US Dollar Index Price Analysis: Extra gains favoured above 95.30

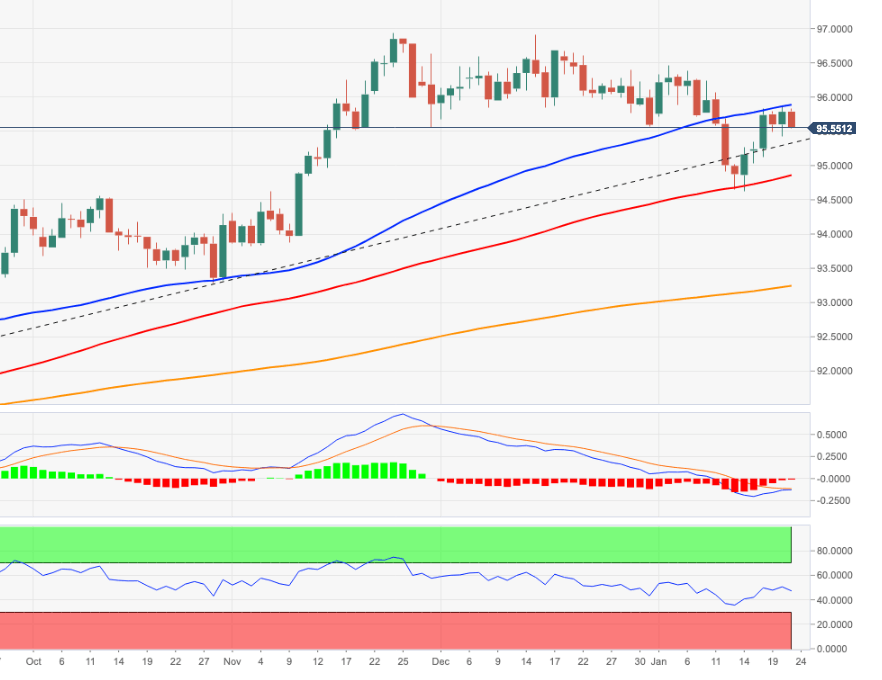

- DXY fades Thursday advance and returns to the 95.50 area.

- Further gains likely above the 4-month line near 95.30.

DXY comes under pressure after the daily bullish attempt faltered in the 95.80 region on Friday.

The intense upside in the dollar has recently surpassed the 4-month line, today near 95.30, and in doing so it has reinstated the short-term bullish bias. That said, the next target is seen at the weekly high at 95.83 (January 18) ahead of the YTD high at 96.46 recorded on January 4.

Looking at the broader picture, the longer-term positive stance in the dollar remains unchanged above the 200-day SMA at 93.22.

DXY daily chart

Author

Pablo Piovano

FXStreet

Born and bred in Argentina, Pablo has been carrying on with his passion for FX markets and trading since his first college years.