USD/CAD gradually grinds lower from 1.3000 as US dollar slides

- USD/CAD has continued to edge lower since dipping below 1.3000, despite somewhat thin volumes and uneventful markets.

- Driving the move has been a broad softening of the US dollar, with DXY having fallen below 92.00.

USD/CAD is just above lows of the day below 1.2980, the pair having gradually ground to the downside throughout the final trading session of the week amid a broad weakening of USD that has seen the Dollar Index (DXY) slip below 92.00 and towards lows of the year around 91.74. As things stand right now, USD/CAD trades with losses on the day of just under 30 pips or around 0.2%.

CAD conforms to bearish USD flows, amid subdued crude and lack of Canada specific drivers

Amid a distinct lack of any Canada specific news flow or data on Friday, as well as broadly subdued trade within crude oil markets, USD/CAD has broadly traded as a function of USD flows, or USD weakness to be more precise.

For many analysts and institutions, continued USD downside does not come as much of a surprise, given that many of the prevailing market narratives work directly against USD.

One of the key narratives that has lifted stock markets, commodity markets and risk-sensitive FX markets since the start of November has been the improving outlook for 2021 and beyond amid 1) good vaccine news (giving financial markets light at the end of the tunnel regarding the pandemic) and 2) Joe Biden’s victory in the US Presidential election, signalling a turning point for international relations towards more favourable global trade conditions.

However, many are also now citing near-term risk factors as weighing on USD. Credit Agricole attribute persistent USD downside to investors fretting “about the health of the US economy, which is still in the grip of a third Covid-19 wave”, and note that “the Fed’s October minutes have already hinted that the FOMC could adjust the pace of its QE programme if the economic outlook deteriorates further and given that the prospects for another fiscal stimulus package before year-end appear slim”.

Looking ahead to next week, Credit Agricole think that tier one US data releases for November (ISM manufacturing and services PMIs, Non-farm payrolls) “could determine whether the Fed will have to act again at its December policy meeting or not”. The implications is that bad data ought to be bad for USD (rather than what sometimes happens when USD rallies after bad US data on a safe haven bid), given that bad data implies a more dovish Fed. However, the bank suspects that “a lot of negatives are already in the price of the USD, so it would take significant US data disappointments to send the currency sharply lower”.

Looking ahead, things might spice up for crude oil markets next week with the conclusion of the two-day OPEC+ meeting on Monday, meaning the loonie might also see some volatility in tandem.

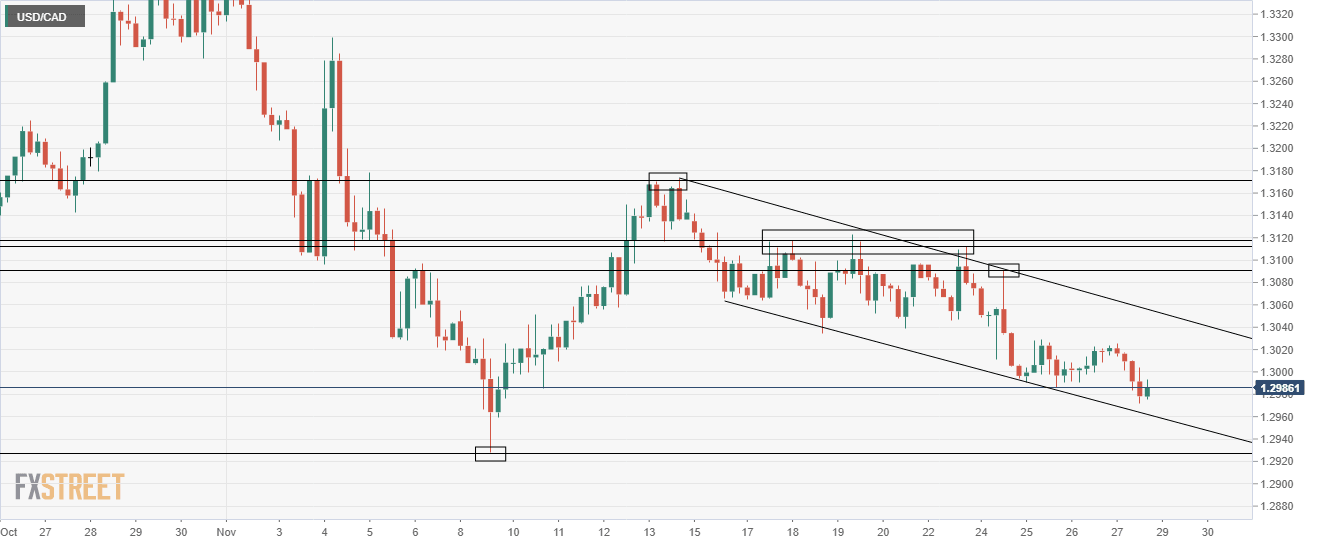

USD/CAD continues to grind lower within bearish trend channel

USD/CAD has continued to grind to the south within the confines of a downwards trend channel that links the 15, 23 and 25 November highs to the upside and the 16, 19 and 25 November lows to the downside.

The implication is thus that USD/CAD’s path of least resistance remains to the downside, where an eventual grind lower towards 1.2950 and ultimately lows of the year at around 1.2930 is the most likely course of action.

However, if the bulls to pick up some steam and push the pair outside the top of its trend channel (which would come into play as resistance around 1.3040), then resistance at 1.3090, then the 1.3100 psychological level and then around 1.3110-1.3120 would be the areas to watch.

Author

Joel Frank

Independent Analyst

Joel Frank is an economics graduate from the University of Birmingham and has worked as a full-time financial market analyst since 2018, specialising in the coverage of how developments in the global economy impact financial asset