USD/CAD: Bears look to test 1.3350 amid weaker dollar, bearish technicals

- USD/CAD on the back foot amid fresh USD supply.

- CAD ignores drop in WTI, as risk-on mood prevails.

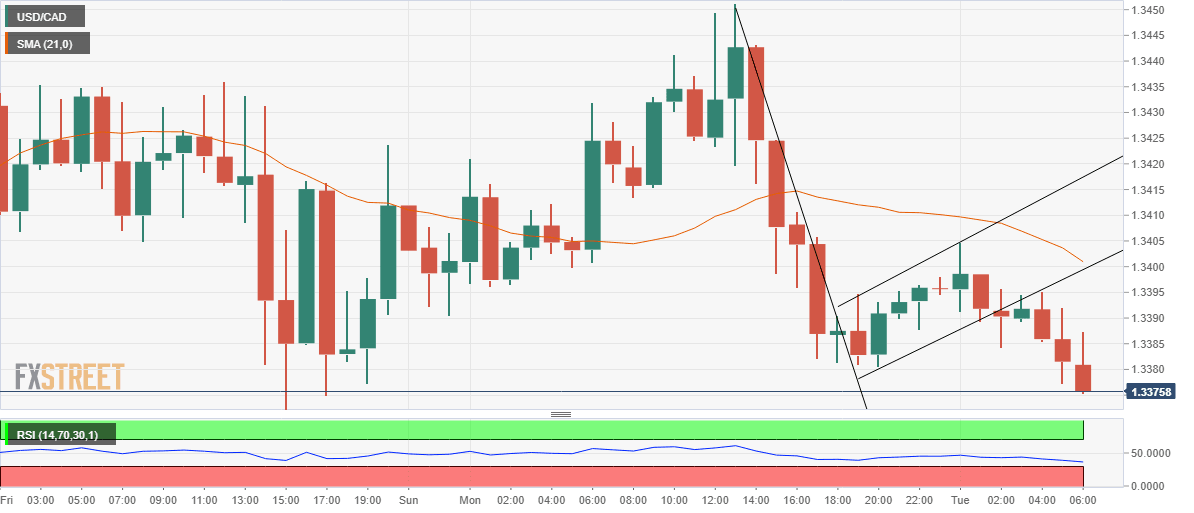

- Bear flag breakdown spotted on hourly chart.

USD/CAD is on a gradual decline below 1.3400 following a brief attempt to regain the latter in early Asia.

The bears have regained control and now look to test the 1.3350 levels, aided by the resurgence of the US dollar supply across the board.

The dollar recovery faltered amid concerns over the health of the US labor market after the manufacturing sector employment sub-index dwindled, the latest ISM data showed. Further, the slowing progress on the US fiscal aid also remains a weight on the greenback.

On the CAD-side of the story, the Canadian dollar tracks its commodity peers higher, as they cheer the upbeat market mood. The loonie ignores the drop in WTI prices below the $41 level. Attention now turns towards the US Factory Orders and Canadian Markit Manufacturing PMI data for fresh trading impetus.

From a near-term technical perspective, the spot has carved out a bear flag breakdown on the hourly sticks alongside a bearish Relative Strength Index (RSI). The technical set up, therefore, suggests additional scope to the downside.

The bears could likely test the 1.3350 psychological level should the selling pressure intensify. Only a break above the downward-sloping 21-hourly Simple Moving Average (HMA) at 1.3401 could prompt any recovery attempts in the spot.

USD/CAD hourly chart

USD/CAD additional levels

USD/CAD additional levels

Author

Dhwani Mehta

FXStreet

Residing in Mumbai (India), Dhwani is a Senior Analyst and Manager of the Asian session at FXStreet. She has over 10 years of experience in analyzing and covering the global financial markets, with specialization in Forex and commodities markets.