quickly reversed the dip and jumped back above the 1.2800 round-figure mark in the last hour.

Looking at the broader picture, the USD/CAD pair has been trending higher along an ascending channel over the past two months or so, pointing to a short-term uptrend. Apart from this, oscillators on the daily chart – though have been losing traction – are still holding in the positive territory and favour bullish traders.

This, in turn, supports prospects for the emergence of some dip-buying at lower levels. Hence, any subsequent weakness below the 1.2770-60 horizontal support is more likely to stall near the lower boundary of the mentioned channel, currently around the 1.2740 region, which should now act as a key pivotal point.

A convincing break below will negate any near-term positive bias and pave the way for an extension of the recent pullback from the YTD high touched on Monday. The USD/CAD pair would then turn vulnerable to break below the 1.2700 mark and accelerate the fall towards testing the next relevant support near the 1.2640-35 region.

On the flip side, momentum beyond the daily swing high, around the 1.2835 region, might confront some resistance near the 1.2860 area. Some follow-through buying will reaffirm the bullish outlook and allow the USD/CAD pair to reclaim the 1.2900 mark. The momentum could further push spot prices to the 1.2960-65 area, or the YTD top.

USD/CAD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.