USD/CAD climbs amid a soft Canada’s inflation report

- USD/CAD slips to 1.3565 following Canadian CPI report showing inflation cooling more than expected.

- Disinflationary trend boosts speculation of an upcoming Bank of Canada rate cut, with June odds at 73%.

- US housing data indicates market resilience, adding a positive backdrop to the currency dynamics.

The USD/CAD climbed during the North American session, though it slipped below the 1.3600 figure after data from Canada suggested the disinflationary process continued. At the time of writing, the pair exchanges hands at 1.3565 after hitting a new year-to-date (YTD) high of 1.3613.

The Loonie on the defensive as market participants eye first BoC cut in June

Canada’s economic docket featured the release of inflation data, which decreased below the 3% threshold on annual figures. On a monthly basis, the Consumer Price Index (CPI) saw a 0.3% rise, below the consensus of 0.6%. The Bank of Canada’s (BoC) preferred measure of inflation, the core CPI, slowed in the 12 months to February, from 2.4% to 2.1%.

The data sent the USD/CAD rallying amid speculations that the BoC might cut rates sooner than expected. In the meantime, money market futures data suggest that the odds for the first rate cut by the BoC in the June meeting lie at 73.0%, according to Capital Edge and Refinitiv data.

The US housing sector shows signs of strengthening according to recent economic data. Building Permits in February rose by 1.9% month-over-month, from 1.489 million to 1.496 million. Meanwhile, Housing Starts for the same period saw a significant increase of 10.7%, surpassing the expected 8.2%.

USD/CAD traders brace for Wednesday’s Federal Open Market Committee (FOMC) decision. Futures data shows that the Fed holding rates are unchanged, though uncertainty lies in the update of their Summary of Economic Projections (SEP). Some analysts suggest Fed policymakers could disregard one rate cut, keeping rates higher for longer.

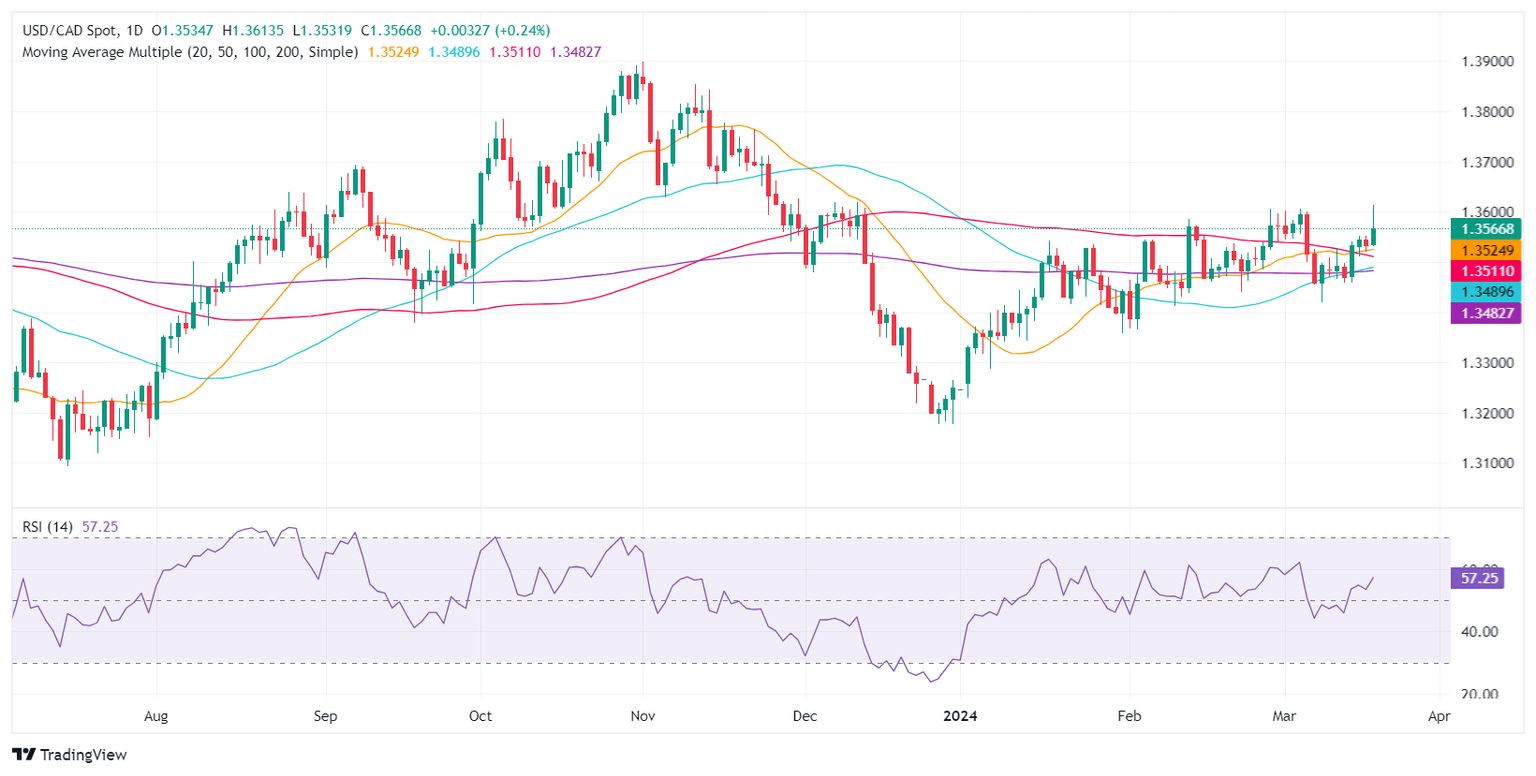

USD/CAD Price Analysis: Technical outlook

After reaching a new YTD high, the USD/CAD retreated below the 1.3600 mark. If the pair closes below the 1.3550 area, that will form an ‘inverted hammer’ opening the door for further losses, but the 100-day moving average (DMA) at 1.3520, a dynamic support level, could cap the losses. Further downside is seen at 1.3500 and at the confluence of the 200 and 50-DMA at 1.3481/87. On the other hand, if buyers come back and reclaim 1.3600, look for a challenge of the November 24 high at 1.3711.

Author

Christian Borjon Valencia

FXStreet

Christian Borjon began his career as a retail trader in 2010, mainly focused on technical analysis and strategies around it. He started as a swing trader, as he used to work in another industry unrelated to the financial markets.