USD/CAD Price Analysis: The bearish playbook is unfolding, daily M-formation in focus

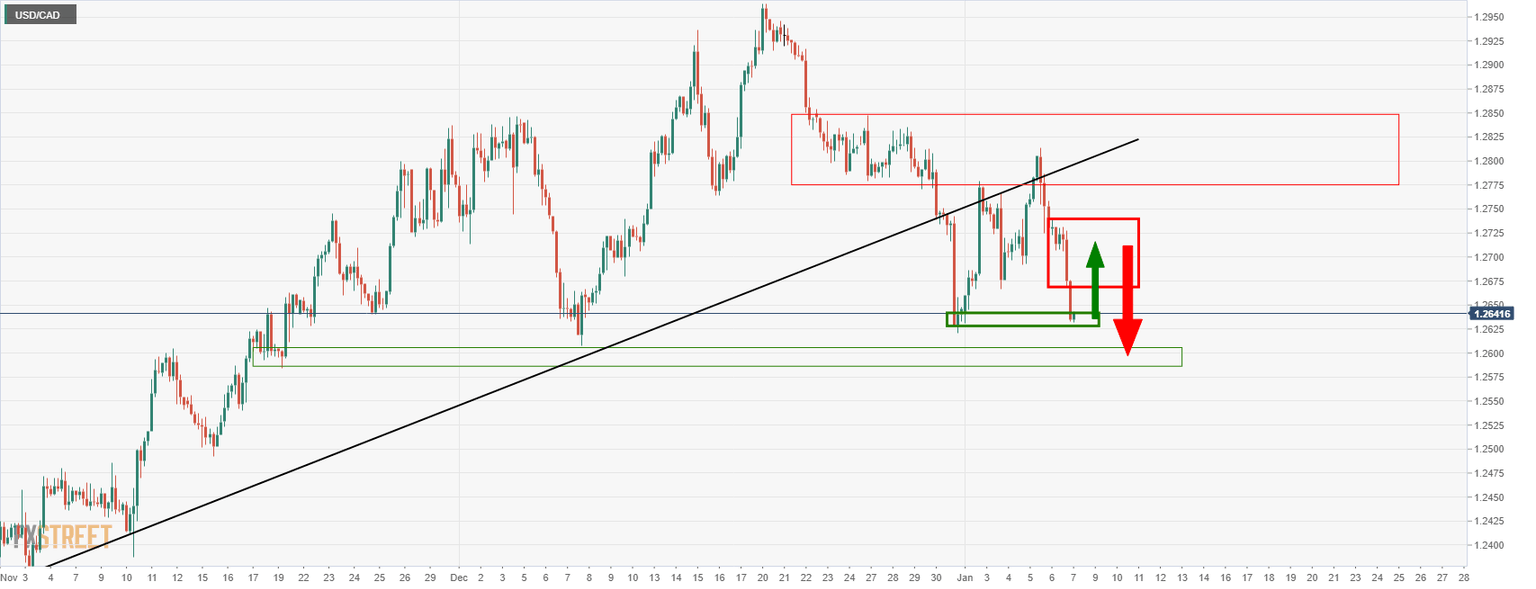

- USD/CAD is carving out a bearish structure on the daily chart.

- Some consolidation would be expected prior to the next downside move with 1.2600 eyed.

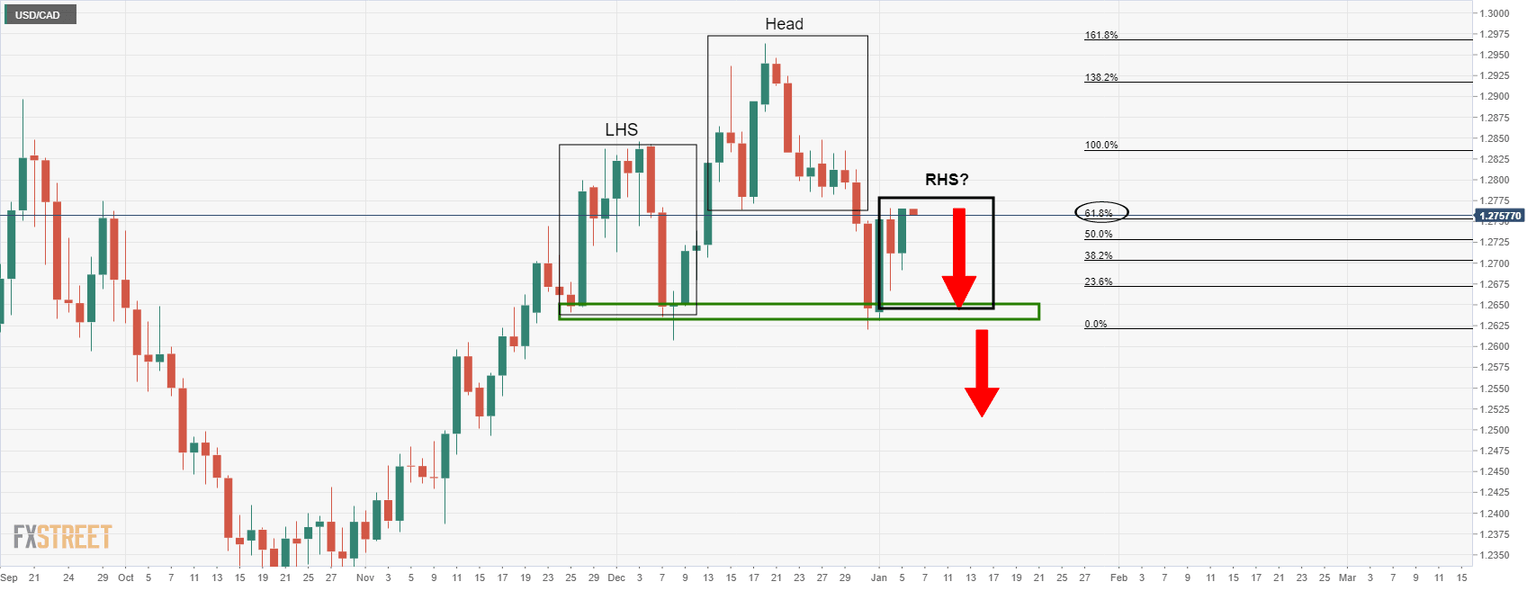

As per the start of the week's analysis, The Chart of the Week: USD/CAD has complied with the medium-term bearish bias, the price is adhering to the market's structure and the following illustrates the bearish perspective:

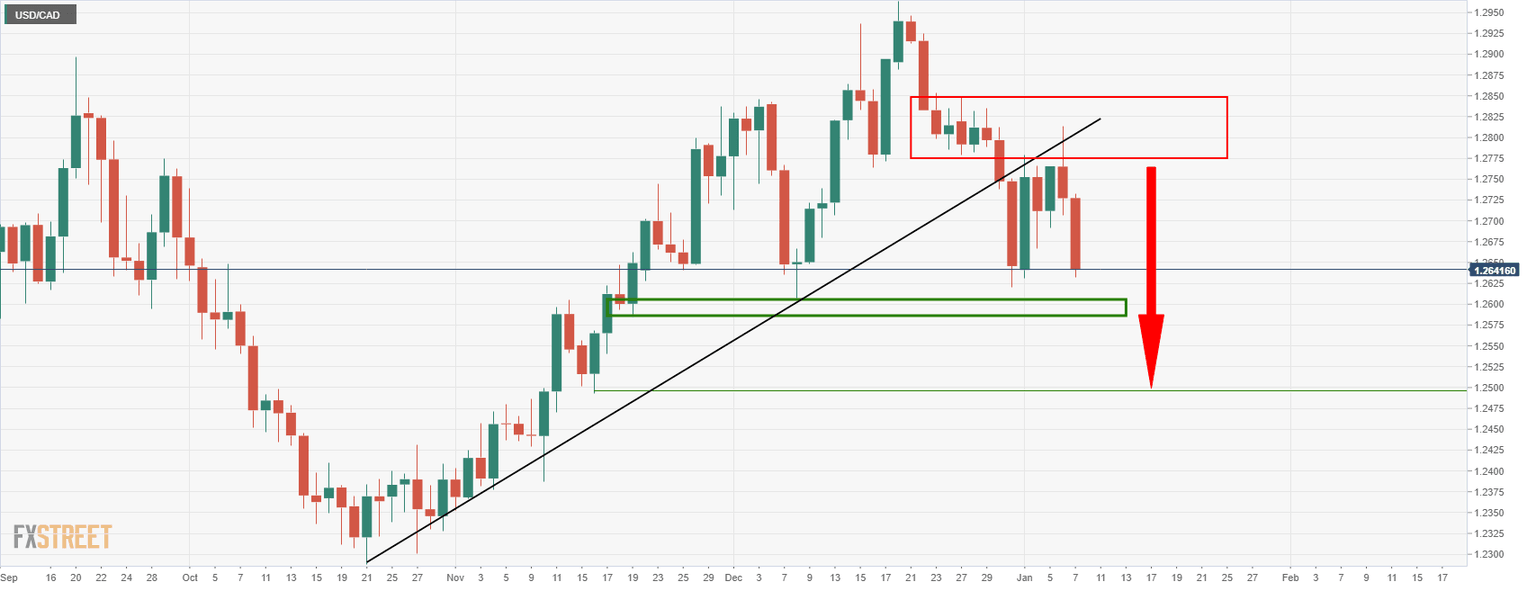

USD/CAD daily chart, prior analysis

As illustrated above, the head and shoulders were in the making...

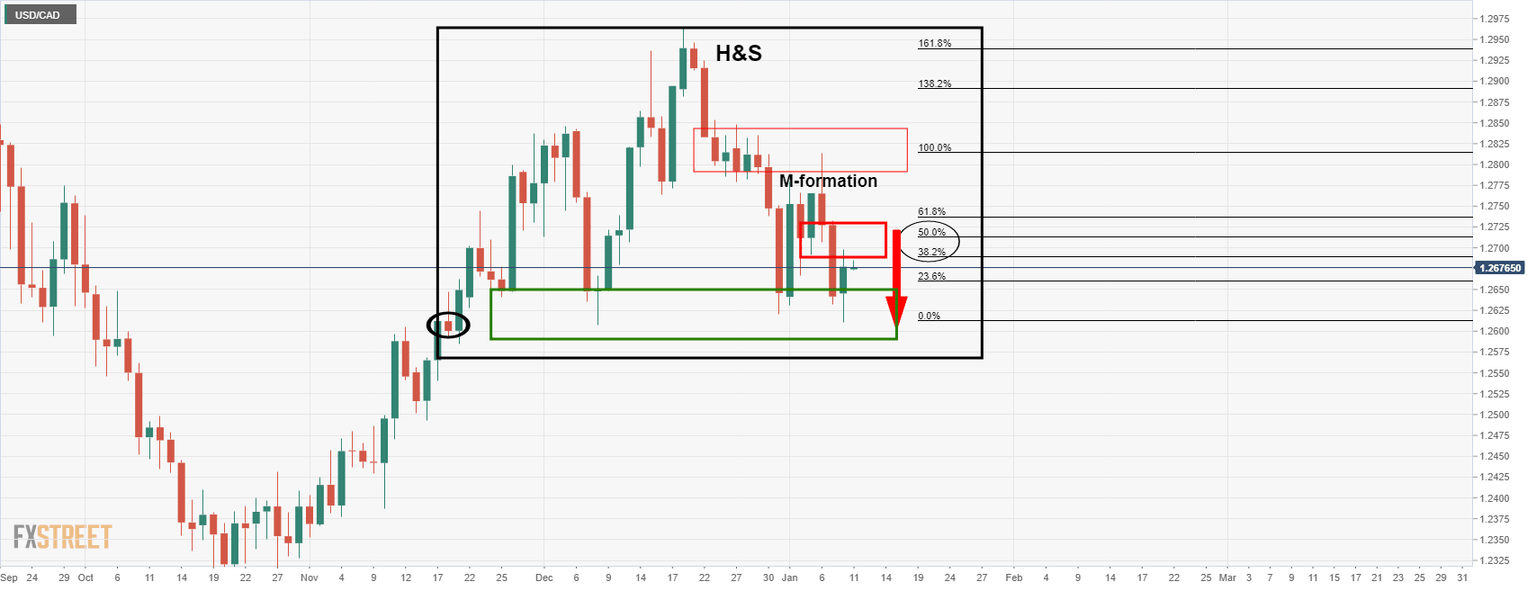

USD/CAD daily chart analysis

The price is now leaving an M-formation on the chart as illustrated above and is drawing the bulls into the neckline.

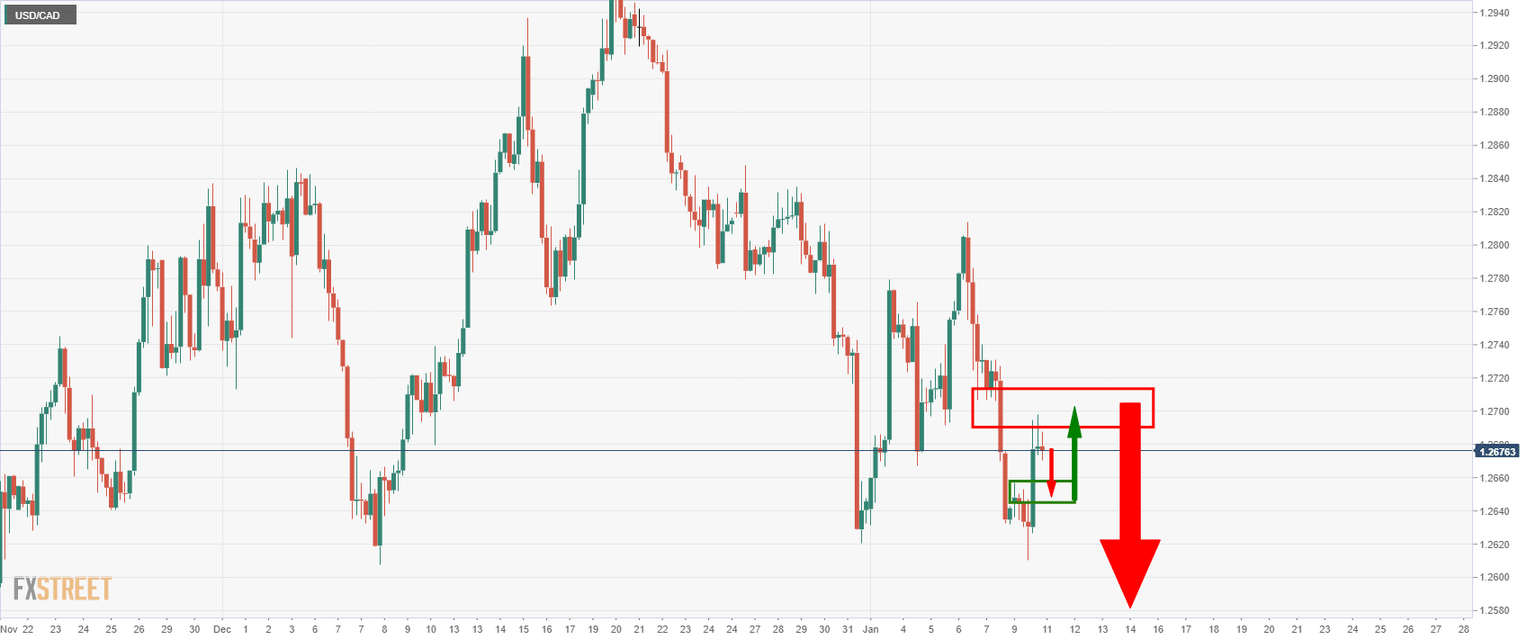

This can be seen on the 4-hour time frame as in the following prior analysis:

As seen, the prior analysis at the start of the week forecasted a move into the 1.27 area and it has played out as follows:

USD/CAD H4 chart

We can now expect the price to mitigate the imbalance to a restest of what would be expected to act as support on first attempts near 1.2650. This could lead to a deeper bullish correction into the daily M-formation's neckline near 1.2700/10 again prior to a full-on downside break to test 1.26 the figure.

Author

Ross J Burland

FXStreet

Ross J Burland, born in England, UK, is a sportsman at heart. He played Rugby and Judo for his county, Kent and the South East of England Rugby team.