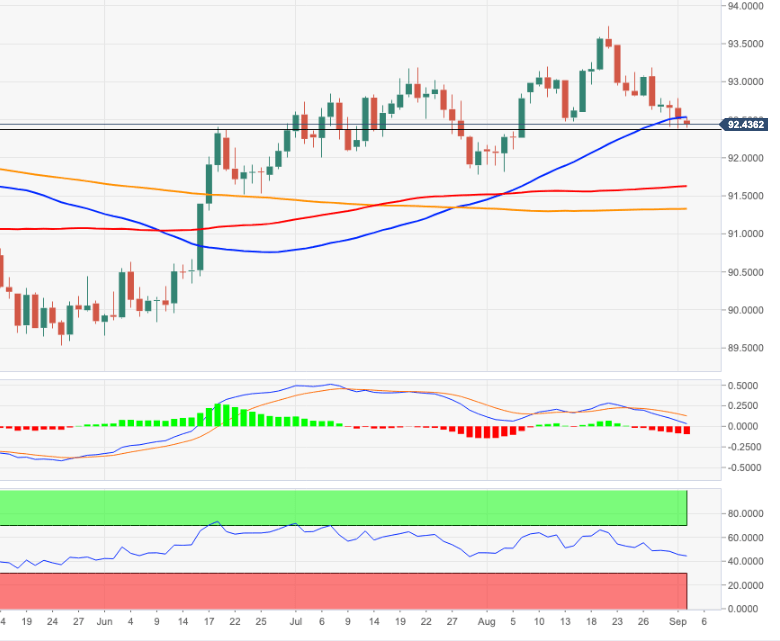

US Dollar Index Price Analysis: Looks cautious around 92.40

- DXY remains under pressure in he 92.50/40 band.

- A drop below the 92.40/35 band exposes a deeper pullback.

Rising cautiousness and thin trading conditions prompts DXY to remain under pressure in the area of multi-week lows near 92.40.

A move further south of the 92.40/35 band in the short-term horizon should open the door to extra retracements to, initially, the interim support at 92.00 ahead of the 91.80/75 band, where sits the July/August lows.

In the meantime, and looking at the broader scenario, the positive stance on the dollar is expected to remain unchanged as long as the index trades above the 200-day SMA, today at 91.33.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.