USD/CAD Price Analysis: Bulls await a move beyond 1.2625-30 confluence hurdle

- A combination of factors assisted USD/CAD to regain positive traction on Friday.

- Bulls struggled to build on the move or find acceptance above the 1.2600 mark.

- The technical set-up supports prospects for an eventual breakout to the upside.

The USD/CAD pair shot to an intraday high level of 1.2611 during the early European session, albeit quickly retreated few pips thereafter. The pair was last seen trading around the 1.2600 mark, up around 0.30% for the day.

The US dollar staged a solid rebound from over two-week lows amid a strong pickup in the US Treasury bond yields. Apart from this, a softer tone surrounding crude oil prices undermined the commodity-linked loonie and provided an additional boost to the USD/CAD pair.

That said, the underlying bullish sentiment in the financial markets capped gains for the safe-haven USD and held bulls from placing aggressive bets. Investors also seemed reluctant, rather preferred to wait for Friday's release of Canadian monthly employment details.

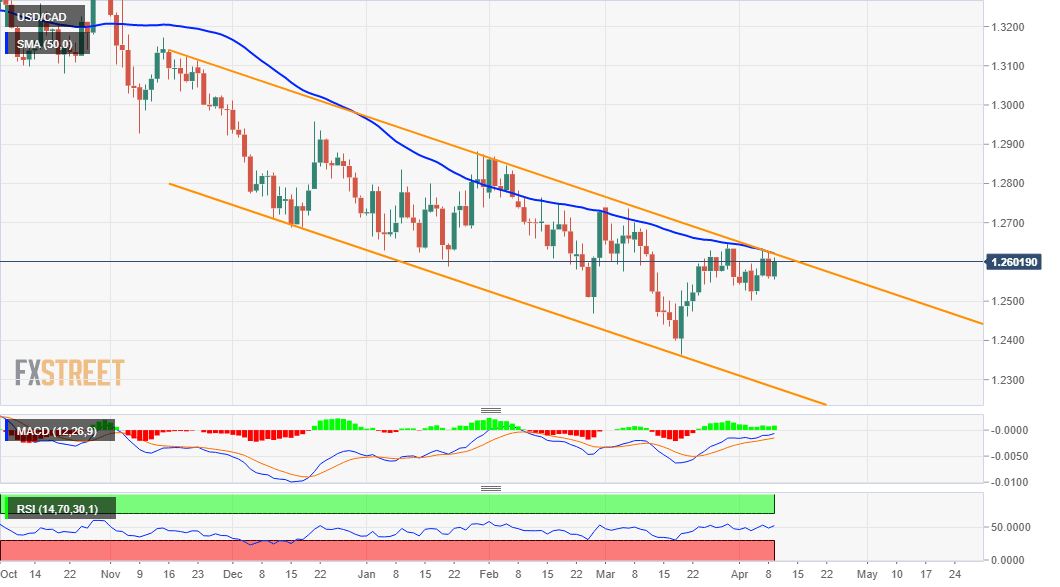

Looking at the technical picture, the USD/CAD pair, so far, has been struggling to find acceptance above the 1.2600 mark. This is followed by a confluence hurdle comprising of the top boundary of a four-month-old descending channel and 50-day SMA, around the 1.2625-30 region.

This should act as a key pivotal point, which if cleared decisively will mark a fresh bullish breakout and trigger a short-covering move. The momentum could then push the USD/CAD pair beyond the 1.2700 mark, towards the next relevant hurdle near the 1.2740-50 zone.

Meanwhile, technical indicators on hourly charts have been gaining positive traction and just started moving into the bullish territory on the daily chart. The set-up supports prospects for an eventual bullish breakout through the trend-channel and additional near-term gains.

On the flip side, any meaningful pullback should continue to attract some dip-buying and remain limited near the overnight swing lows, around the 1.2560-55 region. Some follow-through weakness below might turn the USD/CAD pair vulnerable to retest the 1.2500 psychological mark.

USD/CAD daily chart

Technical levels to watch

Author

Haresh Menghani

FXStreet

Haresh Menghani is a detail-oriented professional with 10+ years of extensive experience in analysing the global financial markets.