USD/CAD Price Analysis: On its way down to monthly support trendline

- USD/CAD registers three-day losing streak.

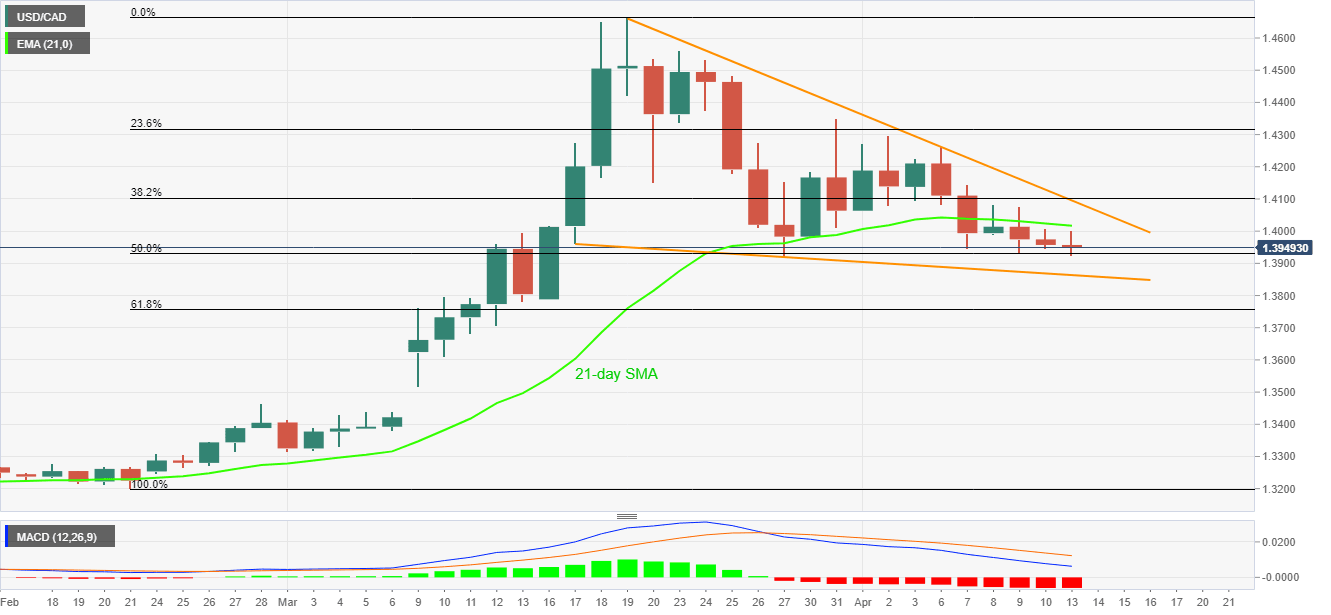

- Sustained trading below 21-day EMA, break of 50% Fibonacci retracement keep sellers hopeful.

- The support line of the monthly falling wedge could question further downside.

- Buyers will seek confirmation of the bullish pattern for fresh entry.

While staying below 21-day EMA for the fourth consecutive day, USD/CAD declines to 1.3945, down 0.08% on a day, during the early Monday’s trading session.

Not the only pair’s sustained trading below 21-day EMA but bearish MACD and the recent drop below 50% Fibonacci retracement of February-March upside also favor the sellers.

However, a support line of the four-week-old falling wedge formation, near 1.3865, could keep the pair’s further downside limited, if not 61.8% Fibonacci retracement level of 1.3755 will return to the charts.

On the upside break of the 21-day EMA level of 1.4020, buyers will wait for the confirmation of the bullish chart pattern, which requires a successful break above 1.4100, for fresh entry.

USD/CAD daily chart

Trend: Further weakness expected

Author

Anil Panchal

FXStreet

Anil Panchal has nearly 15 years of experience in tracking financial markets. With a keen interest in macroeconomics, Anil aptly tracks global news/updates and stays well-informed about the global financial moves and their implications.