USD/CAD Price Analysis: Bears to target 1.2480 on a breakout below daily H&S neckline

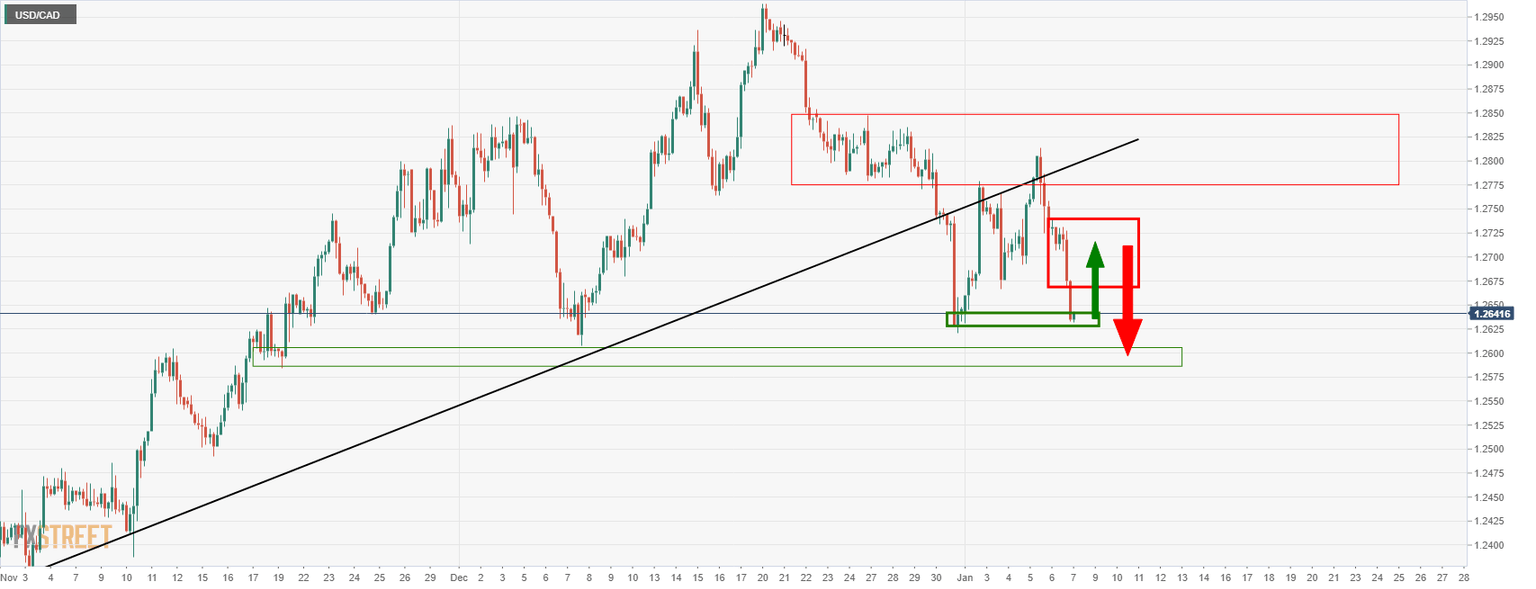

- USD/CAD bears are taking on the 1.26 area with a fresh cycle low at 1.2588.

- The longer-term outlook will be significantly bearish should the price break 1.2580 on a daily closing basis.

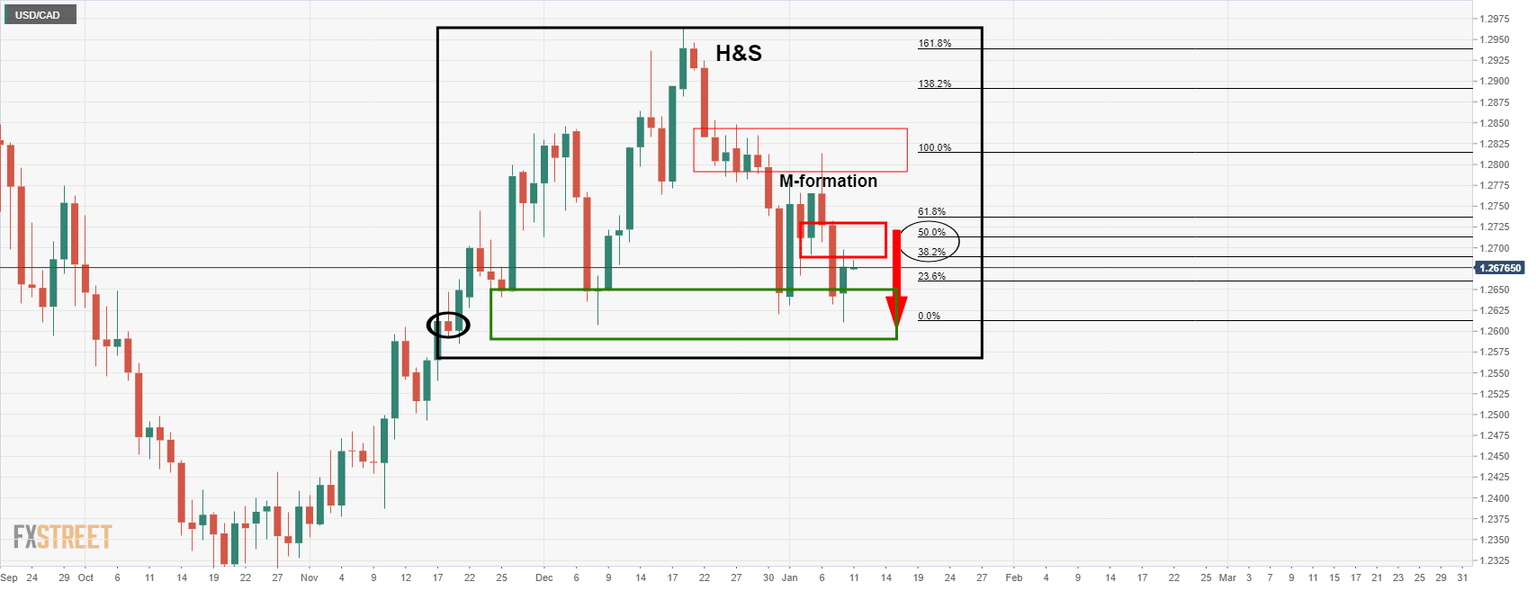

USD/CAD has been steadily carving out a bearish head and shoulders pattern on the daily time frame for the start of 2022, as per the following original analysis: USD/CAD Price Analysis: Bears line up for their discounts

Tracking the performance of the pair at the start of this week, the following analysis noted the M-formation: USD/CAD Price Analysis: The bearish playbook is unfolding, daily M-formation in focus

The price was leaving an M-formation on the chart as illustrated above and was drawing the bulls into the neckline.

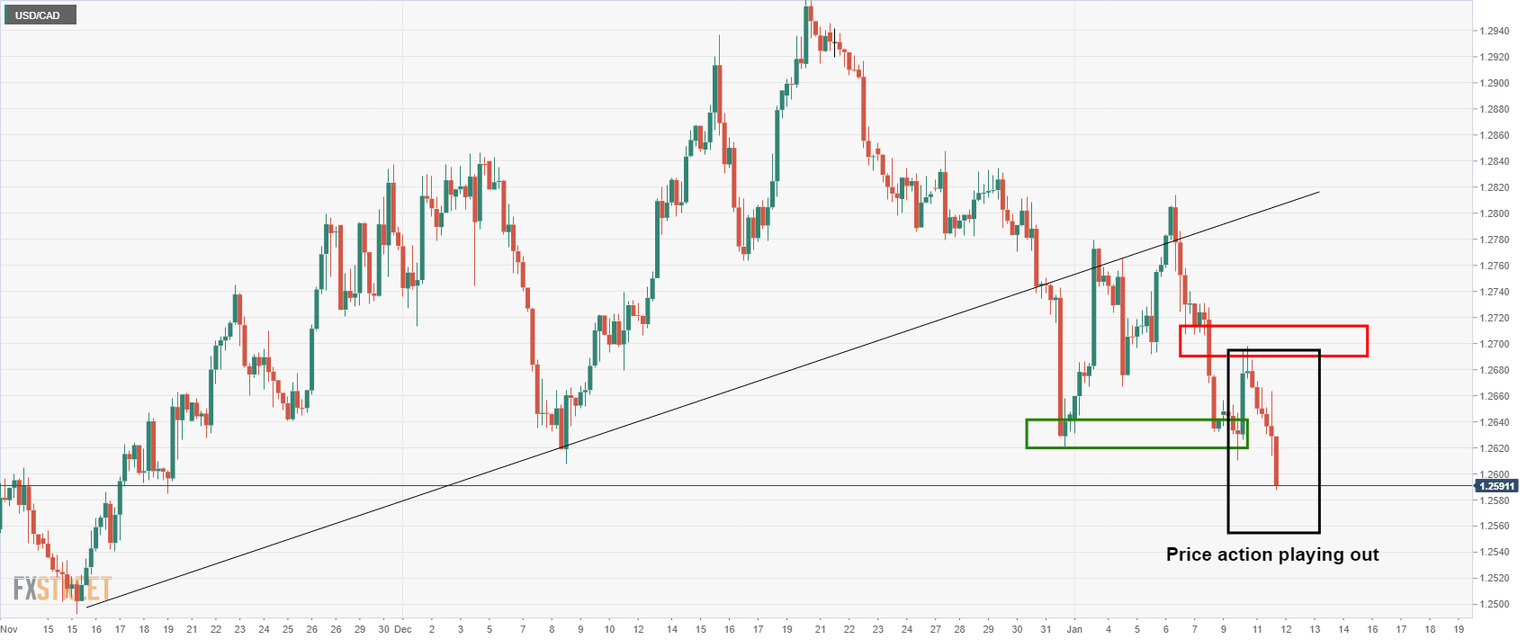

This was seen on the 4-hour time frame as in the following prior analysis:

Since the analysis, the price has indeed played out according to the 4-hour forecast as follows:

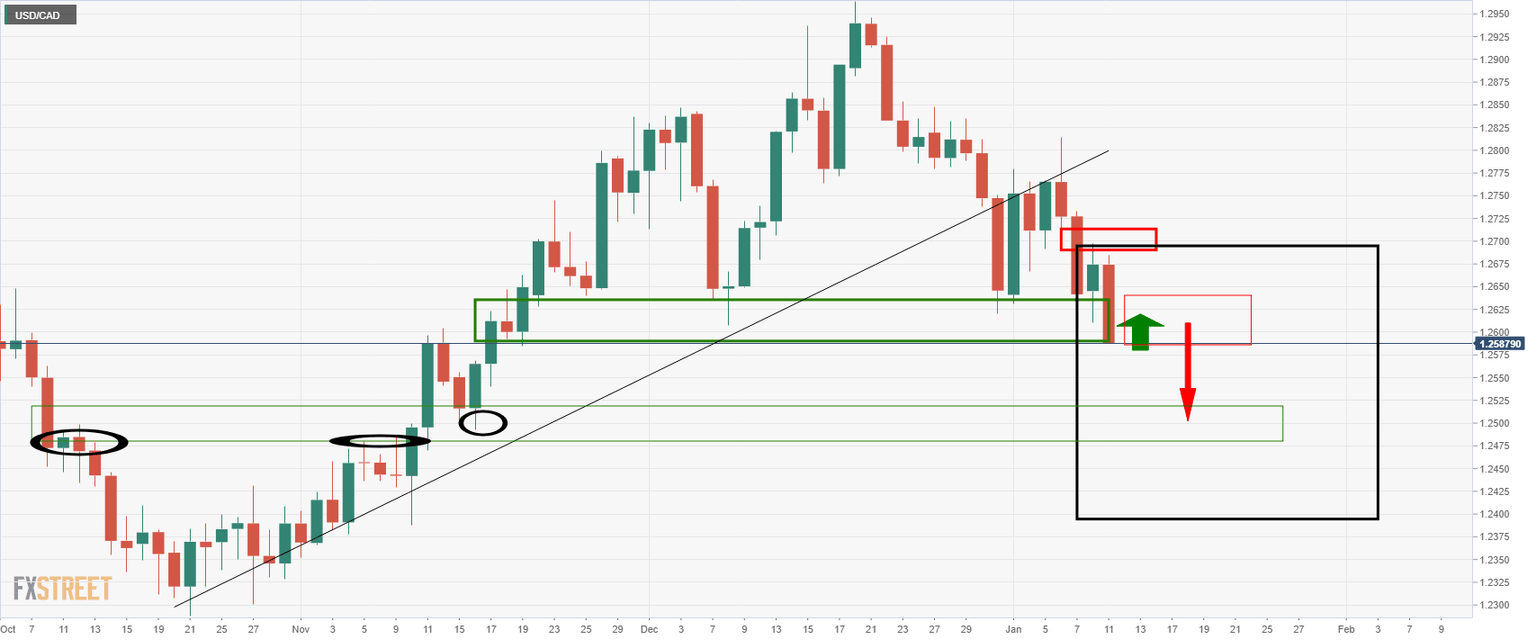

The price mitigated the imbalance into the daily M-formation's neckline near 1.2700/10 prior to the recent break to test 1.26 the figure.

At this juncture, the neckline of the daily head and shoulders would be expected to act as resistance near 1.2580/1.2610. Bears can look near to 1.25 the figure and 1.2480 as the next area of expected support:

USD/CAD daily chart

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.