USD/CAD Price Analysis: Bears line up for their discounts

- USD/CAD bulls run into a wall of resistance and the bears are lurking, hungry for a discount.

- USD/CAD bears need to break 1.27 the figure for a bearish structure to really take shape.

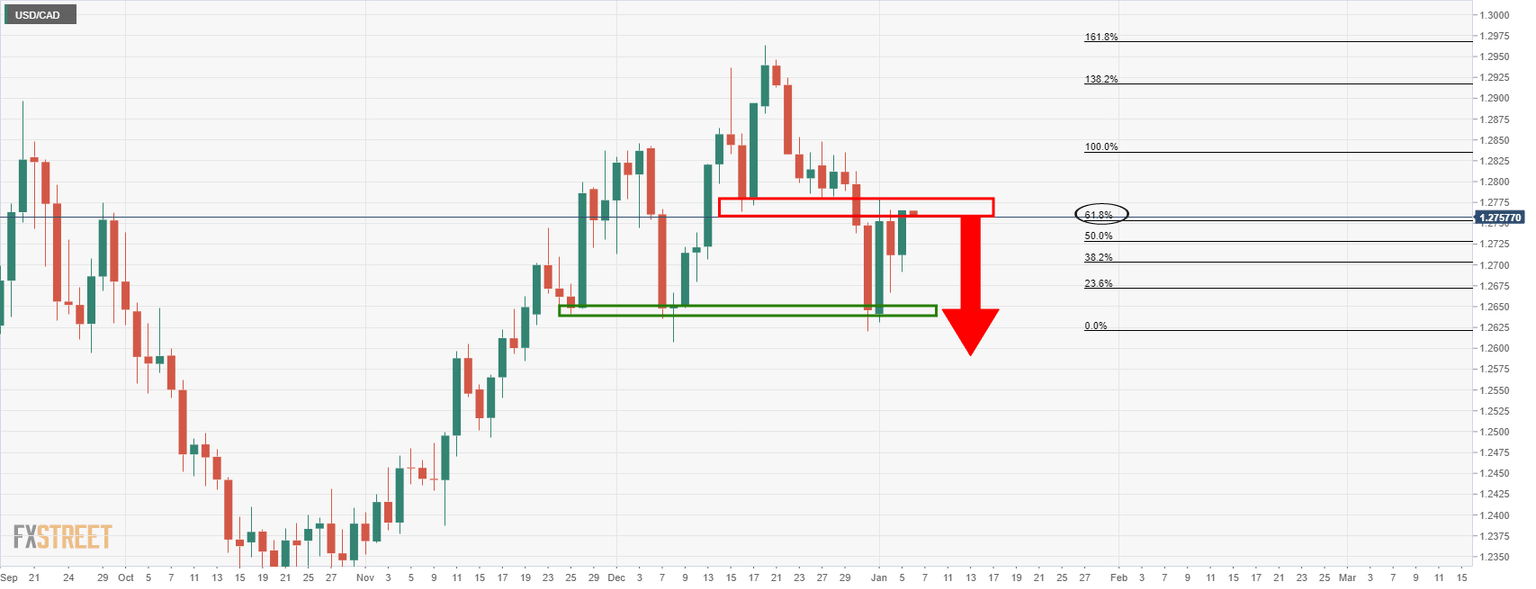

USD/CAD is forming the makings of a bearish outlook despite the hawkish Federal Reserve. The price has run higher in the bullish correction of the bearish daily impulse, but should the bears engage at a discount, then the focus will be on a break to the downside as follows:

USD/CAD daily charts

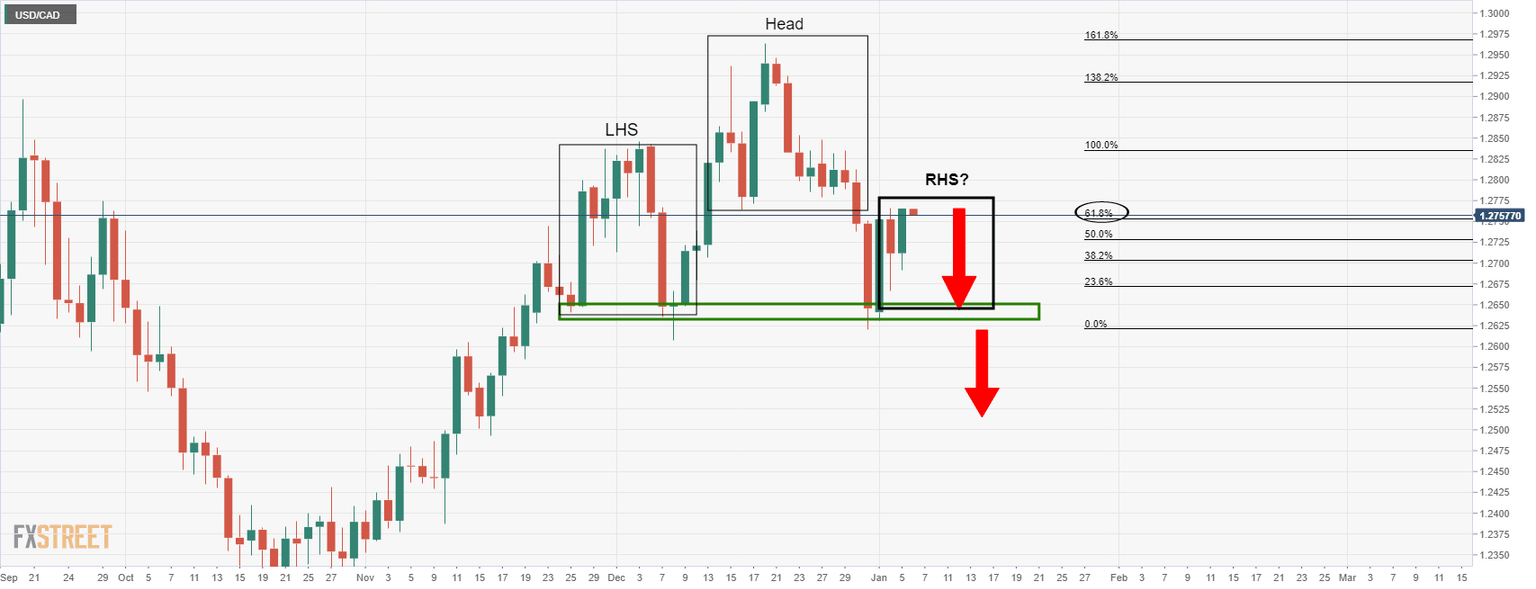

The price, in doing so, will have completed a head and shoulders as follows:

USD/CAD H&S

The head and shoulders is a topping formation, so the price would be expected to run significantly lower on a break and retest of the neckline near 1.2630.

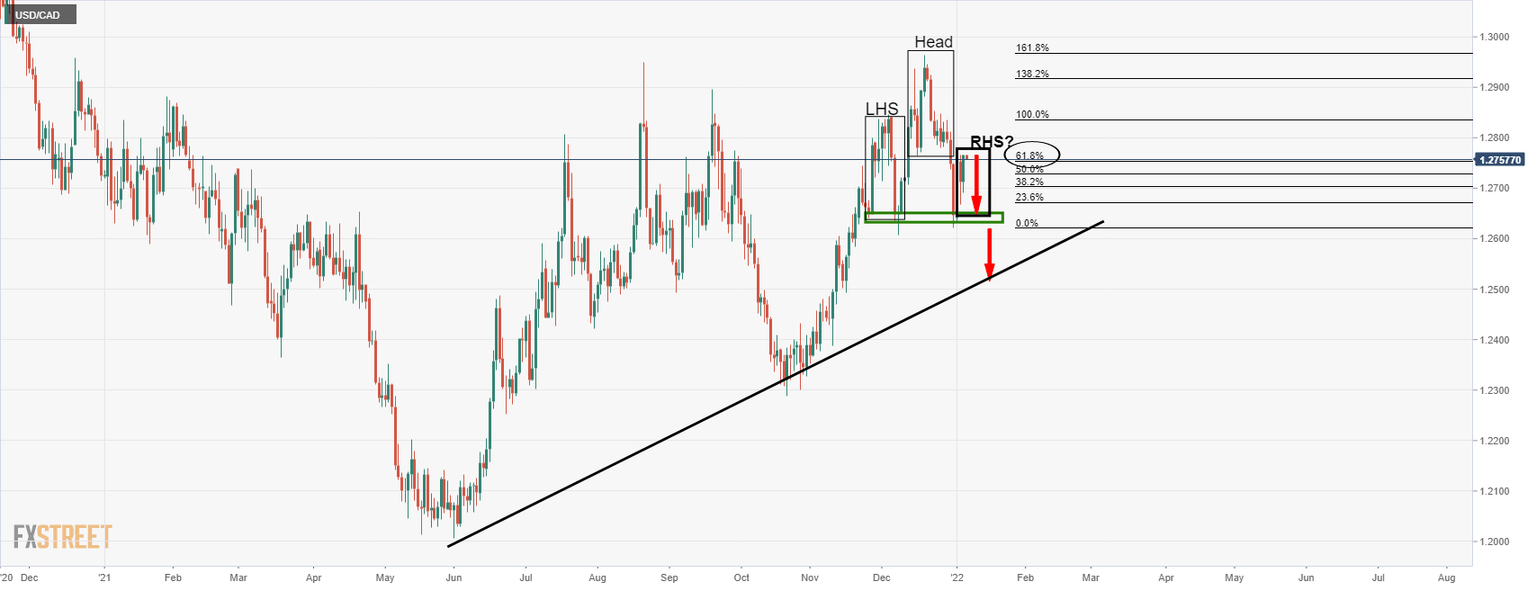

1.2520 will be earmarked as per the dynamic trendline support:

USD/CAD 4-hour chart

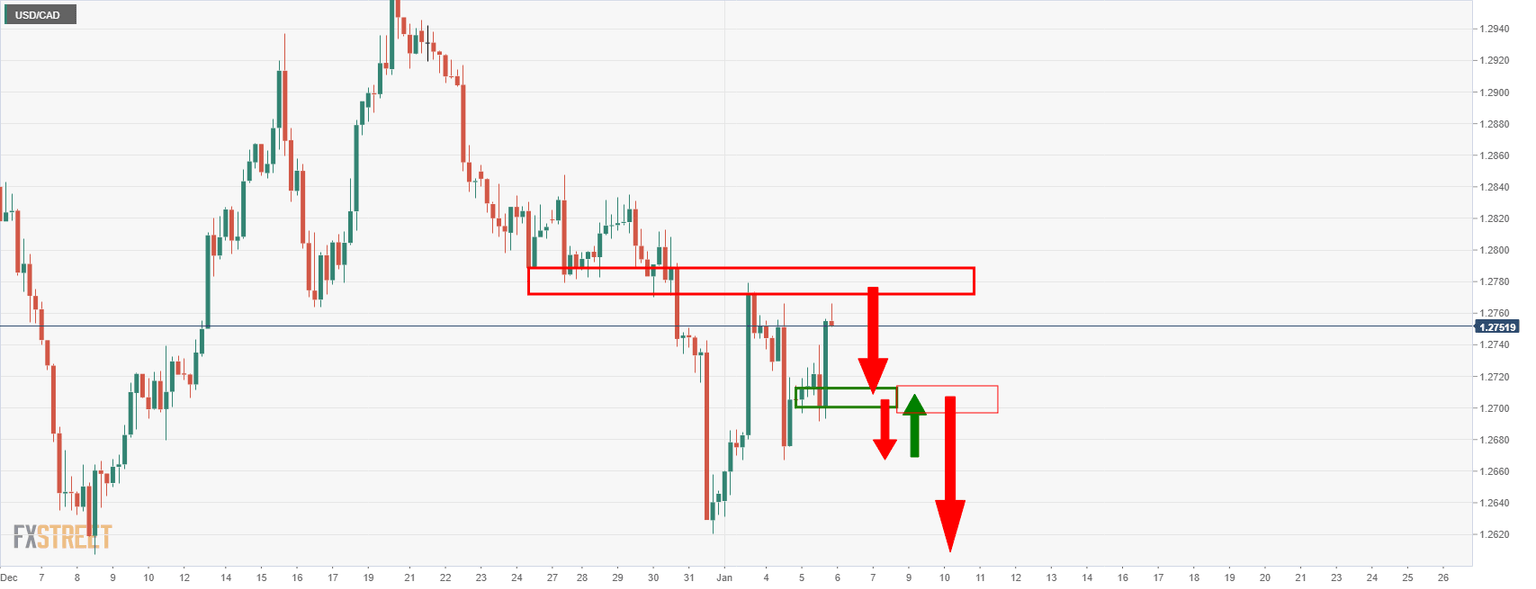

The bears would be prudent to wait to engage on a retest of the 4-hour support just below 1.27 the figure that would be expected to act as a resistance on a break thereof.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.